Church & Dwight (NYSE:CHD) Reports Sales Below Analyst Estimates In Q1 Earnings, Stock Drops

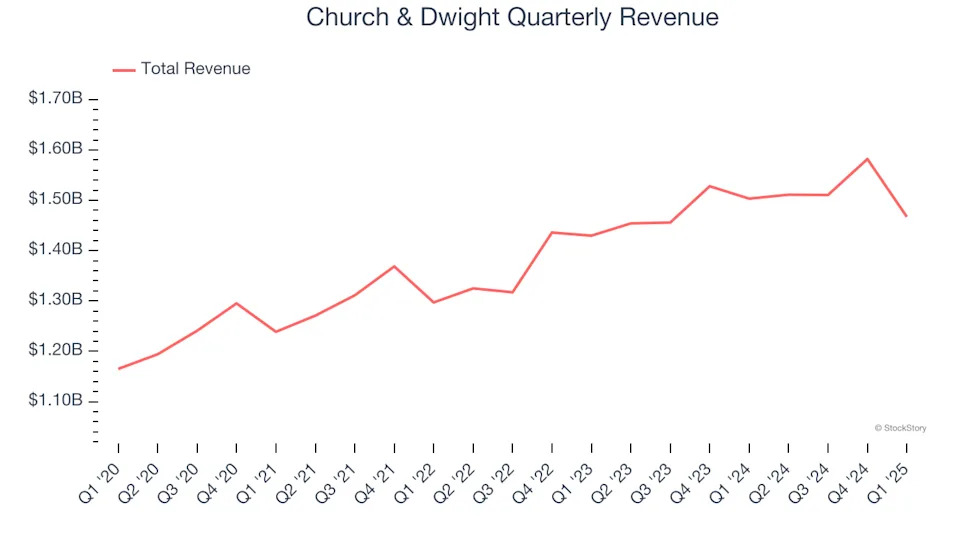

Household products company Church & Dwight (NYSE:CHD) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 2.4% year on year to $1.47 billion. Next quarter’s revenue guidance of $1.50 billion underwhelmed, coming in 4% below analysts’ estimates. Its non-GAAP profit of $0.91 per share was 1.4% above analysts’ consensus estimates.

Is now the time to buy Church & Dwight? Find out in our full research report .

Church & Dwight (CHD) Q1 CY2025 Highlights:

Rick Dierker, Chief Executive Officer, commented, “In an environment of slowing consumption, our brands are performing well. We continue to drive both dollar and volume share gains across most of our brands. Our balanced portfolio of value and premium products keep us well positioned to navigate this environment.

Company Overview

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

With $6.07 billion in revenue over the past 12 months, Church & Dwight carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

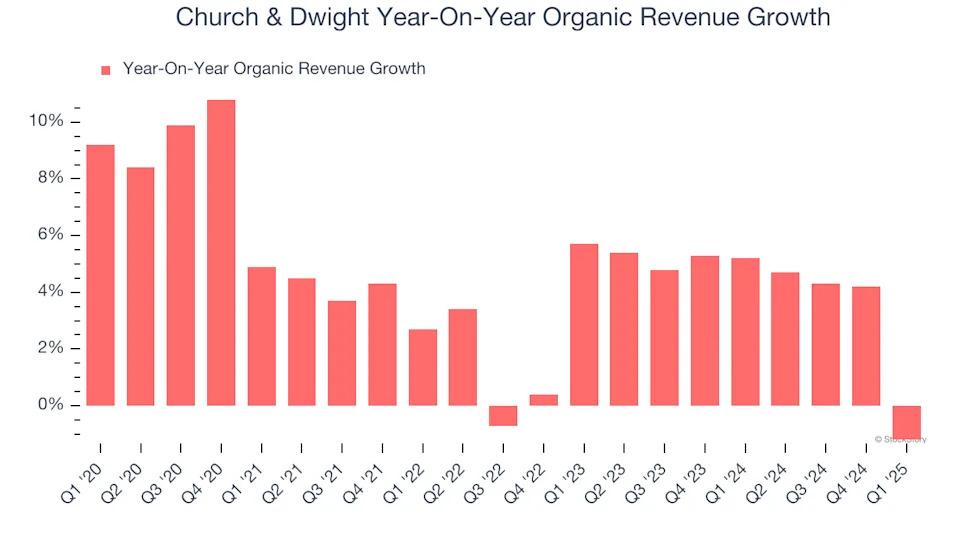

As you can see below, Church & Dwight’s sales grew at a tepid 5% compounded annual growth rate over the last three years, but to its credit, consumers bought more of its products.

This quarter, Church & Dwight missed Wall Street’s estimates and reported a rather uninspiring 2.4% year-on-year revenue decline, generating $1.47 billion of revenue. Company management is currently guiding for a 1% year-on-year decline in sales next quarter.