3 Reasons GWRE is Risky and 1 Stock to Buy Instead

Even during a down period for the markets, Guidewire has gone against the grain, climbing to $210. Its shares have yielded a 12.9% return over the last six months, beating the S&P 500 by 15.8%. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Guidewire, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Why Is Guidewire Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Guidewire. Here are three reasons why there are better opportunities than GWRE and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

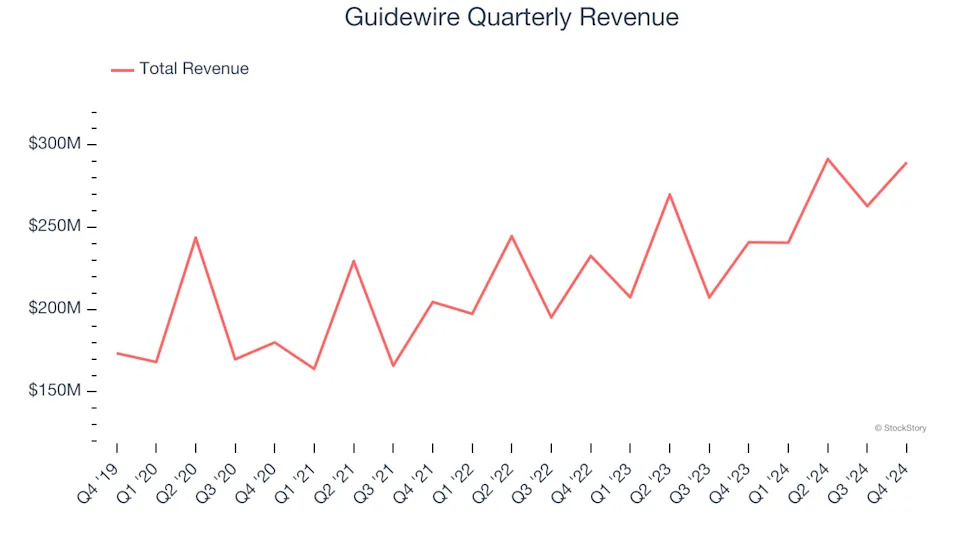

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Guidewire grew its sales at a 12.4% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

2. Low Gross Margin Reveals Weak Structural Profitability

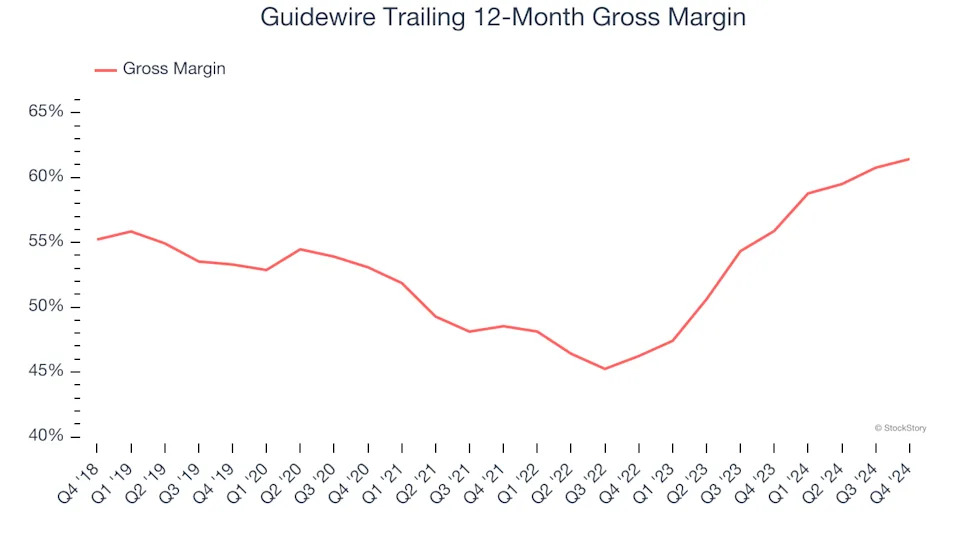

For software companies like Guidewire, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Guidewire’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 61.4% gross margin over the last year. That means Guidewire paid its providers a lot of money ($38.57 for every $100 in revenue) to run its business.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Guidewire’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Final Judgment

Guidewire’s business quality ultimately falls short of our standards. With its shares beating the market recently, the stock trades at 13.7× forward price-to-sales (or $210 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy .