UnitedHealth Spirals Downward Amid New Criminal Probe: Time to Sell?

UnitedHealth Group Incorporated UNH is facing a wave of challenges, with little room to catch a break. The latest blow? A criminal investigation into possible Medicare fraud was reported by the Wall Street Journal. This comes on the heels of a disappointing first-quarter performance, where the company missed both earnings and revenue estimates. Rising costs, primarily tied to Medicare Advantage plans and the Optum health services segment, and higher utilization trends, are weighing heavily on margins.

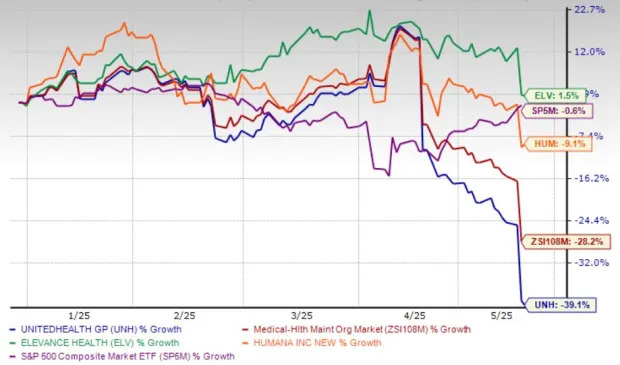

In a further sign of uncertainty, UnitedHealth withdrew its 2025 financial guidance. The sudden leadership shake-up also adds to the mix, with former CEO Andrew Witty, who joined in 2021, stepping down and longtime leader Stephen Hemsley returning to the helm. Over the past week, UNH shares have plunged 21.2%, bringing its year-to-date decline to 39.1%, significantly underperforming both the industry (-28.2%) and the S&P 500 (-0.6%). In comparison, peer Humana Inc. HUM dropped 9.1%, while Elevance Health, Inc. ELV actually gained 1.5%.

YTD Price Performance - UNH, HUM, ELV, Industry & S&P 500

Image Source: Zacks Investment Research

This is not the first time UnitedHealth has been in the spotlight for the wrong reasons. The company had suffered a fallout from a 2024 cyberattack on its tech division, which resulted in a massive data breach and a subsequent federal investigation. Adding to the list: the tragic killing of its insurance unit CEO Brian Thompson, a public backlash against the industry, and the legal roadblock to its $3.3 billion Amedisys acquisition.

Now, the Department of Justice is investigating the company for potential Medicare fraud, according to the WSJ, a probe that reportedly began last summer. While the details remain unclear, this follows a February inquiry launched by Senator Chuck Grassley into UnitedHealth’s Medicare billing practices.

The stock is trading below both its 50-day and 200-day moving averages: technical signals that indicate sustained downward momentum.

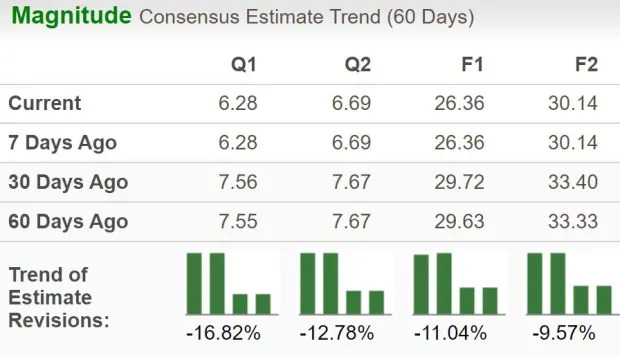

UNH’s Unfavorable Estimate Revisions

Unsurprisingly, analyst sentiment has turned negative. The Zacks Consensus Estimate for UNH’s 2025 EPS has seen 13 downward revisions in the past month, while the 2026 EPS estimate has seen 11, without a single upward revision. Earnings for 2025 are now projected to decline by 4.7%, even as revenues are still expected to climb 13.1% year over year. (See the Zacks Earnings Calendar to stay ahead of market-making news.)

Image Source: Zacks Investment Research

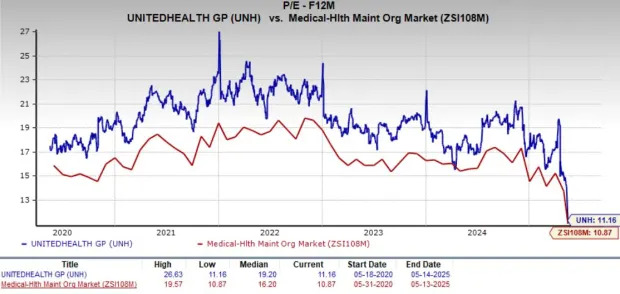

UNH’s Valuation Still Rich

Despite the selloff, UNH remains expensive. The stock currently trades at a forward P/E of 11.16X, above the industry average of 10.87X. By comparison, Humana trades at 14.88X and Elevance at 10.35X, placing UnitedHealth somewhere in the middle despite the selloff.