3 Reasons to Avoid MKFG and 1 Stock to Buy Instead

In a sliding market, Markforged has defied the odds, trading up to $4.80 per share. Its 6% gain since October 2024 has outpaced the S&P 500’s 8.1% drop. This performance may have investors wondering how to approach the situation.

Is now the time to buy Markforged, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

We’re happy investors have made money, but we're cautious about Markforged. Here are three reasons why we avoid MKFG and a stock we'd rather own.

Why Is Markforged Not Exciting?

Beginning as a start-up at SolidWorks World–an annual design and engineering conference, Markforged (NYSE:MKFG) offers 3D printers and softwares to manufacturers of various industries.

1. Long-Term Revenue Growth Disappoints

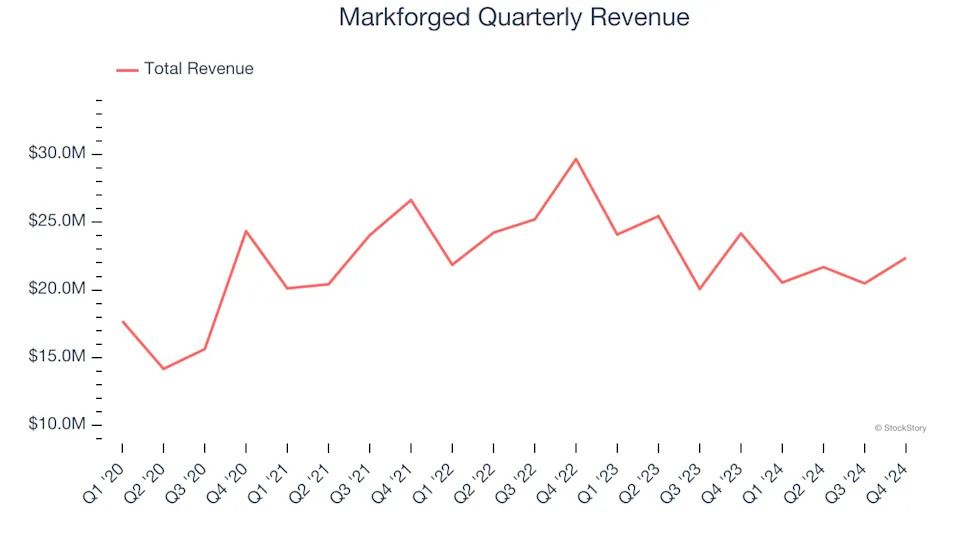

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Markforged’s sales grew at a sluggish 4.3% compounded annual growth rate over the last four years. This fell short of our benchmark for the industrials sector.

2. Free Cash Flow Margin Dropping

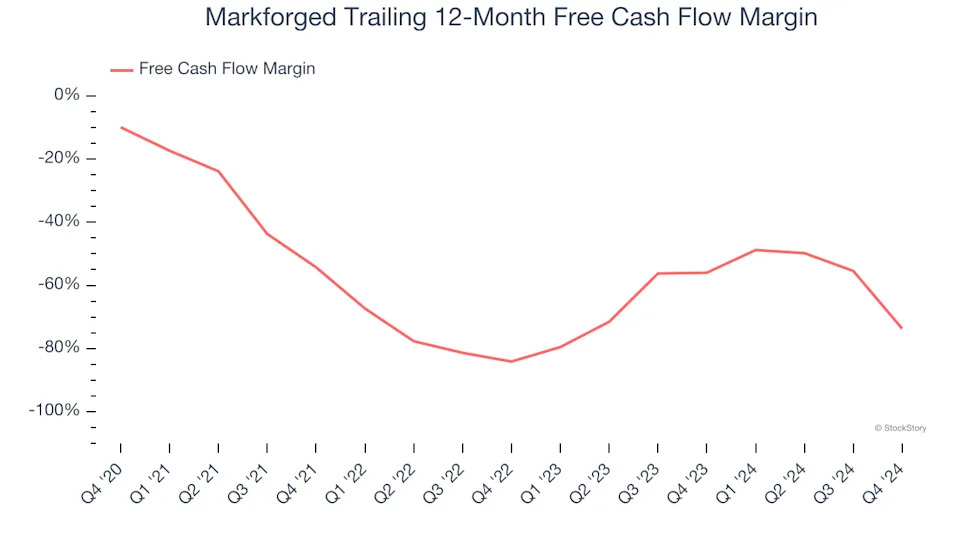

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Markforged’s margin dropped by 63.8 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business. Markforged’s free cash flow margin for the trailing 12 months was negative 73.7%.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

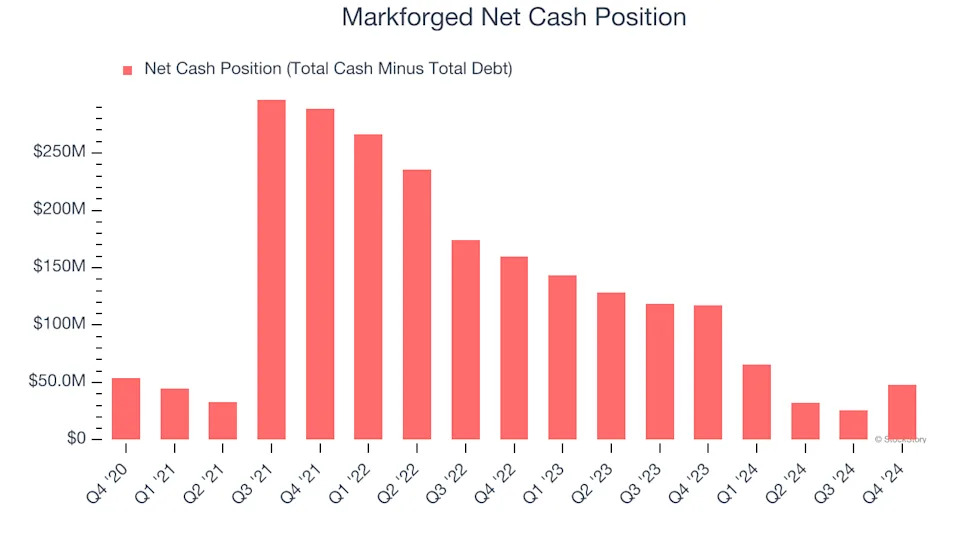

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Markforged burned through $62.71 million of cash over the last year. With $53.63 million of cash on its balance sheet, the company has around 10 months of runway left (assuming its $5.77 million of debt isn’t due right away).

Unless the Markforged’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.