Why JPMorgan thinks the market's 'sell America' narrative is overblown

The "sell America" narrative that's been blamed for big gyrations in US assets in recent weeks might be overblown, JPMorgan said.

Speculation has run hot that foreign investors have been ditching US stocks, bonds, and the dollar amid swelling policy uncertainty. The premise seemed especially strong at the start of April, when President Donald Trump's sweeping tariffs tarnished confidence in equities but also safe-haven trades like Treasury bonds.

However, recent data doesn't entirely support the thesis, JPMorgan said on Thursday.

"There is little evidence thus far of significant selling of US equities or bonds by foreign investors," JPMorgan analysts wrote in a Wednesday note.

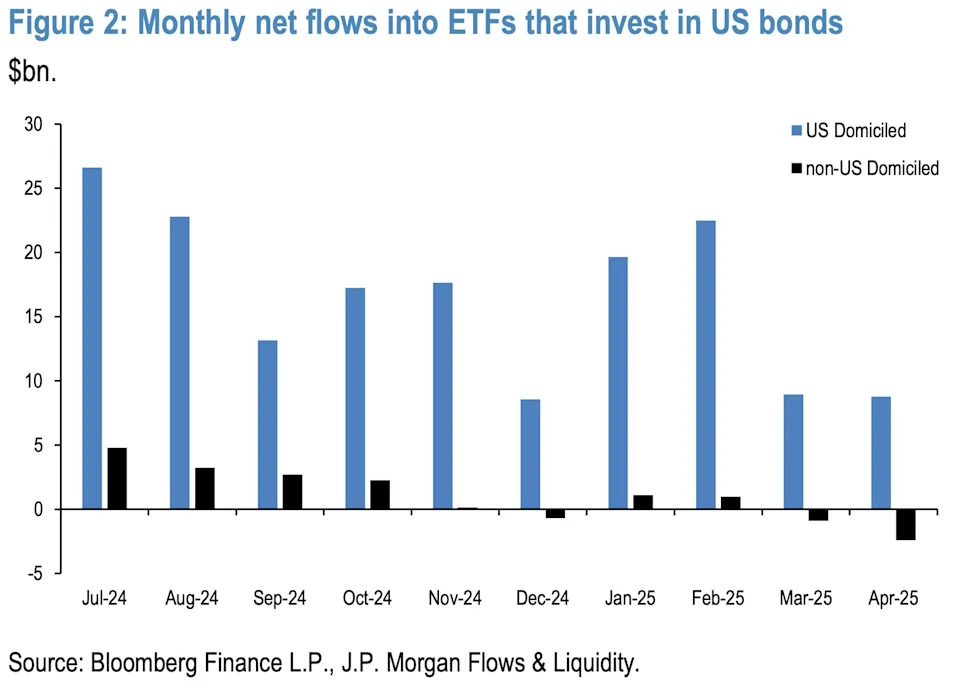

While the S&P 500 has corrected sharply since its February 19 record high, its 20% peak-to-trough decline can't be entirely justified by foreign outflows. In fact, a glance at US stock ETFs trading outside the country shows that net buying has continued during that time.

Instead, the bank wrote that it sees hedge funds as the primary culprit behind the brisk sell-off.

"We believe that much of the selling of US equities

YTD has been driven by equity-focused hedge funds such

as Equity Long/Short funds, both quant and discretionary.

We estimate that these investors have sold around $750bn

of equities YTD," the analysts wrote.

"This hedge fund selling impulse is also consistent with the large negative impulse we detect in US equity futures YTD, particularly

in the S&P 500 and Nasdaq 100 futures contracts."

Some have also pointed to April's erratic bond sell-off as a more assertive sign that foreigners are giving up on America. Treasury bond yields shot up aggressively earlier this month as Trump unleashed his tariff policy .

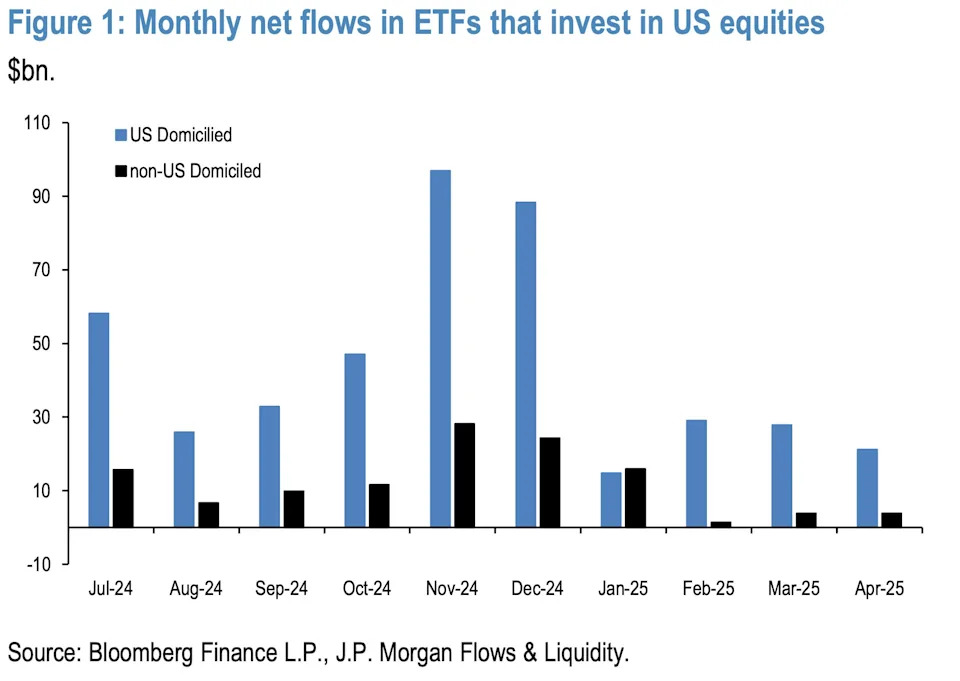

But so far, data points to "modest selling" of non-domiciled US bond ETFs, JPMorgan wrote.

The Institute of International Finance was similarly unconvinced.

"Based on weekly custody holdings at the Federal Reserve Bank of New York (through April 9), there is no sign of major foreign selling. Indeed, the share of U.S. Treasuries held by foreign investors has been gradually declining since 2015, following a peak that year," the IIF wrote in mid-April.