3 Reasons PANL is Risky and 1 Stock to Buy Instead

Pangaea’s stock price has taken a beating over the past six months, shedding 37% of its value and falling to $4.24 per share. This might have investors contemplating their next move.

Is now the time to buy Pangaea, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free .

Even though the stock has become cheaper, we don't have much confidence in Pangaea. Here are three reasons why there are better opportunities than PANL and a stock we'd rather own.

Why Do We Think Pangaea Will Underperform?

Established in 1996, Pangaea Logistics (NASDAQ:PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

1. Long-Term Revenue Growth Disappoints

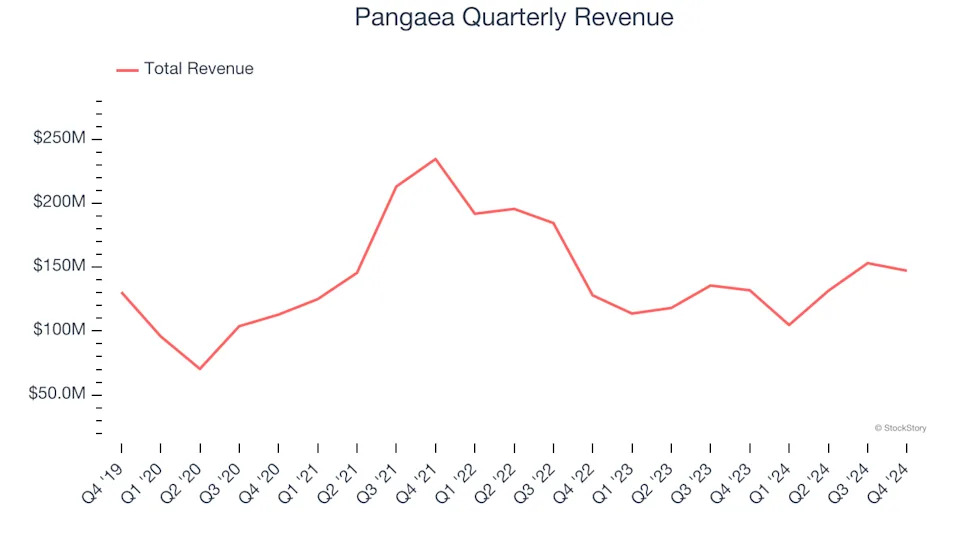

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Pangaea’s sales grew at a tepid 5.4% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector.

2. EPS Barely Growing

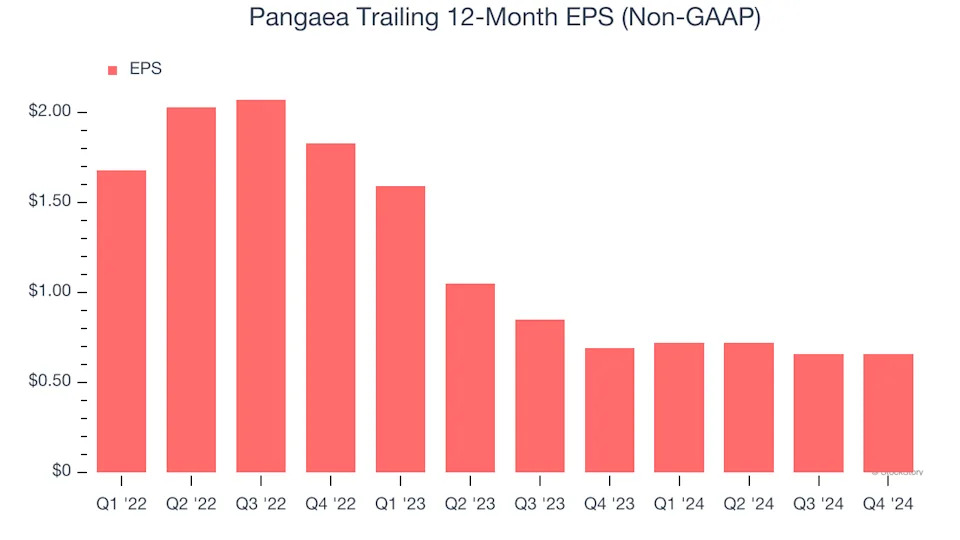

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Pangaea’s unimpressive 6.3% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

3. Free Cash Flow Margin Dropping

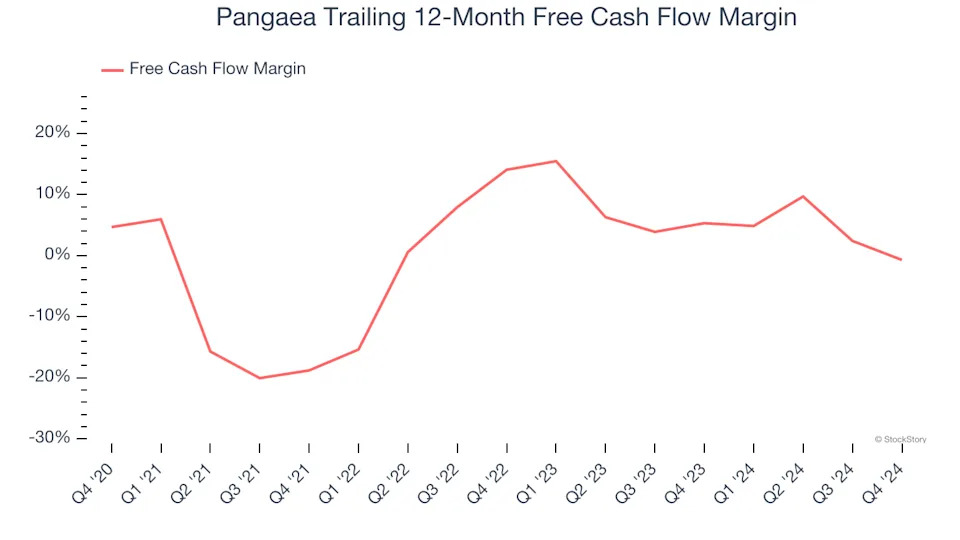

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Pangaea’s margin dropped by 5.4 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Pangaea’s free cash flow margin for the trailing 12 months was breakeven.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Pangaea, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 4× forward price-to-earnings (or $4.24 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. Let us point you toward one of Charlie Munger’s all-time favorite businesses .