FormFactor (NASDAQ:FORM) Beats Q1 Sales Targets, Stock Soars

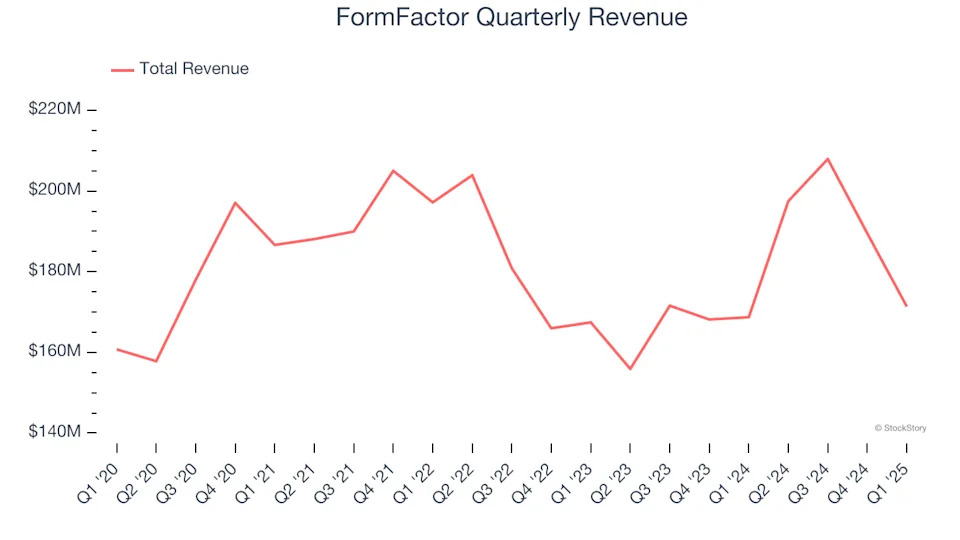

Semiconductor testing company FormFactor (NASDAQ:FORM) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 1.6% year on year to $171.4 million. Guidance for next quarter’s revenue was better than expected at $190 million at the midpoint, 2% above analysts’ estimates. Its non-GAAP profit of $0.23 per share was 21.1% above analysts’ consensus estimates.

Is now the time to buy FormFactor? Find out in our full research report .

FormFactor (FORM) Q1 CY2025 Highlights:

“As expected, FormFactor reported sequentially lower first-quarter revenue and profitability due to anticipated reductions in demand for both DRAM probe cards and Systems,” said Mike Slessor, CEO of FormFactor,

Company Overview

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

Sales Growth

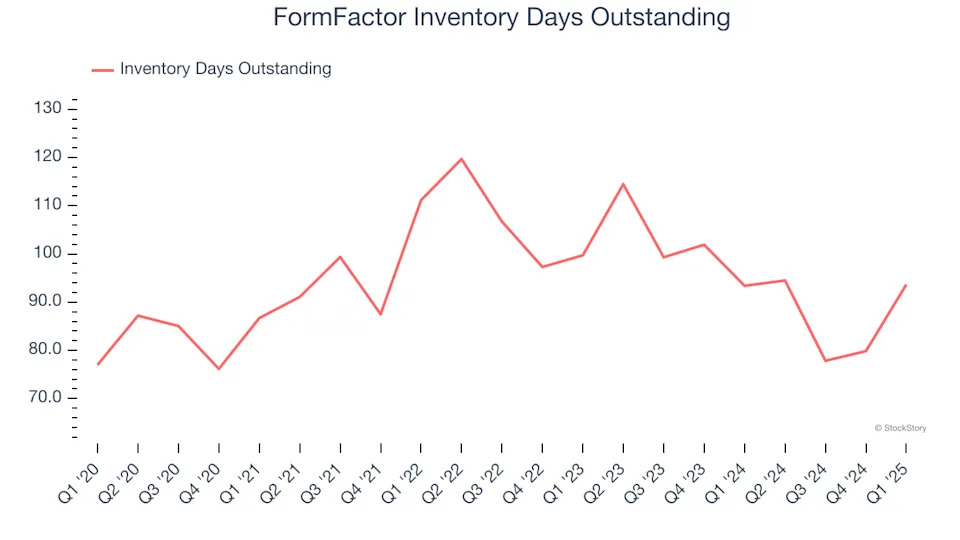

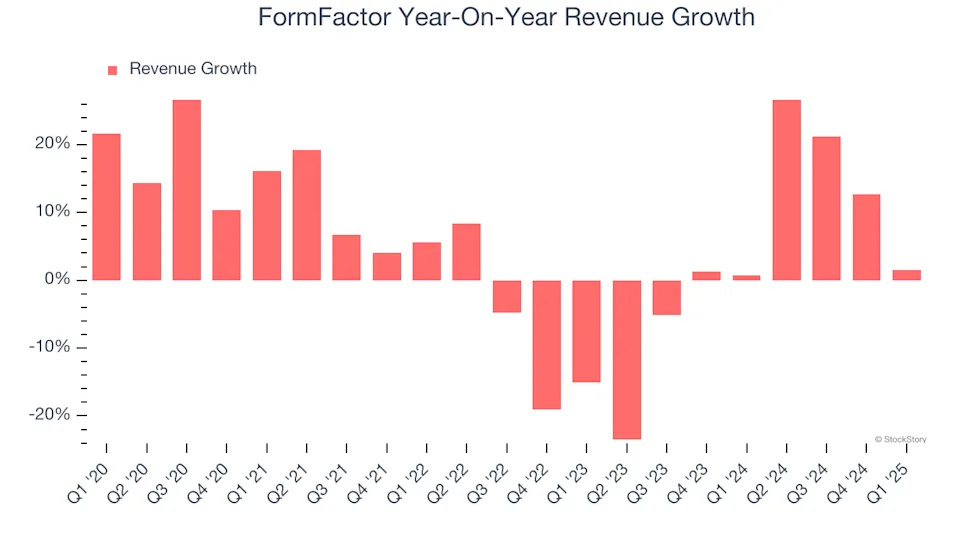

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, FormFactor grew its sales at a sluggish 4.4% compounded annual growth rate. This fell short of our benchmark for the semiconductor sector and is a tough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. FormFactor’s recent performance shows its demand has slowed as its annualized revenue growth of 3.3% over the last two years was below its five-year trend.

This quarter, FormFactor reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 0.9%. Despite the beat, this was its third consecutive quarter of decelerating growth, indicating a potential cyclical downturn. Company management is currently guiding for a 3.8% year-on-year decline in sales next quarter.