Align Technology (NASDAQ:ALGN) Reports Q1 In Line With Expectations, Stock Jumps 10.3%

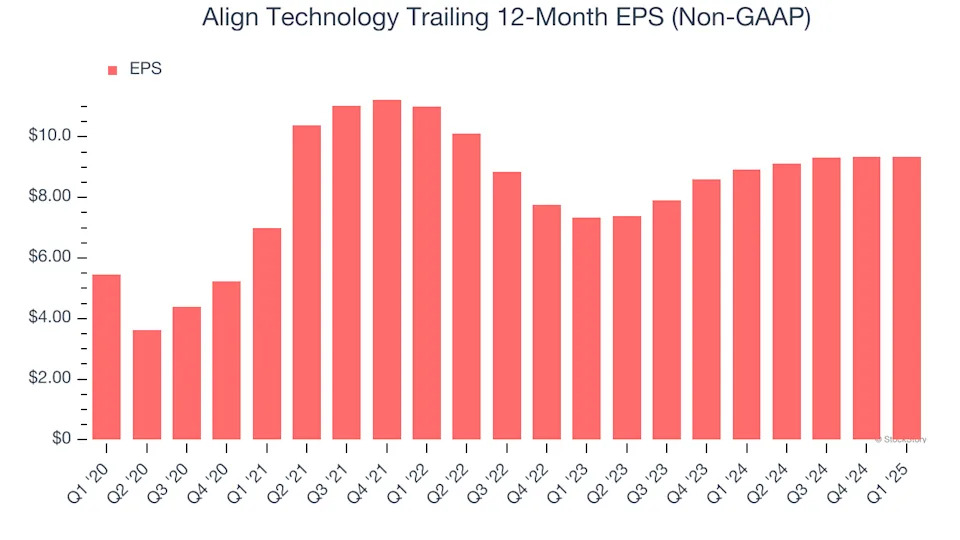

Dental technology company Align Technology (NASDAQ:ALGN) met Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 1.8% year on year to $979.3 million. The company expects next quarter’s revenue to be around $1.06 billion, coming in 0.8% above analysts’ estimates. Its non-GAAP profit of $2.13 per share was 7.1% above analysts’ consensus estimates.

Is now the time to buy Align Technology? Find out in our full research report .

Align Technology (ALGN) Q1 CY2025 Highlights:

Company Overview

Pioneering an alternative to traditional metal braces with nearly invisible plastic aligners, Align Technology (NASDAQ:ALGN) designs and manufactures Invisalign clear aligners, iTero intraoral scanners, and dental CAD/CAM software for orthodontic and restorative treatments.

Sales Growth

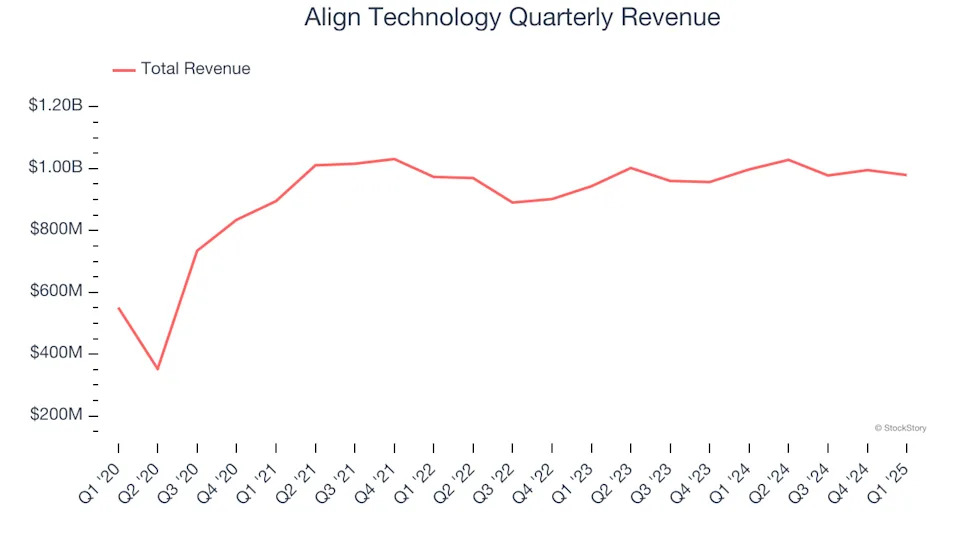

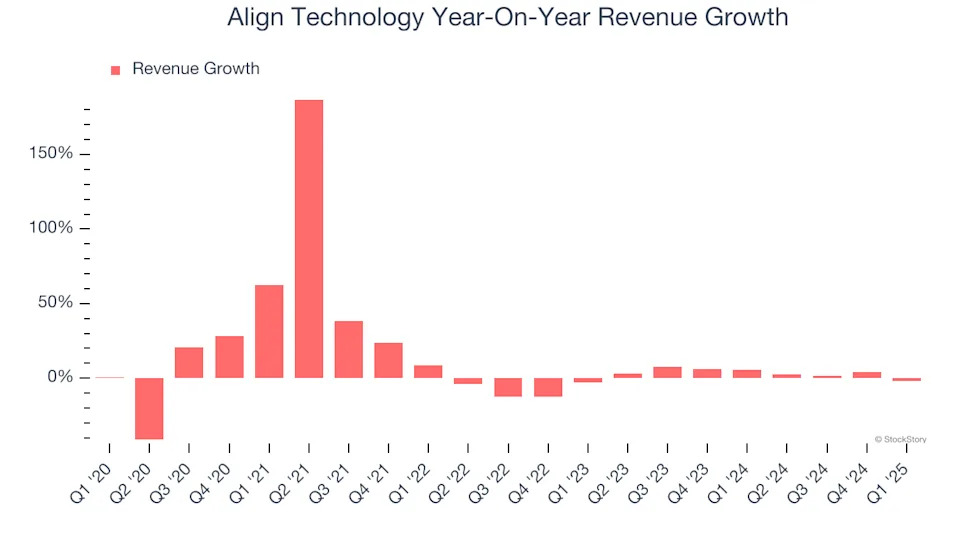

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Align Technology grew its sales at a decent 10.6% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Align Technology’s recent performance shows its demand has slowed as its annualized revenue growth of 3.7% over the last two years was below its five-year trend.

This quarter, Align Technology reported a rather uninspiring 1.8% year-on-year revenue decline to $979.3 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 3.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories .