Trump’s hefty tariffs send stock markets falling

Stock markets across Asia-Pacific and Europe fell Thursday and US markets were also set to open lower after US President Donald Trump imposed tariffs on trading partners around the world, with many Asian countries taking the biggest hits.

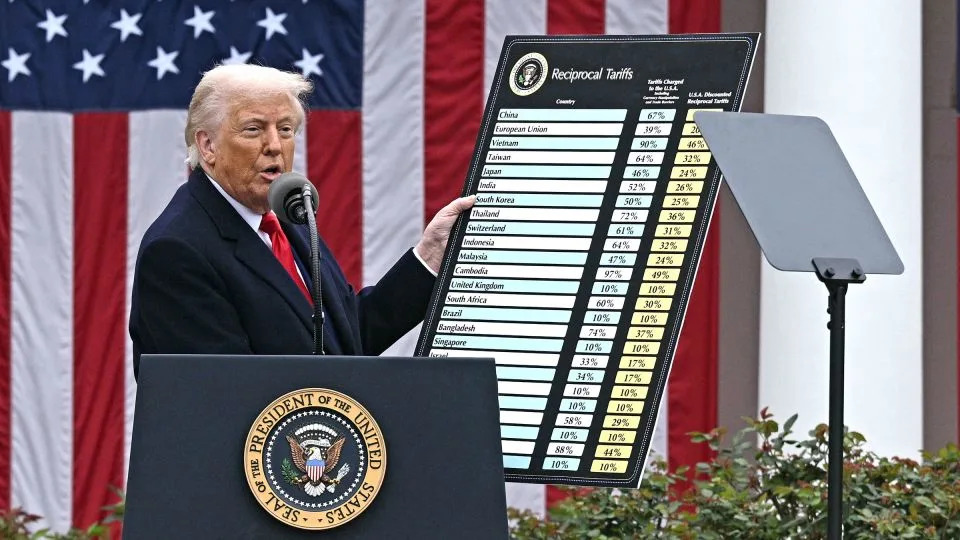

Trump’s broad-based tariffs have raised levies on Chinese imports, the second-largest source of US imports after Mexico, from 20% to 54%. Duties of 24% were slapped on Japan and 25% on South Korea: Both are major US trading partners and allies. Taiwan, a major exporting economy and electronics manufacturer, was hit with a 32% tariff.

The tariffs news sent US stocks plummeting in after-hours trading Wednesday and caused Asian markets to fall shortly after opening on Thursday.

Japan’s benchmark Nikkei 225 index tumbled over 4% after the open, and closed 2.8% down. South Korea’s Kospi index dropped 2.7% and closed less than 1% lower. Hong Kong’s benchmark Hang Seng Index was down 1.5% by 4.23 a.m. ET. In Australia, which faces a 10% tariff, the benchmark ASX 200 index closed 0.9% down. Markets in Taiwan were closed Thursday.

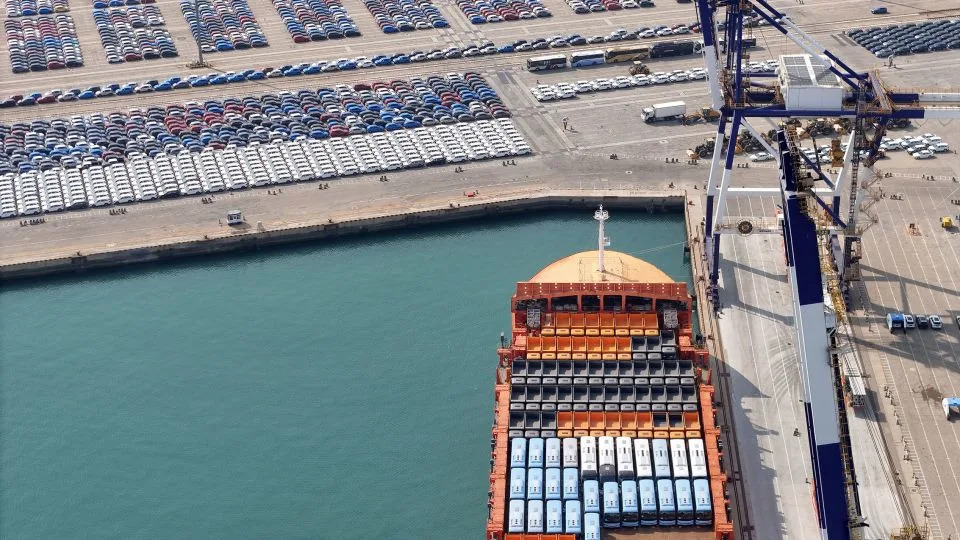

Shares of major tech and automotive companies in the region were among the hardest hit. Japanese tech giant Sony plummeted more than 5.4% in the morning. Carmakers Toyota and Honda slid nearly 5% and over 4% at one point. Korean tech heavyweight Samsung and car giant Hyundai each fell over 3% after the open.

In Europe, the region’s benchmark Stoxx 600 index was trading 1.2% lower by 4.24 a.m. ET, while Germany’s DAX index was down 1.3% and France’s CAC 1.6% lower on the day. London’s FTSE 100 had fallen 1% by the same time.

Falling US stock futures also pointed to a difficult day ahead. Dow futures were 2.4% down and S&P 500 futures 2.9% down. The tech-heavy Nasdaq was set to open 3.2% lower.

Meanwhile, gold surged to a record high above $3,160 an ounce, according to Reuters, as investors flocked to the precious metal, traditionally seen as a safe-haven asset.

The Rose Garden announcement further escalated Trump’s trade war with China and opened new fronts with the rest of the world. The president has repeatedly claimed the measures would revive domestic manufacturing and address what he views as unfair trade practices.

Before Wednesday, the US stock market had already had its worst start to a year since 2022. For weeks, Trump’s flip-flopping on the scale and scope of tariffs has unrattled investors and roiled global markets.

The tariffs announced on Wednesday added to his recent import taxes on aluminum, steel and cars. Trump has imposed 25% tariffs on all steel and aluminum imports, along with a 25% tariff on foreign cars set to take effect Thursday. Additionally, a 25% tariff on foreign auto parts is scheduled for early May. These levies will be applied on top of any existing country-specific tariffs.