3 Reasons to Avoid KN and 1 Stock to Buy Instead

Although the S&P 500 is down 7.2% over the past six months, Knowles’s stock price has fallen further to $15.09, losing shareholders 15.5% of their capital. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Knowles, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why you should be careful with KN and a stock we'd rather own.

Why Do We Think Knowles Will Underperform?

With roots dating back to 1946 and a focus on components that must perform flawlessly in critical situations, Knowles (NYSE:KN) designs and manufactures specialized electronic components like high-performance capacitors, microphones, and speakers for medical technology, defense, and industrial applications.

1. Revenue Spiraling Downwards

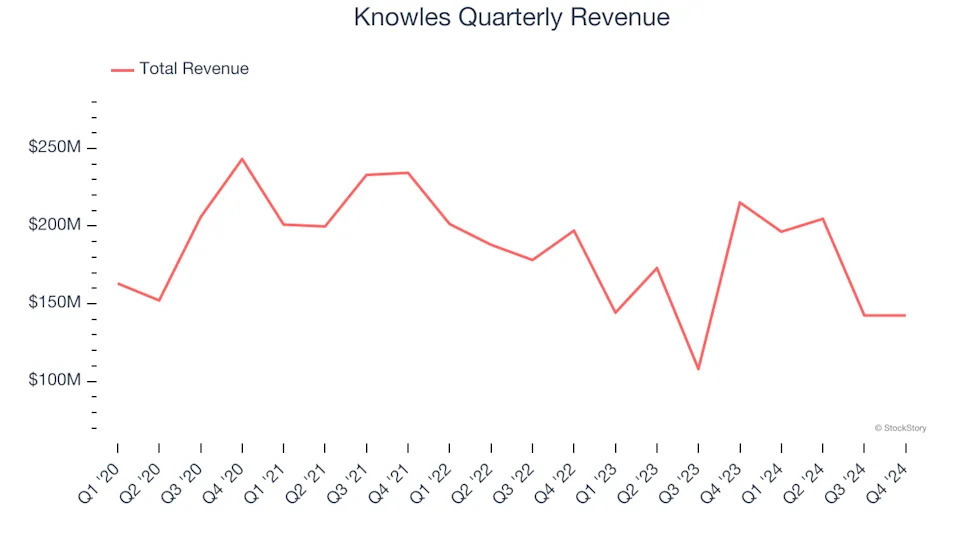

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Knowles struggled to consistently generate demand over the last four years as its sales dropped at a 2.7% annual rate. This wasn’t a great result and is a sign of poor business quality.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Knowles’s revenue to drop by 14.3%, a decrease from its 5.3% annualized declines for the past two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

3. EPS Trending Down

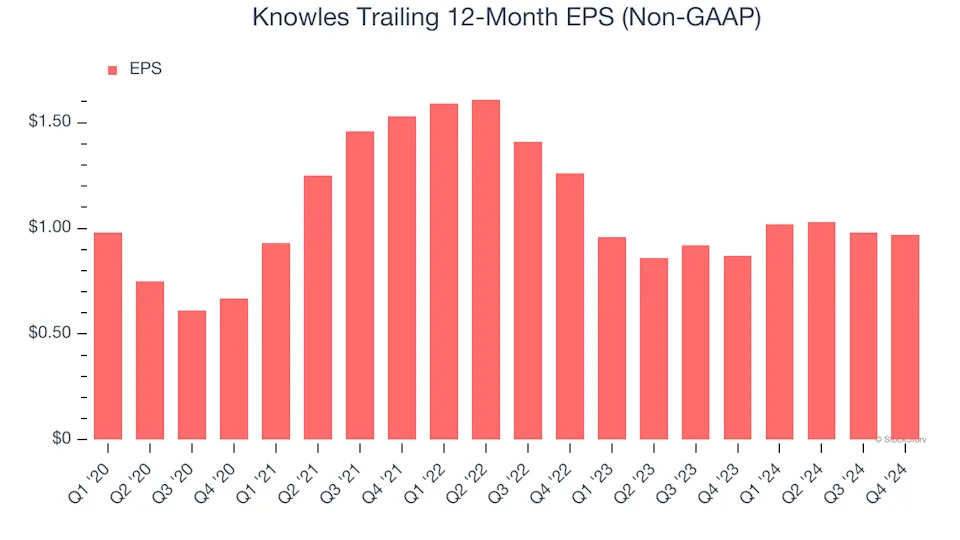

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Knowles’s full-year EPS dropped 22.3%, or 4.1% annually, over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Knowles’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Knowles doesn’t pass our quality test. After the recent drawdown, the stock trades at 13.1× forward price-to-earnings (or $15.09 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at the Amazon and PayPal of Latin America .