Duolingo (NASDAQ:DUOL) Reports Strong Q1, Stock Jumps 11.6%

Language-learning app Duolingo (NASDAQ:DUOL) announced better-than-expected revenue in Q1 CY2025, with sales up 37.7% year on year to $230.7 million. Guidance for next quarter’s revenue was optimistic at $240 million at the midpoint, 2.6% above analysts’ estimates. Its GAAP profit of $0.72 per share was 39.3% above analysts’ consensus estimates.

Is now the time to buy Duolingo? Find out in our full research report .

Duolingo (DUOL) Q1 CY2025 Highlights:

Company Overview

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ:DUOL) is a mobile app helping people learn new languages.

Sales Growth

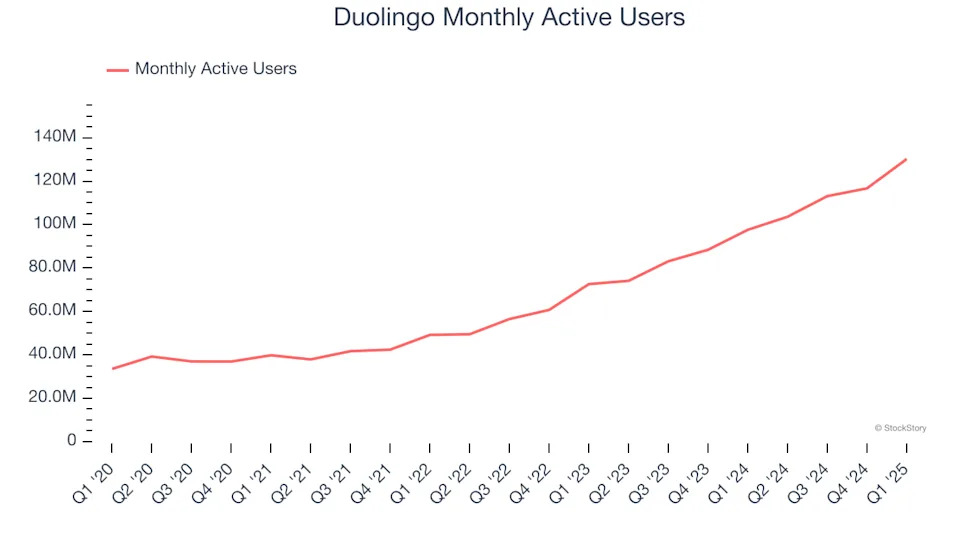

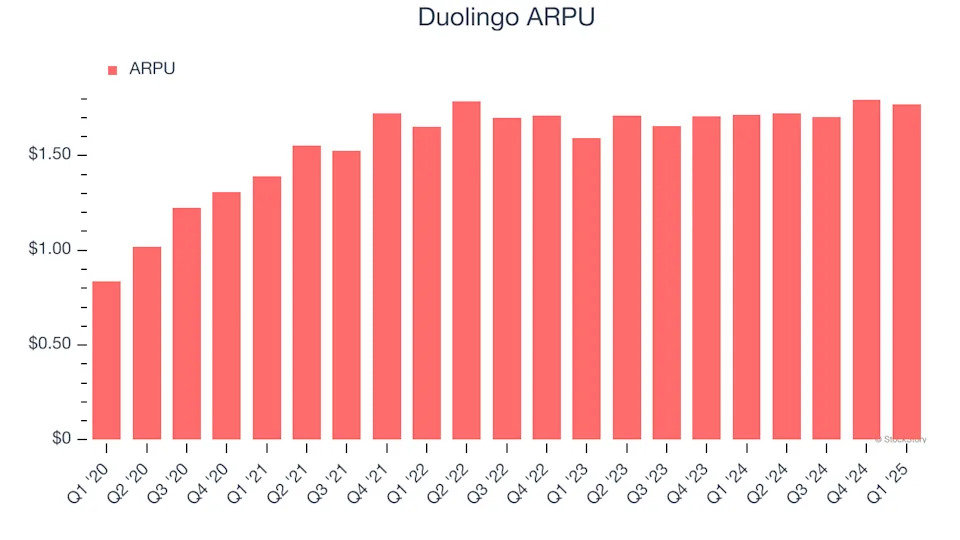

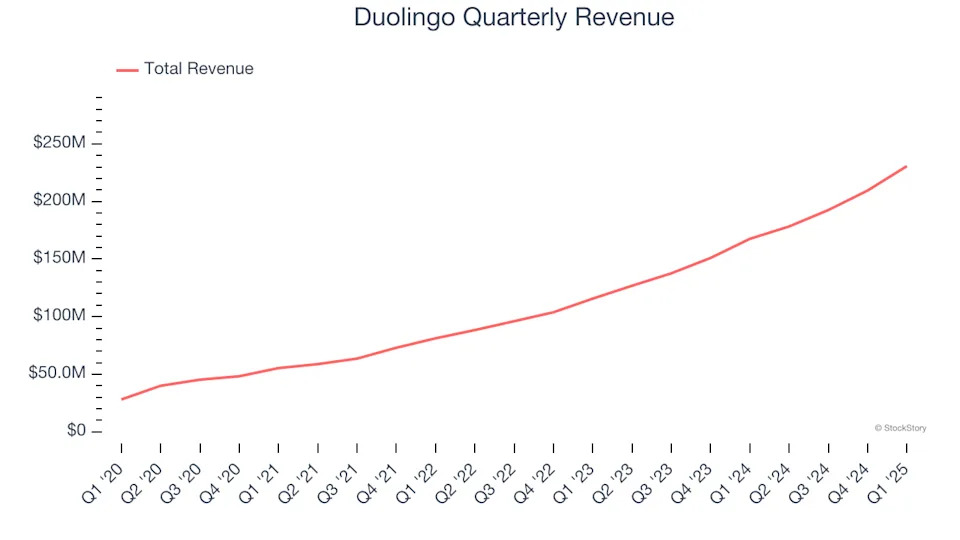

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Duolingo’s sales grew at an incredible 43.1% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Duolingo reported wonderful year-on-year revenue growth of 37.7%, and its $230.7 million of revenue exceeded Wall Street’s estimates by 3.4%. Company management is currently guiding for a 34.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 27.6% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and suggests the market is baking in success for its products and services.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .