3 Reasons to Avoid VPG and 1 Stock to Buy Instead

Over the last six months, Vishay Precision shares have sunk to $20.40, producing a disappointing 17.8% loss - worse than the S&P 500’s 9.8% drop. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Vishay Precision, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why there are better opportunities than VPG and a stock we'd rather own.

Why Do We Think Vishay Precision Will Underperform?

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE:VPG) operates as a global provider of precision measurement and sensing technologies.

1. Long-Term Revenue Growth Disappoints

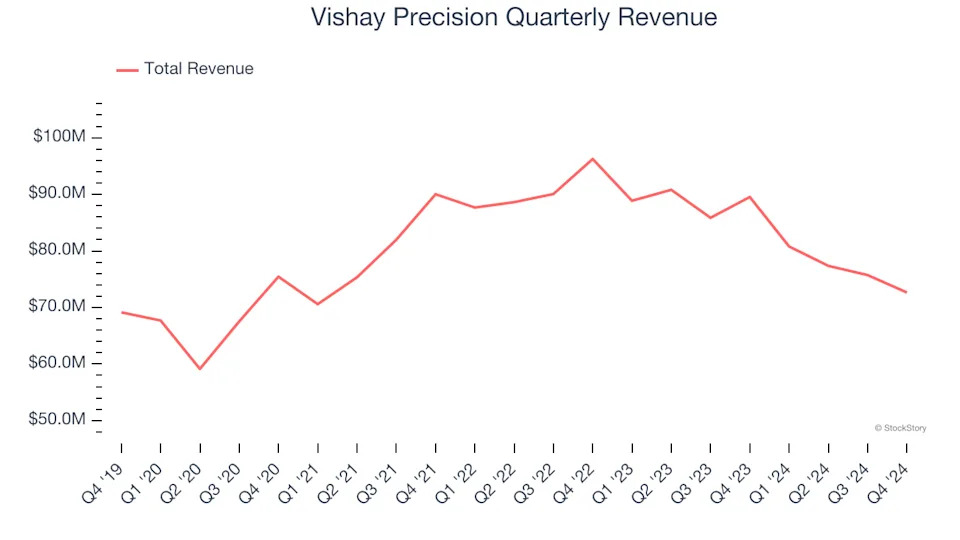

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Vishay Precision grew its sales at a sluggish 1.5% compounded annual growth rate. This fell short of our benchmarks.

2. Shrinking Operating Margin

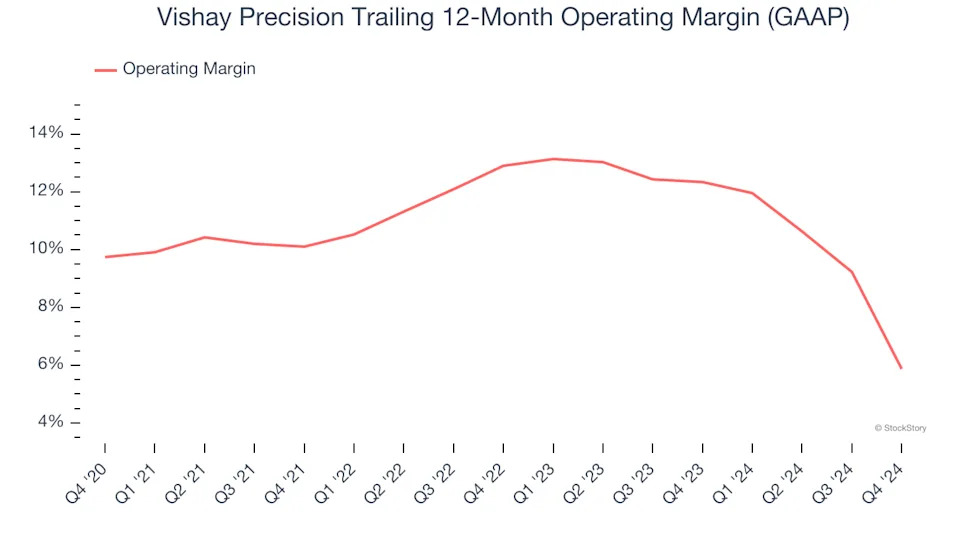

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Analyzing the trend in its profitability, Vishay Precision’s operating margin decreased by 3.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 5.9%.

3. EPS Trending Down

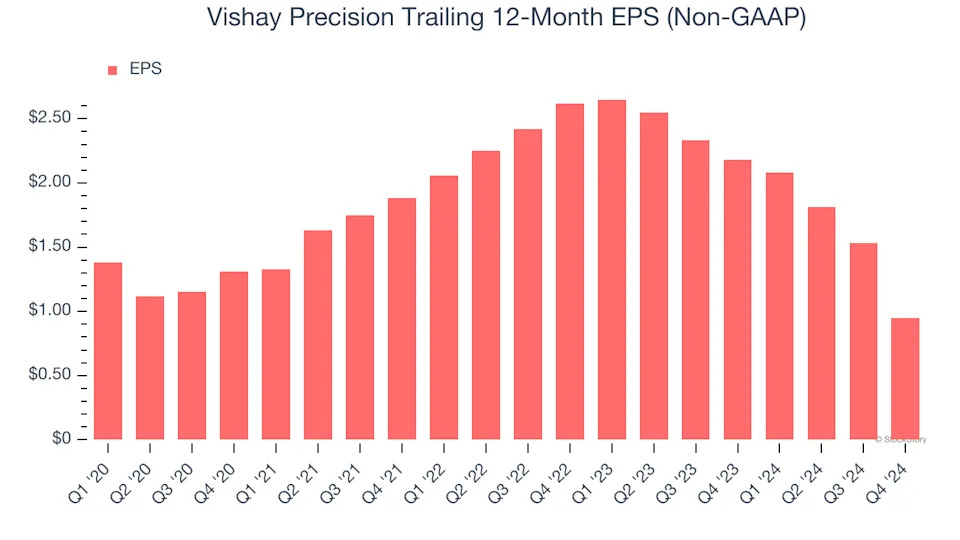

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Vishay Precision, its EPS declined by 13.4% annually over the last five years while its revenue grew by 1.5%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Vishay Precision falls short of our quality standards. Following the recent decline, the stock trades at 18.7× forward price-to-earnings (or $20.40 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d recommend looking at one of our top digital advertising picks .