Vertical Software Stocks Q4 Results: Benchmarking Q2 Holdings (NYSE:QTWO)

As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the vertical software industry, including Q2 Holdings (NYSE:QTWO) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 14 vertical software stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 3.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18.1% since the latest earnings results.

Q2 Holdings (NYSE:QTWO)

Founded in 2004 by Hank Seale, Q2 (NYSE:QTWO) offers software-as-a-service that enables small banks to provide online banking and consumer lending services to their clients.

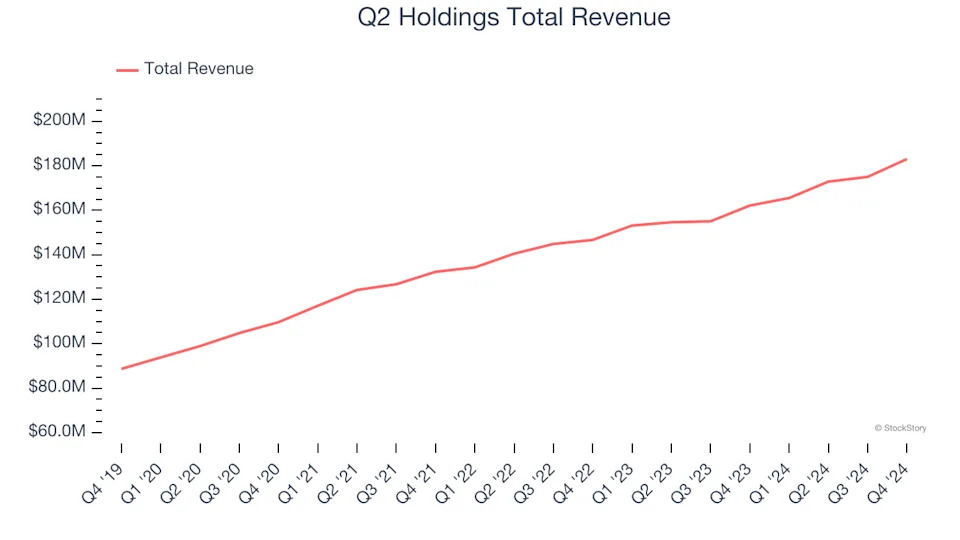

Q2 Holdings reported revenues of $183 million, up 12.9% year on year. This print exceeded analysts’ expectations by 1.7%. Overall, it was a very strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations.

“We delivered strong fourth-quarter results to cap off a great year,” said Matt Flake, chairman and CEO, Q2.

The stock is down 19.1% since reporting and currently trades at $74.51.

Is now the time to buy Q2 Holdings? Access our full analysis of the earnings results here, it’s free .

Best Q4: Upstart (NASDAQ:UPST)

Founded by the former head of Google's enterprise business, Upstart (NASDAQ:UPST) is an AI-powered lending platform facilitating loans for banks and consumers.

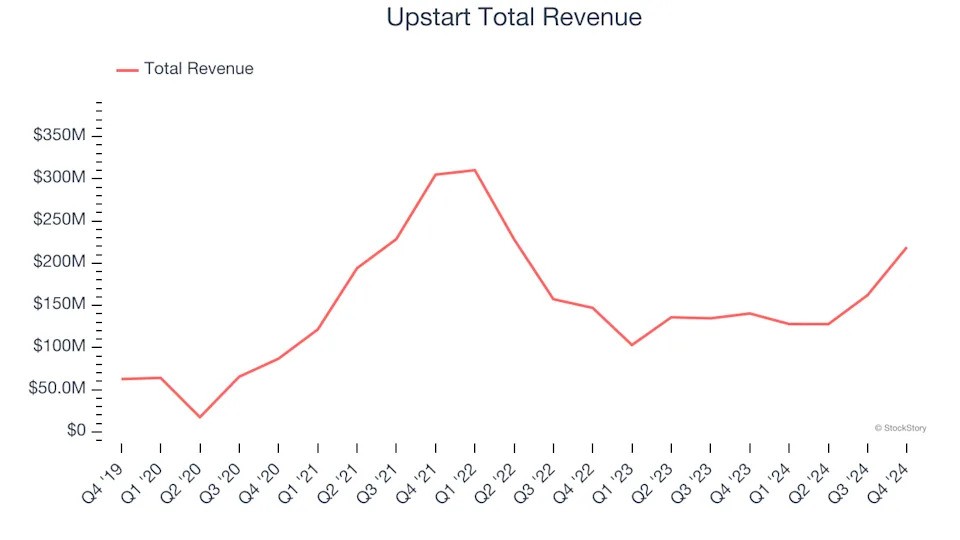

Upstart reported revenues of $219 million, up 56.1% year on year, outperforming analysts’ expectations by 20.1%. The business had an exceptional quarter with EBITDA guidance for next quarter exceeding analysts’ expectations.

Upstart delivered the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 40.8% since reporting. It currently trades at $39.84.

Is now the time to buy Upstart? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.