Tesla director finally buys shares after more than 5 years—only to see his own board chair promptly sell $32 million in stock

It’s been more than five years, but a

Tesla

insider has finally invested his own money to buy the company’s shares on the open market.

The $1 million paid by independent boardroom director Joe Gebbia, the co-founder of AirBnB, was a drop in the bucket next to a board otherwise renowned for cashing in its shares.

Yet fans of the brand hailed the open market purchase as a sign of confidence the upcoming robotaxi pilot so vital to its equity story will prove a success while the “unexpected bumps this year” that CEO Elon Musk warned of last week would be a minor inconvenience.

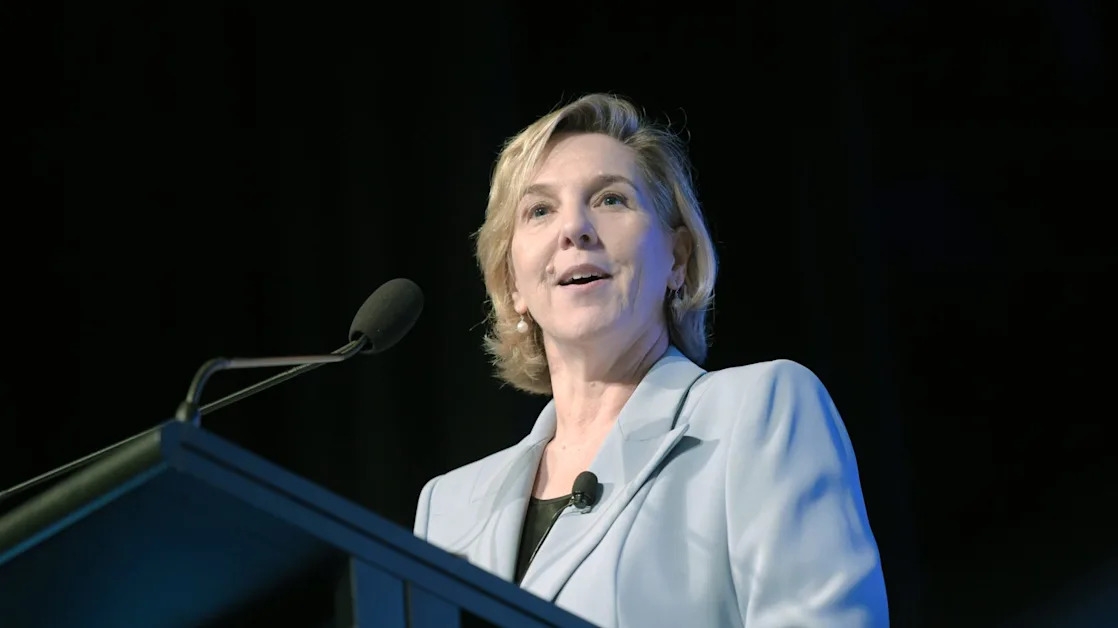

Within 24 hours, however, Tesla’s chair Robyn Denholm unloaded another $32 million-plus tranche to add to her

recent string of stock sales

under her 10b5-1 trading plan, according to a regulatory filing on Tuesday.

That means investors’ chief independent delegate to the board has now unloaded nearly $150 million in stock since

early December

.

Prior to Gebbia, the last Tesla insider to demonstrate his faith in the company’s future was Elon Musk. The CEO bought stock

late in 2018

during a period when the company was plagued with production problems around the Model 3 and nearly went bankrupt.

“For Tesla, it has become a running joke that insiders only sell, never buy the stock,” Fred Lambert, the editor-in-chief of EV motoring site Electrek and fan-turned-critic of Musk,

wrote

on Tuesday.

Denholm, whose term expires in about 12 months, is a controversial figure in the Tesla investor community over her approach to handling Musk, which has been broadly described as hands-off. Both supporters and detractors point to the same evidence to support their argument that she gives her CEO all the freedom he desires to act as he sees fit.

Initially this proved to be a wild success. During the first year of the pandemic, when the government showered Americans with stimulus checks, shares in Tesla gained tenfold their value, rising from $29 to roughly $290.

Business boomed, with the Model Y that launched that year going on to become the

best-selling car of any kind

worldwide just three years later — despite its relatively high price.

But the

success didn’t last

, with annual

vehicle sales declining

last year for the very first time since the Y’s launch revolutionized the company. Its 2.1% quarterly operating profit margin plumbed a low not seen since mid-2019, with much of the blame being placed on Musk.

Instead of developing an all new low-cost entry model for $25,000 as he had originally promised five years ago during Battery Day, the CEO focused instead on launching the troubled Cybertruck. When Cybertruck sales disappointed, he began re-positioning the company as a leader in the fledgling market of real world AI with his

upcoming CyberCab robotaxi

and Optimus droid.

Meanwhile he has alienated many veteran Tesla customers with his emphatic support for the current White House administration of Donald Trump, whose

popular support

at this point is the

lowest on record

of any presidency in 80 years.

Denholm, who

briefly emerged

last year to fight for her CEO’s pay package, has kept to the background during this process even in the face of investors

asking her to intervene

.

This story was originally featured on

Fortune.com