Snap (NYSE:SNAP) Beats Q1 Sales Targets But Stock Drops 13.8%

Social network Snapchat (NYSE: SNAP) announced better-than-expected revenue in Q1 CY2025, with sales up 14.1% year on year to $1.36 billion. Its GAAP loss of $0.08 per share was 40.3% above analysts’ consensus estimates.

Is now the time to buy Snap? Find out in our full research report .

Snap (SNAP) Q1 CY2025 Highlights:

“We surpassed an important milestone in Q1, with our community growing to over 900 million monthly active users,” said Evan Spiegel, CEO.

Company Overview

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Snap’s 7.8% annualized revenue growth over the last three years was tepid. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Snap reported year-on-year revenue growth of 14.1%, and its $1.36 billion of revenue exceeded Wall Street’s estimates by 1.3%.

Looking ahead, sell-side analysts expect revenue to grow 10.6% over the next 12 months, an acceleration versus the last three years. This projection is above the sector average and implies its newer products and services will fuel better top-line performance.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next .

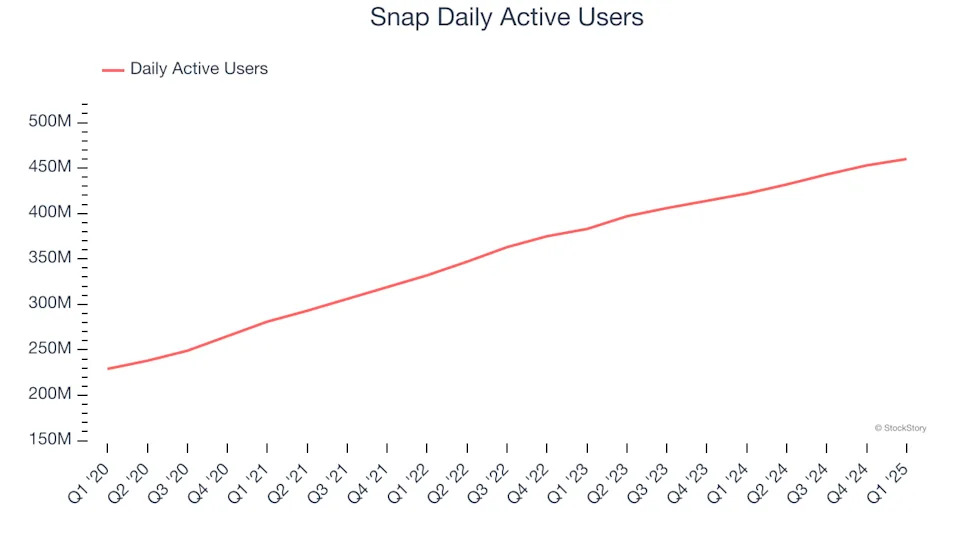

Daily Active Users

User Growth

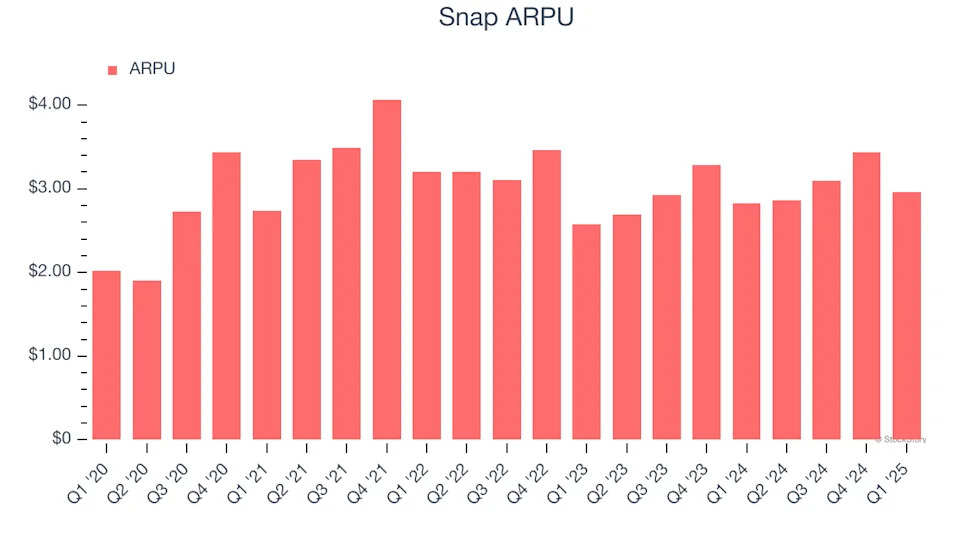

As a social network, Snap generates revenue growth by increasing its user base and charging advertisers more for the ads each user is shown.