3 Reasons CHWY is Risky and 1 Stock to Buy Instead

Even during a down period for the markets, Chewy has gone against the grain, climbing to $34.90. Its shares have yielded a 22.7% return over the last six months, beating the S&P 500 by 29.9%. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Chewy, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the momentum, we don't have much confidence in Chewy. Here are three reasons why we avoid CHWY and a stock we'd rather own.

Why Is Chewy Not Exciting?

Founded by Ryan Cohen, who later became known for his involvement in GameStop, Chewy (NYSE:CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

1. Long-Term Revenue Growth Disappoints

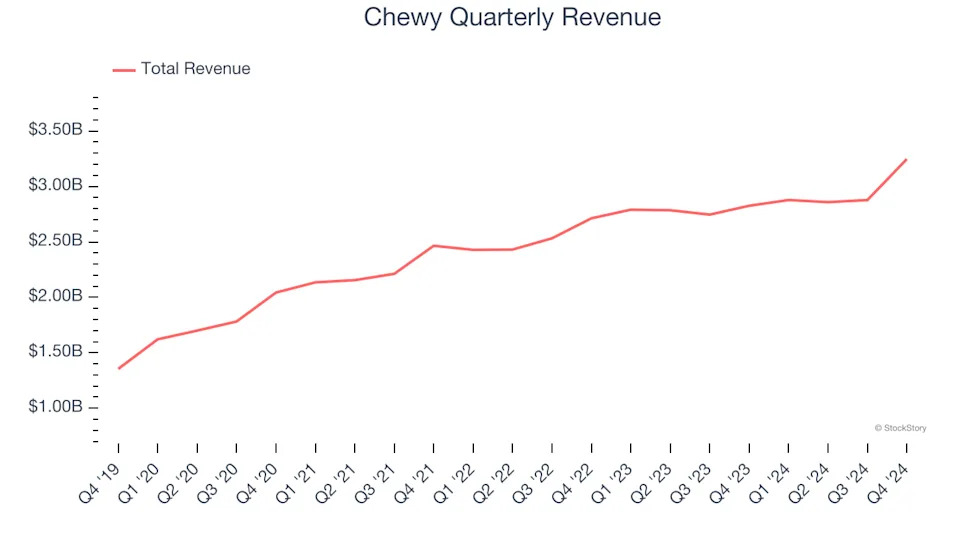

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Chewy’s sales grew at a mediocre 9.8% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Chewy’s revenue to rise by 4.6%, a deceleration versus its 9.8% annualized growth for the past three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

3. Low Gross Margin Reveals Weak Structural Profitability

For online retail (separate from online marketplaces) businesses like Chewy, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure.

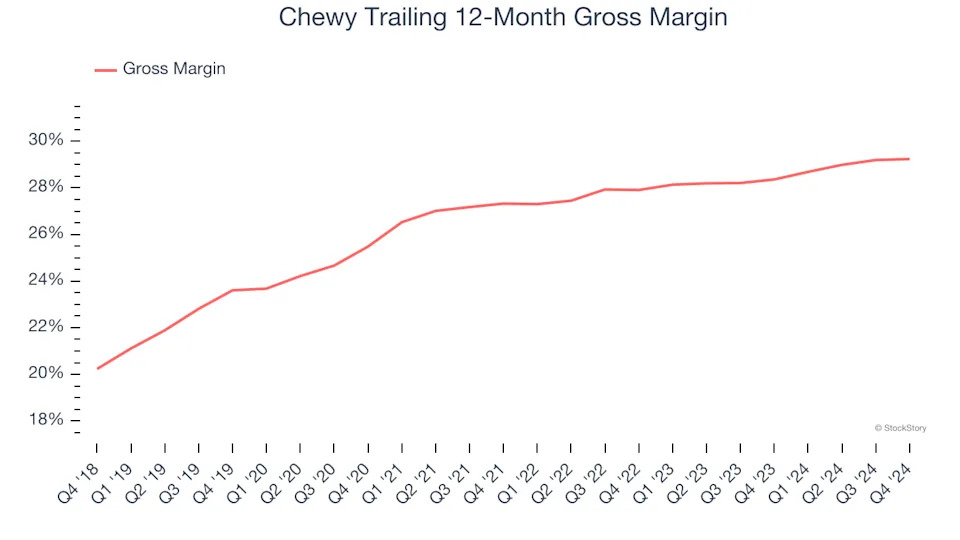

Chewy’s unit economics are far below other consumer internet companies because it must carry inventories as an online retailer. This means it has relatively higher capital intensity than a pure software business like Meta or Airbnb and signals it operates in a competitive market. As you can see below, it averaged a 28.8% gross margin over the last two years. That means Chewy paid its providers a lot of money ($71.19 for every $100 in revenue) to run its business.