3 Reasons to Avoid HLIO and 1 Stock to Buy Instead

Shareholders of Helios would probably like to forget the past six months even happened. The stock dropped 40.5% and now trades at $28.35. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Helios, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Why Do We Think Helios Will Underperform?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with HLIO and a stock we'd rather own.

1. Core Business Falling Behind as Demand Declines

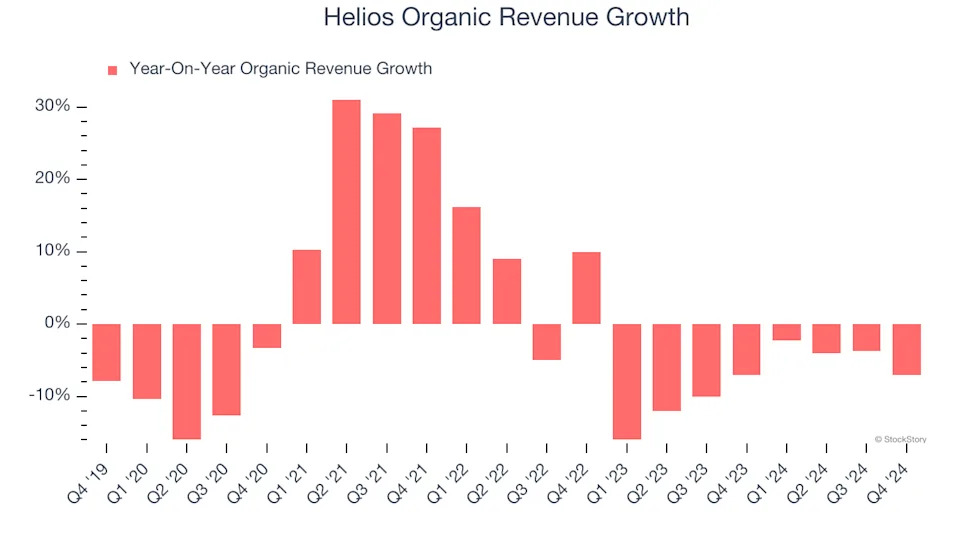

We can better understand Gas and Liquid Handling companies by analyzing their organic revenue. This metric gives visibility into Helios’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Helios’s organic revenue averaged 7.7% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Helios might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. EPS Trending Down

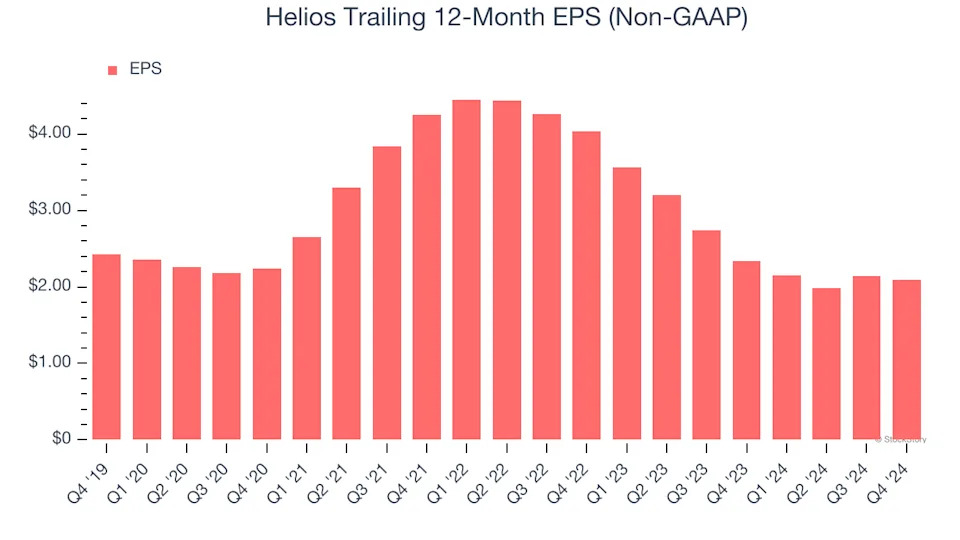

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Helios, its EPS declined by 2.9% annually over the last five years while its revenue grew by 7.8%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

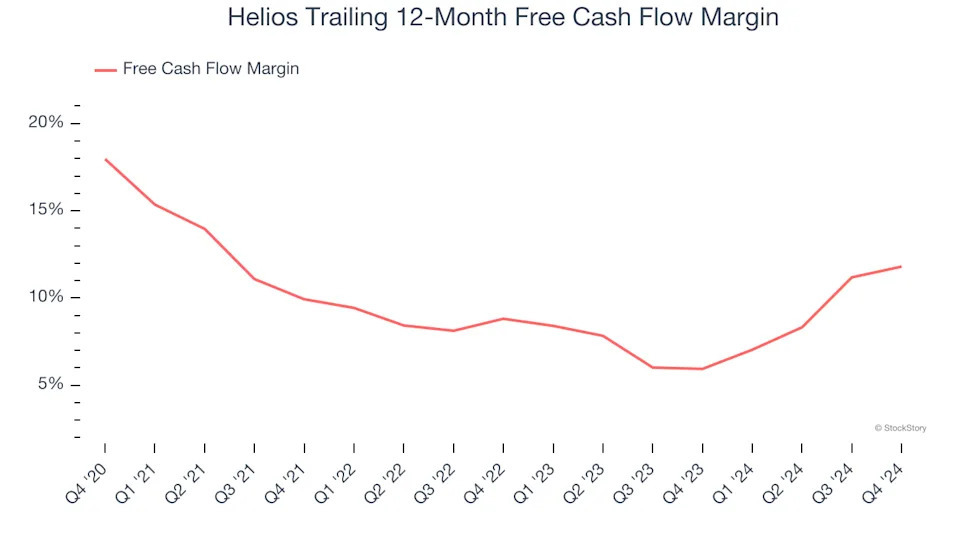

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Helios’s margin dropped by 6.2 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Helios’s free cash flow margin for the trailing 12 months was 11.8%.

Final Judgment

We see the value of companies helping their customers, but in the case of Helios, we’re out. Following the recent decline, the stock trades at 12.2× forward price-to-earnings (or $28.35 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle .