Confluent (NASDAQ:CFLT) Surprises With Q1 Sales But Stock Drops 10.2%

Data infrastructure software company, Confluent (NASDAQ:CFLT) reported Q1 CY2025 results topping the market’s revenue expectations , with sales up 24.8% year on year to $271.1 million. On the other hand, next quarter’s revenue guidance of $267.5 million was less impressive, coming in 3.9% below analysts’ estimates. Its non-GAAP profit of $0.08 per share was 18.3% above analysts’ consensus estimates.

Is now the time to buy Confluent? Find out in our full research report .

Confluent (CFLT) Q1 CY2025 Highlights:

“Confluent started the year with solid momentum, achieving subscription revenue growth of 26% year over year,” said Jay Kreps, co-founder and CEO, Confluent.

Company Overview

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ:CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

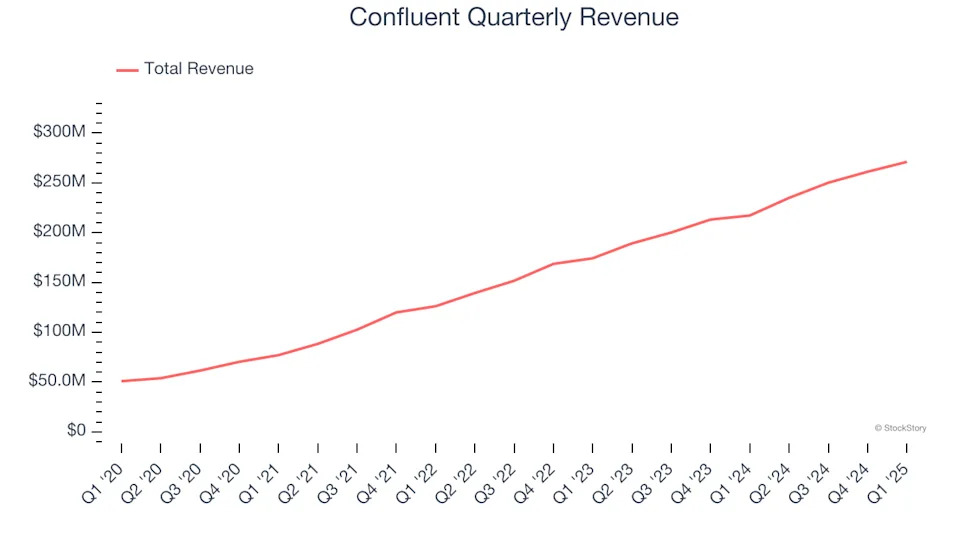

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Confluent grew its sales at an excellent 32.5% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Confluent reported robust year-on-year revenue growth of 24.8%, and its $271.1 million of revenue topped Wall Street estimates by 2.6%. Company management is currently guiding for a 13.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.8% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and implies the market sees success for its products and services.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .