Dow warns of earnings pressure due to tariff uncertainty

(Reuters) -Chemicals firm Dow Inc said on Thursday that it expects extended pressure on earnings as uncertainty from U.S. President Donald Trump's erratic trade policies adds to macroeconomic volatili

West Pharmaceutical Services (NYSE:WST) Exceeds Q1 Expectations, Stock Soars

Healthcare products company West Pharmaceutical Services (NYSE:WST) announced better-than-expected revenue in Q1 CY2025, but sales were flat year on year at $698 million. The company’s full-year rev

Best money market account rates today, April 24, 2025 (earn up to 4.41% APY)

Looking for the best money market account interest rates available today? Here’s where to find the highest rates. Is a good time to open a money market account?

One of Wall Street’s biggest bulls slashes view as tariffs bite

(Bloomberg) -- One of Wall Street’s biggest bulls is throwing in the towel on expectations for large gains this year, seeing tariffs hitting corporate America the hardest.Most Read from BloombergTru

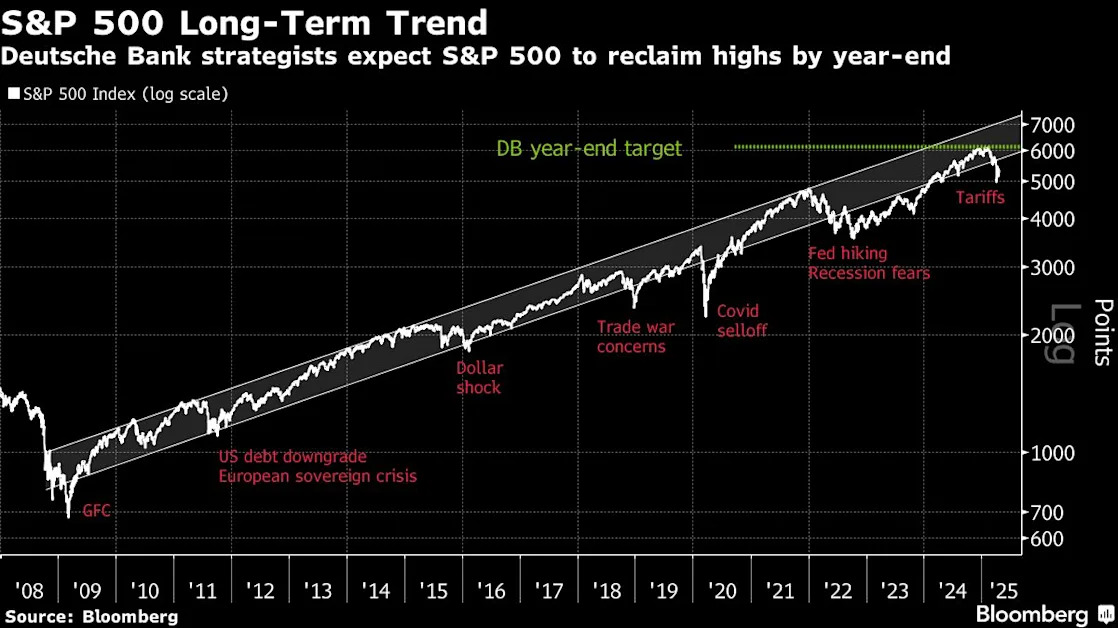

Wall Street stocks traders comb through charts for clues to next S&P 500 move

(Bloomberg) -- In recent days, the wild swings in US stocks, largely driven by President Donald Trump’s repeated U-turns on tariffs, have caused many on Wall Street to throw up their hands in exaspe

The new CEO of the Philippines’ largest telco says his Nigeria and India experience taught him to ‘never underestimate’ any market

Carl Raymond Cruz, the new CEO of Globe Telecom, also admits his "bias" for Indian companies, thanks to their "rigor" and "operational intensity."

3 Reasons to Sell MTZ and 1 Stock to Buy Instead

Since October 2024, MasTec has been in a holding pattern, posting a small loss of 3.6% while floating around $118.18.

3 Reasons to Avoid MKFG and 1 Stock to Buy Instead

In a sliding market, Markforged has defied the odds, trading up to $4.80 per share. Its 6% gain since October 2024 has outpaced the S&P 500’s 8.1% drop. This performance may have investors wondering

3 Reasons to Sell WOR and 1 Stock to Buy Instead

In a sliding market, Worthington has defied the odds, trading up to $46.92 per share. Its 21.6% gain since October 2024 has outpaced the S&P 500’s 8.1% drop. This was partly thanks to its solid quar

3 Reasons AMTM is Risky and 1 Stock to Buy Instead

Amentum has gotten torched over the last six months - since October 2024, its stock price has dropped 34.1% to $19.75 per share. This might have investors contemplating their next move.