EverQuote (NASDAQ:EVER) Delivers Impressive Q1, Provides Optimistic Revenue Guidance for Next Quarter

Online insurance comparison site EverQuote (NASDAQ:EVER) reported Q1 CY2025 results topping the market’s revenue expectations , with sales up 83% year on year to $166.6 million. On top of that, next quarter’s revenue guidance ($157.5 million at the midpoint) was surprisingly good and 5.4% above what analysts were expecting. Its GAAP profit of $0.21 per share was 36.4% below analysts’ consensus estimates.

Is now the time to buy EverQuote? Find out in our full research report .

EverQuote (EVER) Q1 CY2025 Highlights:

“2025 is off to a strong start, building on our momentum from last year, and we once again achieved record financial performance across our key financial metrics of revenue, Variable Marketing Dollars or VMD and Adjusted EBITDA,” said Jayme Mendal, CEO of EverQuote.

Company Overview

Aiming to simplify a once complicated process, EverQuote (NASDAQ:EVER) is an online insurance marketplace where consumers can compare and purchase various types of insurance from different providers

Sales Growth

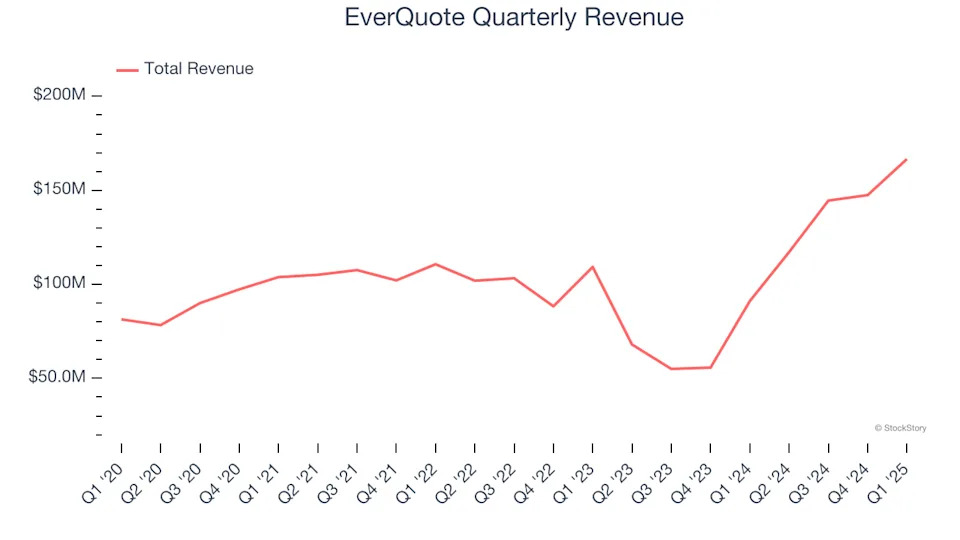

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, EverQuote’s 10.6% annualized revenue growth over the last three years was decent. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, EverQuote reported magnificent year-on-year revenue growth of 83%, and its $166.6 million of revenue beat Wall Street’s estimates by 5.2%. Company management is currently guiding for a 34.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.6% over the next 12 months, similar to its three-year rate. This projection is above the sector average and indicates its newer products and services will help sustain its historical top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories .