Service International (NYSE:SCI) Surprises With Q1 Sales, Stock Soars

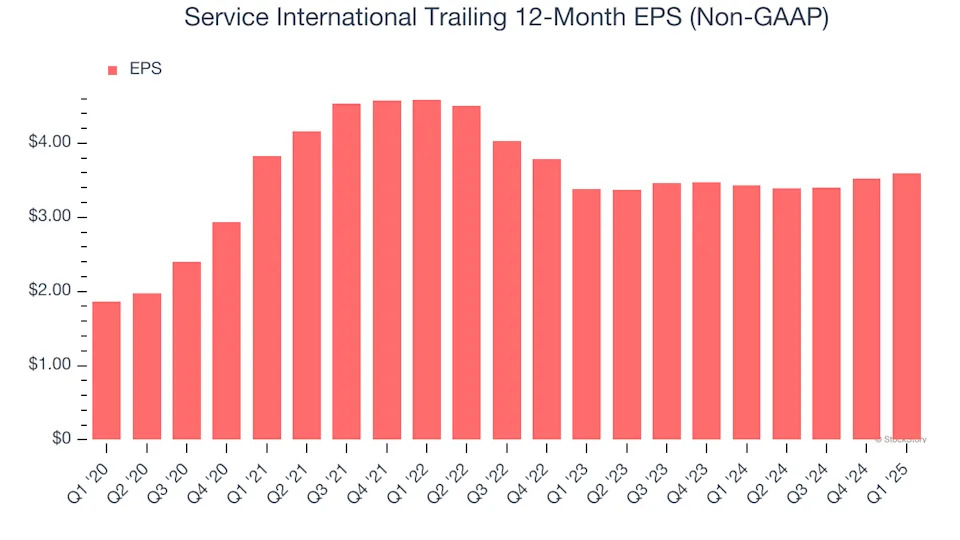

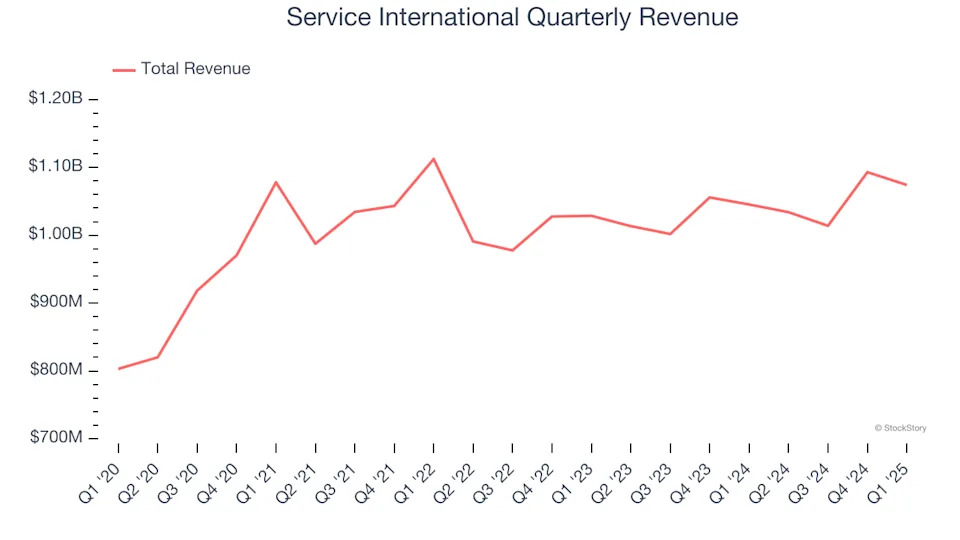

Funeral services company Service International (NYSE:SCI) reported Q1 CY2025 results exceeding the market’s revenue expectations , with sales up 2.8% year on year to $1.07 billion. Its non-GAAP profit of $0.96 per share was 5.7% above analysts’ consensus estimates.

Is now the time to buy Service International? Find out in our full research report .

Service International (SCI) Q1 CY2025 Highlights:

Company Overview

Founded in 1962, Service International (NYSE: SCI) is a leading provider of death care products and services in North America.

Sales Growth

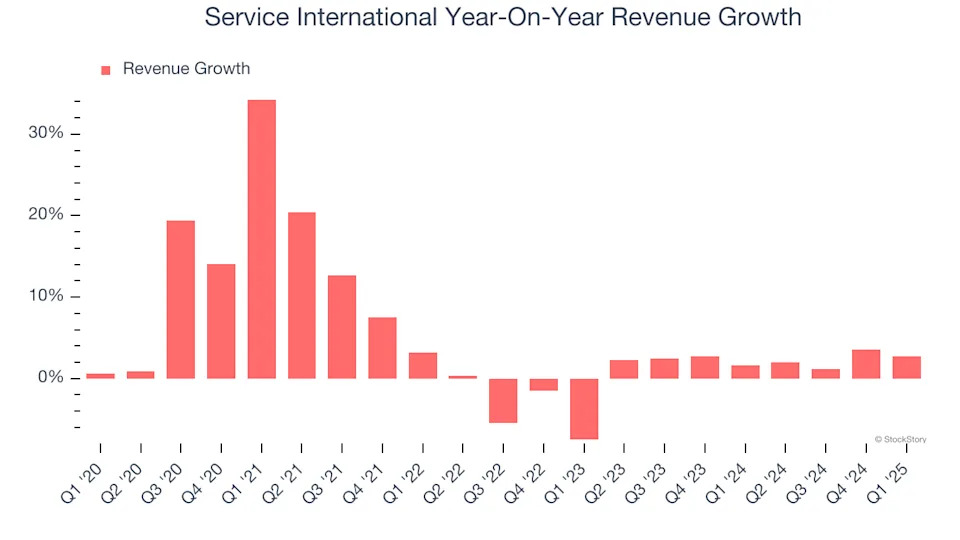

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Service International’s sales grew at a sluggish 5.4% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Service International’s recent performance shows its demand has slowed as its annualized revenue growth of 2.3% over the last two years was below its five-year trend.

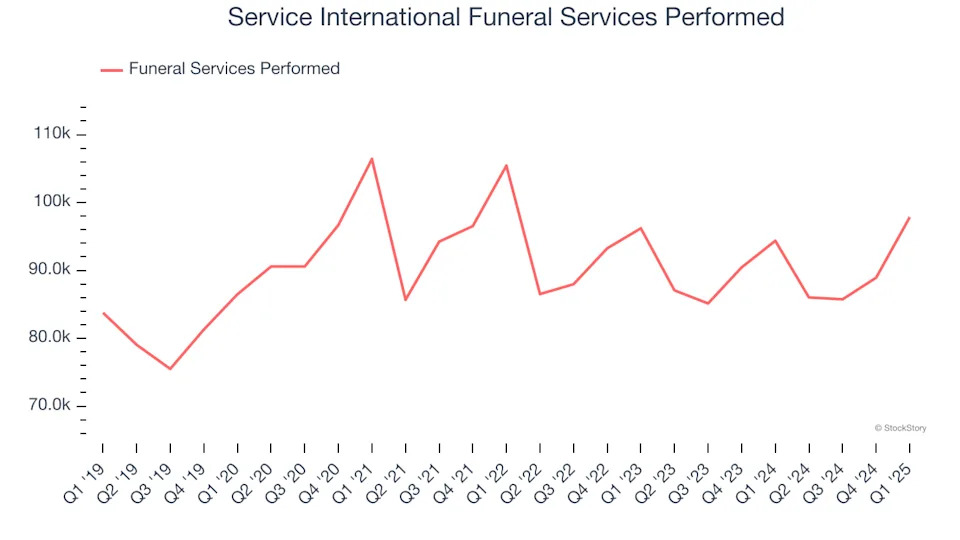

We can better understand the company’s revenue dynamics by analyzing its number of funeral services performed, which reached 97,854 in the latest quarter. Over the last two years, Service International’s funeral services performed were flat. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Service International reported modest year-on-year revenue growth of 2.8% but beat Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories .