3 Reasons HRL is Risky and 1 Stock to Buy Instead

Hormel Foods has been treading water for the past six months, recording a small loss of 4.3% while holding steady at $30.21.

Is there a buying opportunity in Hormel Foods, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

We're sitting this one out for now. Here are three reasons why there are better opportunities than HRL and a stock we'd rather own.

Why Is Hormel Foods Not Exciting?

Best known for its SPAM brand, Hormel (NYSE:HRL) is a packaged foods company with products that span meat, poultry, shelf-stable foods, and spreads.

1. Demand Slipping as Sales Volumes Decline

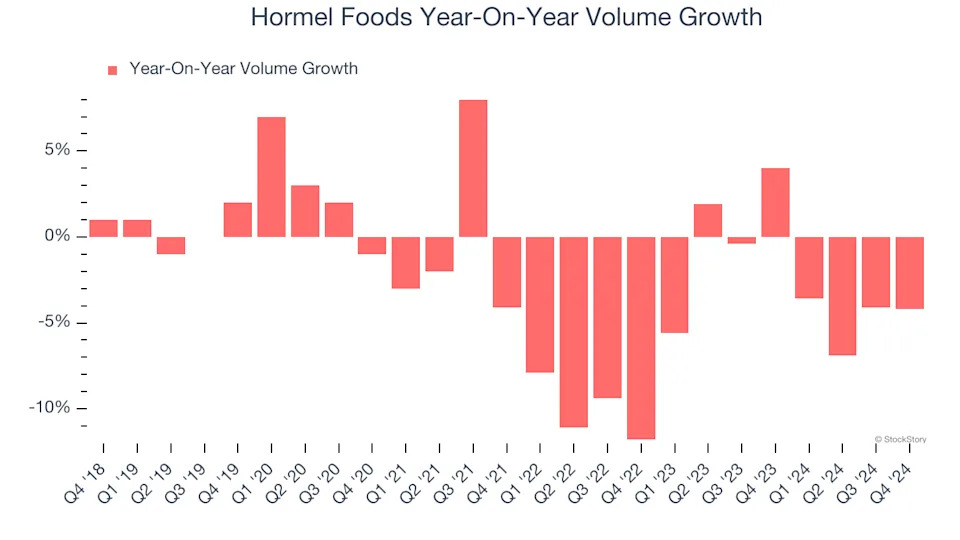

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Hormel Foods’s average quarterly sales volumes have shrunk by 2.4% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Low Gross Margin Reveals Weak Structural Profitability

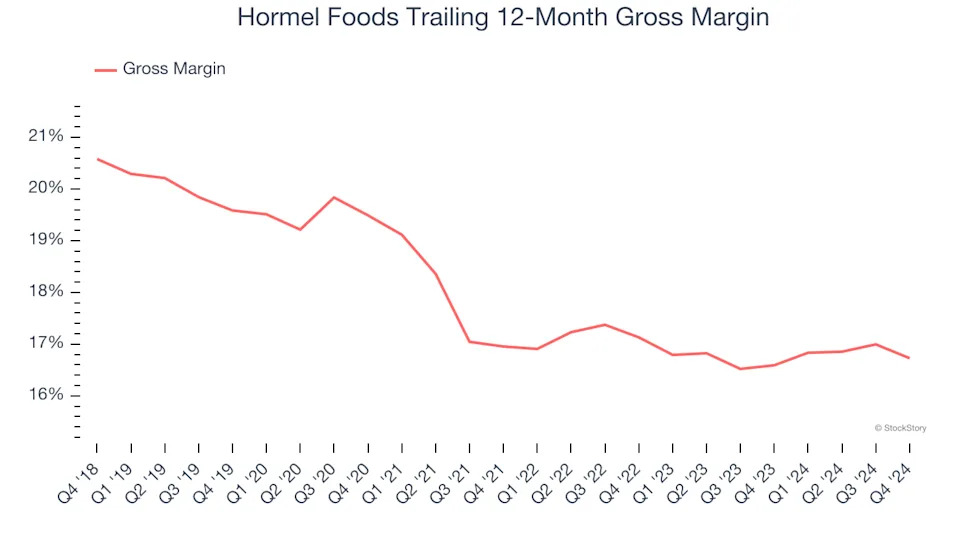

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Hormel Foods has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 16.7% gross margin over the last two years. That means Hormel Foods paid its suppliers a lot of money ($83.34 for every $100 in revenue) to run its business.

3. EPS Trending Down

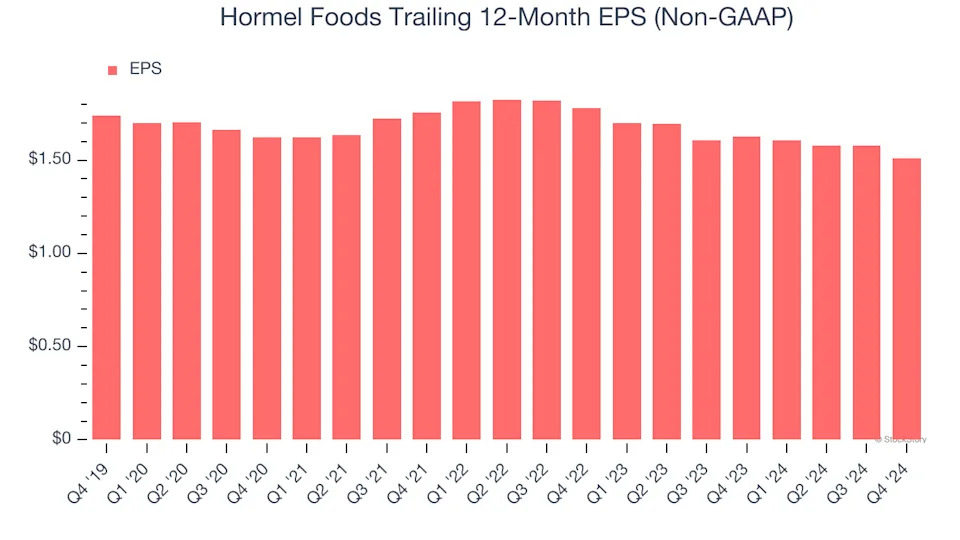

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Hormel Foods, its EPS declined by 4.9% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

Hormel Foods isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 17.7× forward price-to-earnings (or $30.21 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce .