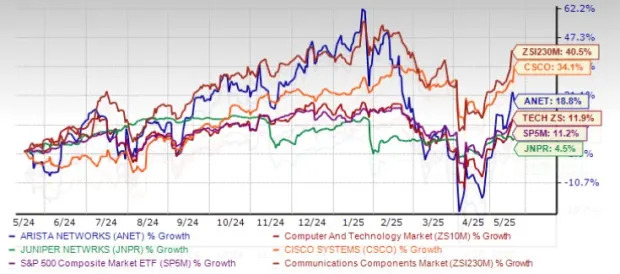

Arista Rises 18.8% in a Year: Should You Bet on the Stock Now?

Arista Networks, Inc. ANET has increased 18.8% over the past year compared with the communication components industry’s growth of 40.5%. The stock has outperformed the Zacks Computer & Technology sector and the S&P 500’s growth of 11.9% and 11.2%, respectively.

One-Year Price Performance

Image Source: Zacks Investment Research

The company has outperformed its peer, Juniper Networks, Inc. JNPR, but underperformed relative to Cisco Systems, Inc. CSCO. Juniper has gained 4.5%, while Cisco has surged 34.1% during this period.

ANET Rides on Portfolio Strength, AI Focus & Solid Liquidity

Arista is steadily expanding its portfolio to match the ever-growing demand for modern AI infrastructure. It is witnessing solid demand among enterprise customers backed by its multi-domain modern software approach, which is built upon its unique and differentiating foundation, the single EOS (Extensible Operating System) and CloudVision stack. It has introduced Cluster Load Balancing, a sophisticated network load-balancing solution integrated into Arista EOS. The solution streamlines the management of large flows of data across network devices.

The latest Arista Etherlink AI Platforms are capable of supporting ultra-fast data rates (800G/400G). It can efficiently support small AI clusters as well as large deployments with 100,000+ accelerators.

NVIDIA

’s NVDA GPU roadmap focuses on pushing the boundaries of high-performance computing and supporting data centers with next-generation capabilities. NVIDIA’s upcoming Blackwell Ultra GPUs are likely to provide up to 25X the token throughput for AI inference compared to Hopper 100. To connect these GPUs in AI clusters, enterprises need networks with ultra-low latency and extremely high throughput. Arista is actively aligning its innovation strategy with such emerging technology trends. Backed by strong momentum in cloud and AI networking solutions, the company is expected to generate $750 million in front-end AI revenues in 2025.

In the first quarter, Arista generated net cash flow of $641.7 million from operations, up from $513.8 million a year ago. Healthy growth in cash flow indicates efficient working capital management. As of March 31, 2025, the company had $1.84 billion in cash and cash equivalents and $257.8 million in other long-term liabilities. At the end of the first quarter of 2025, ANET reported a current ratio of 3.93, way above the industry's average of 1.48. A current ratio above 1 suggests that a company is well-positioned to meet its short-term obligations. Such a strong liquidity position will allow Arista to steadily invest in growth initiatives and expand opportunities across several end markets.