3 Reasons to Sell GH and 1 Stock to Buy Instead

What a time it’s been for Guardant Health. In the past six months alone, the company’s stock price has increased by a massive 112%, reaching $44.11 per share. This run-up might have investors contemplating their next move.

Is now the time to buy Guardant Health, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free .

Despite the momentum, we're sitting this one out for now. Here are three reasons why we avoid GH and a stock we'd rather own.

Why Is Guardant Health Not Exciting?

Pioneering the field of "liquid biopsy" with technology that can identify cancer-specific genetic mutations from a simple blood draw, Guardant Health (NASDAQ:GH) develops blood tests that detect and monitor cancer by analyzing tumor DNA in the bloodstream, helping doctors make treatment decisions without invasive biopsies.

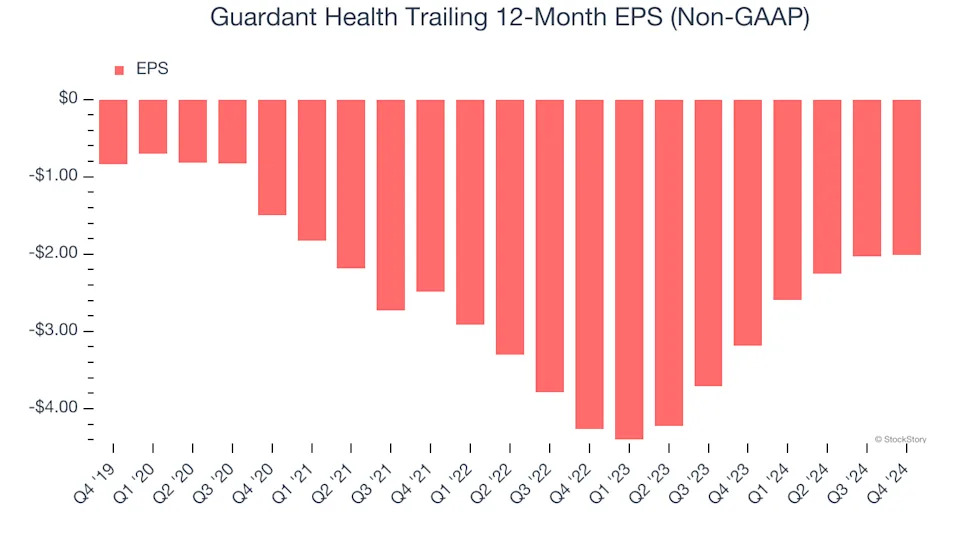

1. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Guardant Health’s earnings losses deepened over the last five years as its EPS dropped 19% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

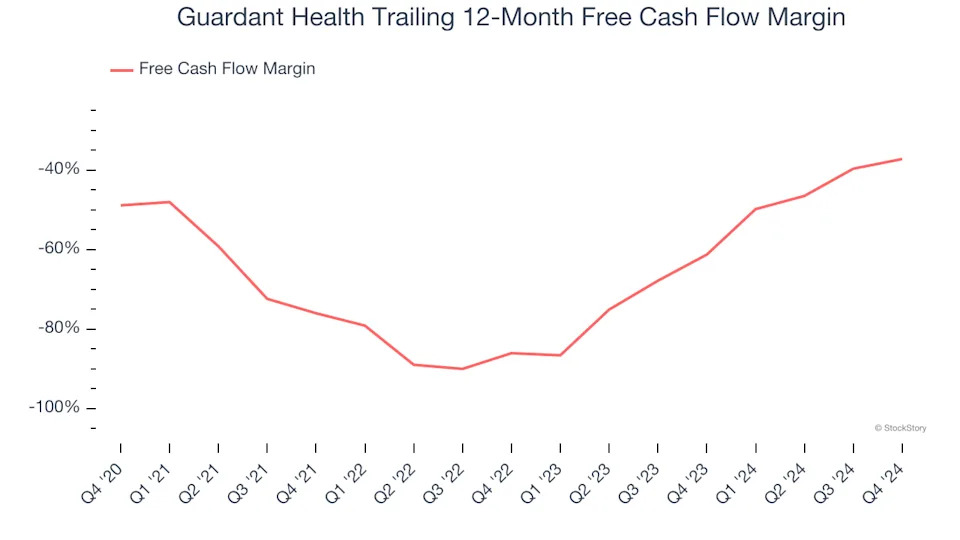

2. Cash Burn Ignites Concerns

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Guardant Health’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 59.3%, meaning it lit $59.33 of cash on fire for every $100 in revenue.

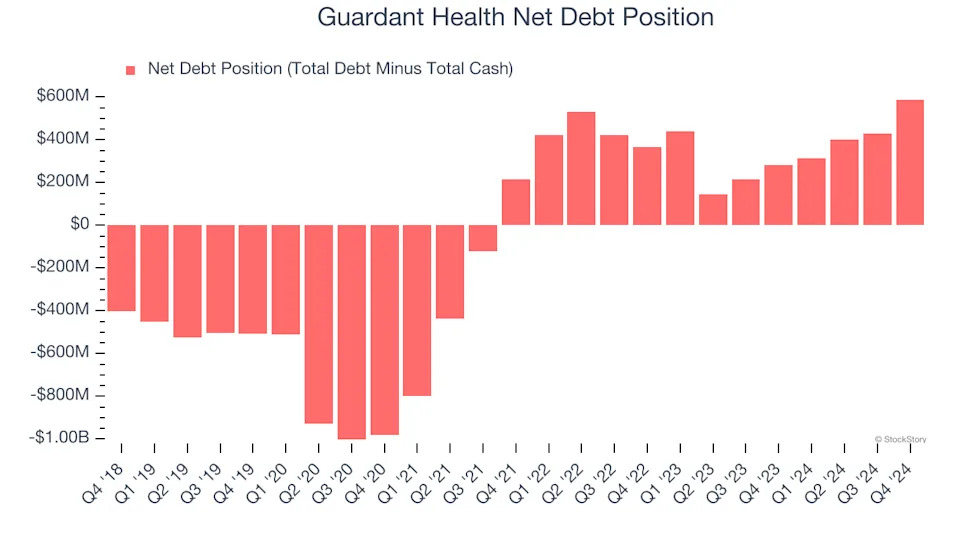

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Guardant Health burned through $274.9 million of cash over the last year, and its $1.43 billion of debt exceeds the $840 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Guardant Health’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.