Market Turmoil Breaks Years of Junk Debt Outperformance in EM

(Bloomberg) -- A plunge in global risk appetite is pushing emerging-market investors into higher quality dollar bonds, signaling a years-long rally in junk debt from developing nations might be at an end.

Most Read from Bloomberg

Money managers from Pinebridge Investments to T. Rowe Price and TCW Group are scooping up sovereign notes from countries including Mexico, Colombia and South Africa, touting their high liquidity, market access and fair valuation. Names rated around BB and BBB, they say, are well-positioned to benefit from falling US Treasury yields and withstand persistently high borrowing costs that may impact their riskier peers.

“We see more value in the BBB/BB segment in emerging markets as a result of the current market forces and a slight dip in sentiment,” said Anders Faergemann, a senior money manager at Pinebridge Investments in London. “That means having less exposure to the cuspy high-yield segment and taking a cautious approach to credits that are highly sensitive to US Treasury volatility.”

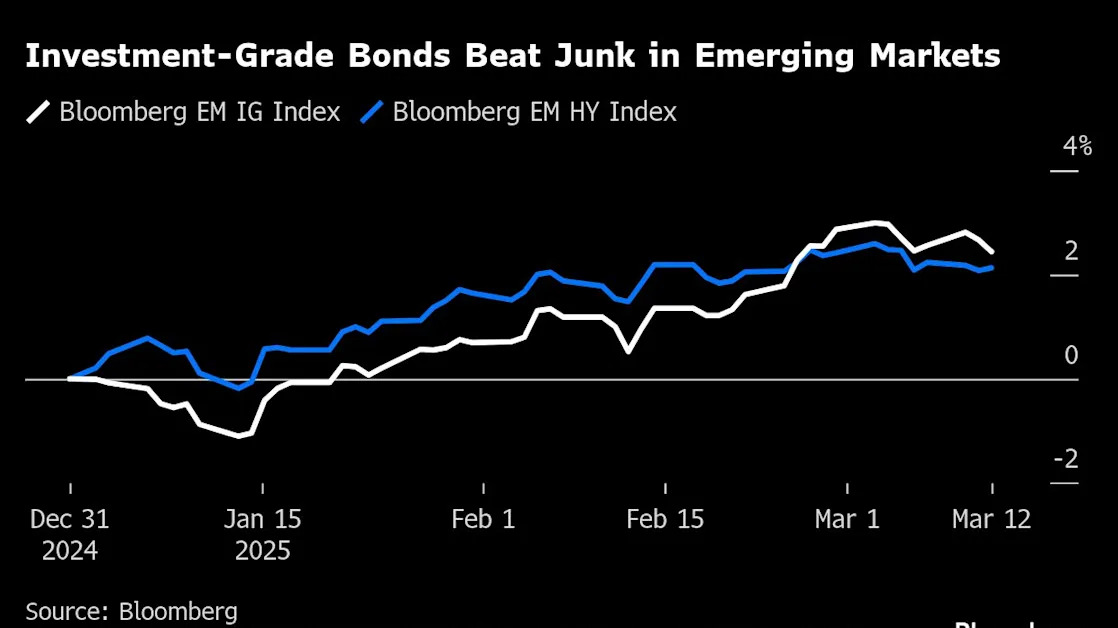

Investment grade bonds in developing nations are up 2.5% in 2025, beating high yield for the first time in five years. The outperformance is even greater for higher-quality junk debt — dollar bonds rated BB have handed an average return of 3% to investors, with Panama, Brazil and Colombia leading gains, according to data compiled on a Bloomberg index.

Global markets have been whipsawed in the past few weeks by the Trump administration’s shape-shifting tariff policy and growing recession risks for the world’s largest economy. Uncertainty over the Ukraine peace deal and elections ranging from Germany and Canada to developing nations added more volatility.

All the turmoil has forced traders to gravitate toward safe haven assets — gold has soared, while US Treasury yields have dropped. In emerging markets, that’s pushed traders out of riskier credits and into higher-quality debt, which tends to be more correlated with developed assets. The possibility of countries like Morocco being raised to investment grade could drive more money into the market, further supporting performance.

It’s a shift from the “close your eyes and buy anything” in high yield that earned EM investors double-digit returns in the past two years. Now, with some vulnerable nations still shut out of global capital markets, tighter spreads and ballooning interest payments on a $29 trillion pile of debt, new outperformers have emerged.

Meanwhile, last year’s top gainers including Ecuador, El Salvador and Argentina have fallen to among the worst performers in 2025 — with traders saying spreads in lower-rated debt aren’t wide enough to reward investors anymore.

JPMorgan recommended dialing down risk exposure in the distressed space last Thursday, citing concerns that historically tight valuations won’t withstand a larger correction in risk assets amid signs of weakness in the US economy. The strategists reaffirmed the view this week.

Attractive Value

Sovereign bonds from higher quality emerging economies will be less impacted by policy shifts like the US foreign aid retrenchment, which can weigh on low income countries, said Samy Muaddi, head of emerging markets fixed income at T. Rowe Price.

Even Mexico, while still facing tariff threats, has enough fiscal standing to absorb some bad news, he added. The country, one of a handful in Latin America with an investment-grade stamp, has some dollar bonds that yield more than 7%.

“That’s an attractive proposition long term,” he said. “You have the opportunity to earn the historical return on the asset class in a much safer way.”

To Polina Kurdyavko, head of emerging market debt at RBC BlueBay Asset Management, sovereign spreads in Mexico and Colombia’s bonds have become too wide in reaction to President Donald Trump’s tariff threats.

“In these countries, valuations overcompensate you for the risk of the tariffs and potential fundamental deterioration,” Kurdyavko said. They’re “some of our core overweights because they’ve widened given the fear of the policies, which we feel is a little bit over done.”

The extra yield investors request to hold Mexico’s dollar debt stands at 332 basis points over US Treasuries, more than double the level for their similarly rated peers, according to JPMorgan & Chase data. The spread for Colombia is also wider than the average BB-rated credits in emerging markets.

“There was a lot more risk premium embedded in those credits than we realized,” said David Robbins, emerging markets investor at TCW, who also highlighted Panama as one of the top gainers year-to-date, with nearly 6% returns. “We’re starting to see spreads tighten there.”

A few names rated CCC and lower have outperformed this year. Lebanon is benefitting from ongoing debt talks and a ceasefire in the Middle East. Bolivia bonds have gained due to coupon payments and signs of a potential regime change. And Suriname is living up to a big oil boom. But overall, lower-rated junk bonds now face more hurdles as risk sentiment sours.

“For 2025, the characterization within the sovereign space is de-risking out of frontiers into mainstream, preferring your kind of bellwether, traditional emerging credits,” said Muaddi.

What to Watch

--With assistance from Vinícius Andrade and Selcuk Gokoluk.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.