Meta (NASDAQ:META) Exceeds Q1 Expectations

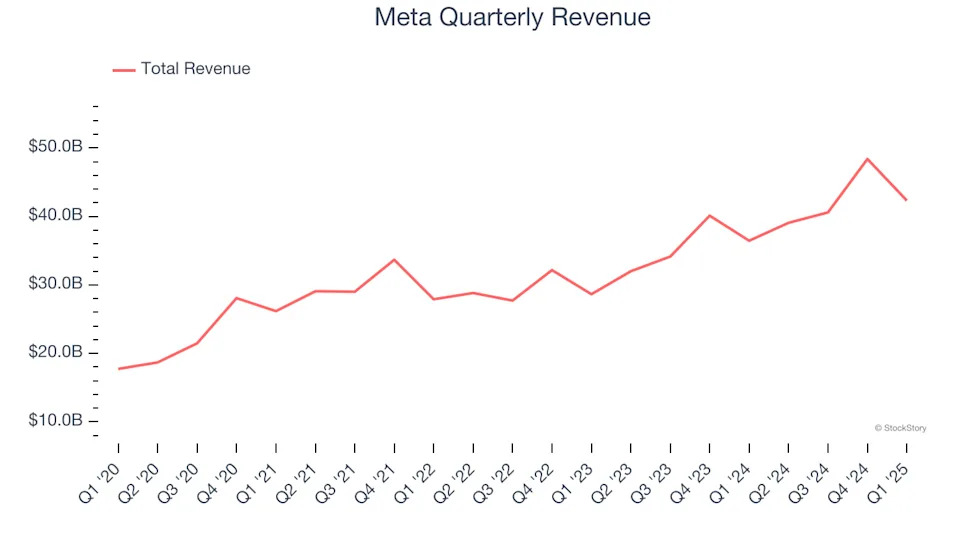

Social network operator Meta Platforms (NASDAQ:META) reported Q1 CY2025 results beating Wall Street’s revenue expectations , with sales up 16.1% year on year to $42.31 billion. The company expects next quarter’s revenue to be around $44 billion, close to analysts’ estimates. Its GAAP profit of $6.43 per share was 23.1% above analysts’ consensus estimates.

Is now the time to buy Meta? Find out in our full research report .

Meta (META) Q1 CY2025 Highlights:

"We've had a strong start to an important year, our community continues to grow and our business is performing very well," said Mark Zuckerberg, Meta founder and CEO.

Company Overview

Famously founded by Mark Zuckerberg in his Harvard dorm, Meta Platforms (NASDAQ:META) operates a collection of the largest social networks in the world - Facebook, Instagram, WhatsApp, and Messenger, along with its metaverse focused Reality Labs.

Sales Growth

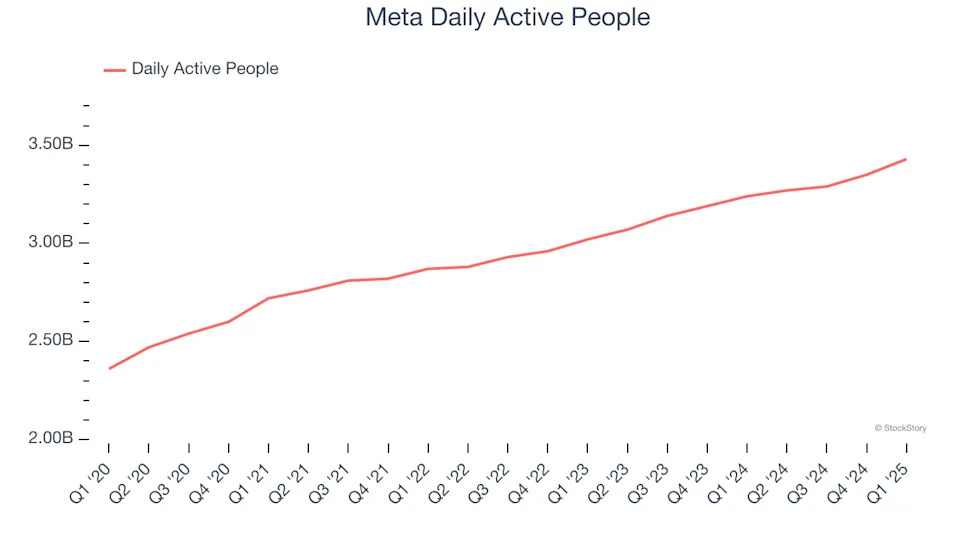

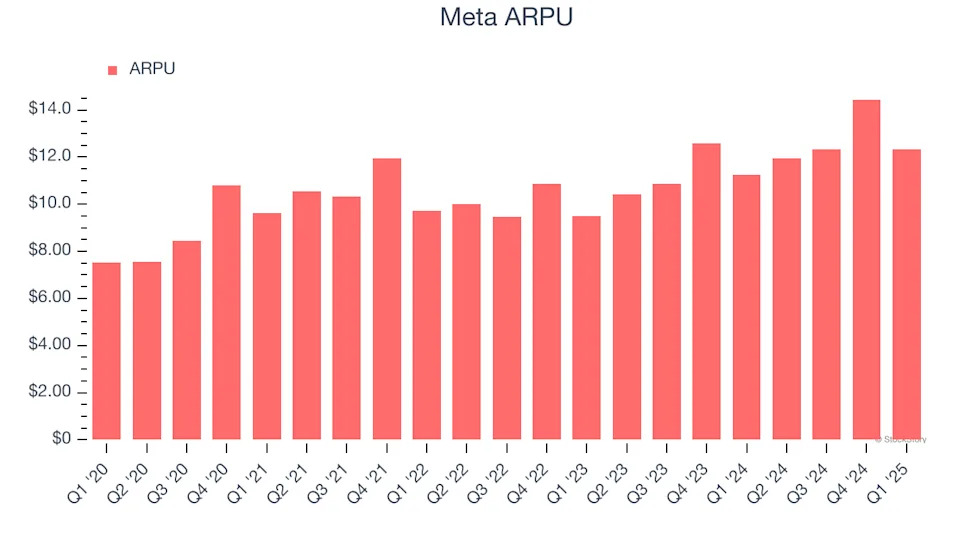

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Meta’s sales grew at a decent 12.5% compounded annual growth rate over the last three years. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Meta reported year-on-year revenue growth of 16.1%, and its $42.31 billion of revenue exceeded Wall Street’s estimates by 2.3%. Company management is currently guiding for a 12.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12% over the next 12 months, similar to its three-year rate. This projection is above average for the sector and implies its newer products and services will help maintain its historical top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend .