Here’s the advice I’m giving wealthy clients through tariff fears and market uncertainty

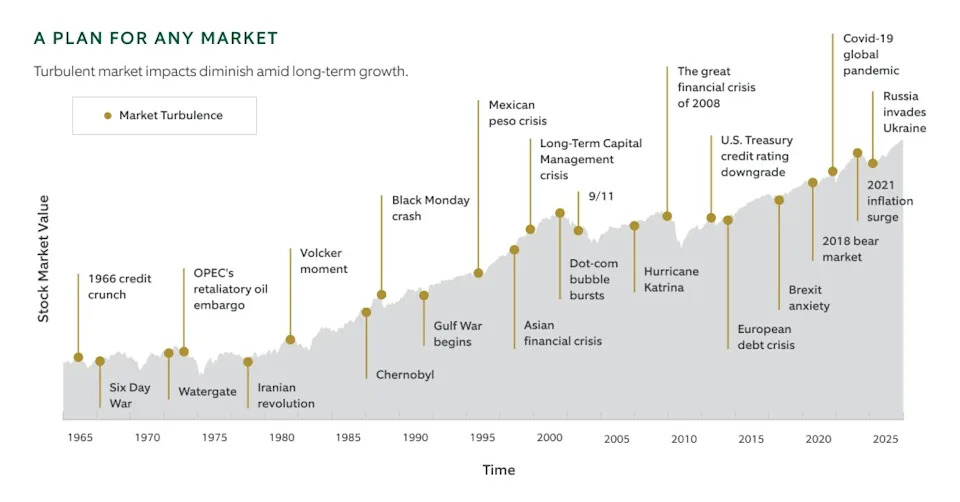

Over the years, we have steered clients through turbulent times—including the Global Financial Crisis, COVID market shocks, and numerous choppy waters in between. Today, we face similarly volatile financial conditions from swift and unpredictable changes in U.S. trade policies. The uncertainty has rattled markets and client portfolios, reminding us that navigating volatility is inevitable and integral to long-term investing success.

Understandably, many investors are deeply concerned. Anxiety is spiking as we witness equity market selloffs, volatile Treasury yields and dramatic swings in currency markets. Questions like, "Is this the start of a recession?" or "Should I make changes to protect my investments?" are at the top of people's minds. However, as history shows, reacting impulsively during market stress can undermine investment success. Instead, we advise our clients to "confirm the course" so they don't make strategy changes at the exact wrong moment.

The tariff turmoil and market reaction

The recent tariff announcements and corresponding retaliations have triggered historically dramatic market responses. In just one example, the Nasdaq entered a bear market in the two days following the April 2 tariff announcements, bounced back for a record-breaking single-day point gain following the announcement of the 90-day pause, then reversed course again the next day as the long-term ramifications of elevated trade barriers settled in. The bond market, meanwhile, currently faces intense stress, with longer-dated Treasury yields spiking due to unwinding leveraged trades and waning foreign capital inflows. Even as global markets reel, these disruptions underscore a critical truth about investing during volatile periods: short-term market movements are unpredictable, but long-term discipline remains the key to success.

Get comfortable staying the course

We anchor our advice in a goals-driven framework, which emphasizes aligning portfolios to individual financial goals based on the unique character of each goal. Amid significant market turbulence, this framework becomes especially important because it helps investors focus on their goals and objectives—instead of reacting to news and volatility. Central to the goals-driven framework is the portfolio reserve. This strategic buffer, composed of high-quality shorter duration fixed income and cash, meets short-term spending needs during market downturns. The portfolio reserve allows clients to avoid selling risk assets such as equities at depressed prices, ensuring their long-term strategy remains intact as markets stabilize.