CNA Financial Near 52-Week High: Time to Buy, Sell or Hold the Stock?

CNA Financial Corporation

CNA closed at $47.00 on Friday, near its 52-week high of $52.36. This proximity underscores investor confidence. It has the ingredients for further price appreciation.

With a market capitalization of $12.71 billion, the average volume of shares traded in the last three months was 0.3 million.

CNA Shares are Affordable

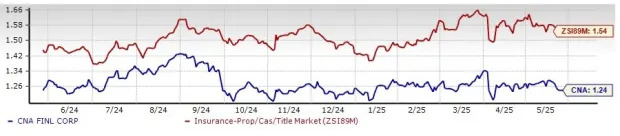

CNA Financial shares are trading at a forward price-to-book value of 1.24X, lower than the industry average of 1.54X, the Finance sector’s 4.3X and the Zacks S&P 500 Composite’s 7.98X. Its pricing, at a discount to the industry average, gives a better entry point to investors. Also, it has a Value Score of B.

Image Source: Zacks Investment Research

Shares of other P&C insurers like RLI Corp . RLI, Arch Capital Group Ltd . ACGL and Cincinnati Financial Corporation CINF are trading at a multiple higher than the industry average.

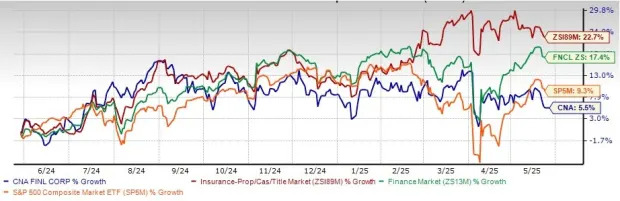

CNA Price Performance

Shares of CNA Financial have gained 5.5% in the past year compared with the industry, the Finance sector and the Zacks S&P 500 composite’s growth of 22.7%, 17.4%, and 9.3%, respectively.

CNA Lags Industry and Sector, Outperforms S&P 500 in 1 Year

Image Source: Zacks Investment Research

CNA’s Encouraging Growth Projection

The Zacks Consensus Estimate for CNA Financial’s 2025 revenues is pegged at $13.43 billion, implying a year-over-year improvement of 5.4%.

The consensus estimate for 2026 earnings per share and revenues indicates an increase of 10.8% and 3.5%, respectively, from the corresponding 2024 estimates.

Mixed Analyst Sentiment on CNA

Each of the two analysts covering the stock has lowered estimates for 2025 while one has raised the same for 2026 over the past 30 days. Thus, the Zacks Consensus Estimate for 2025 earnings has moved down 5.4% in the past 30 days, while the same for 2026 has moved up 1.3% in the same time frame.

Factors Favoring CNA

CNA Financial’s premiums should continue to grow on solid retention, favorable renewal premium change and new business growth across Specialty, Commercial and International segments.

An improving rate environment is favorable for an insurer. Amid the lower rate environment, the company’s fixed-income investment strategy with the highest allocations to diversified investment grade corporates, as well as highly rated municipal securities, should support investment results.

CNA Financial has a solid balance sheet with capital remaining above the target levels required for all ratings. It exited the first quarter with statutory capital and surplus in the combined Continental Casualty Companies of $11 billion. CNA Financial continues to maintain a conservative capital structure. It maintains liquidity in the form of cash and short-term investments, which helps to sustain business variability.

Strong financial position enables CNA Financial to engage in shareholder-friendly moves like dividend hikes. The insurer’s dividend history is impressive, as it witnessed a 10-year CAGR (2015-2025) of 6.3%. The current dividend yield of 3.6% is better than the industry average of 0.2%. On the back of a disciplined execution, denoted by strong underwriting results and confidence in future earnings performances, the insurer has been hiking dividends, apart from paying special dividends over the past couple of years. Thus, the company remains committed to returning more value to shareholders.