Amkor (NASDAQ:AMKR) Beats Expectations in Strong Q1, Guides for Strong Sales Next Quarter

Semiconductor packaging and testing company Amkor Technology (NASDAQ:AMKR) reported Q1 CY2025 results exceeding the market’s revenue expectations , but sales fell by 3.2% year on year to $1.32 billion. On top of that, next quarter’s revenue guidance ($1.43 billion at the midpoint) was surprisingly good and 5.6% above what analysts were expecting. Its GAAP profit of $0.09 per share was in line with analysts’ consensus estimates.

Is now the time to buy Amkor? Find out in our full research report .

Amkor (AMKR) Q1 CY2025 Highlights:

Company Overview

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ:AMKR) provides outsourced packaging and testing for semiconductors.

Sales Growth

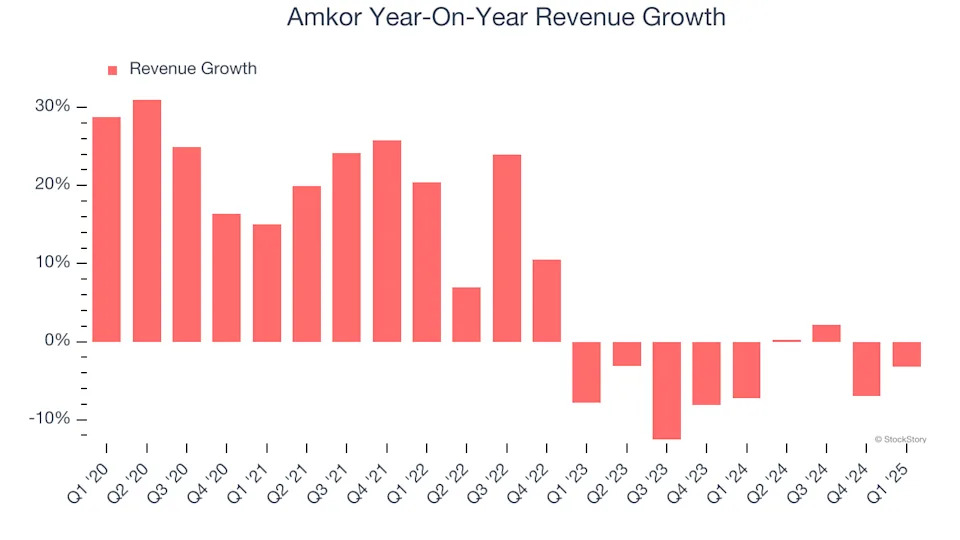

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Amkor’s 7.8% annualized revenue growth over the last five years was decent. Its growth was slightly above the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Amkor’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 5.1% over the last two years.

This quarter, Amkor’s revenue fell by 3.2% year on year to $1.32 billion but beat Wall Street’s estimates by 3.6%. Despite the beat, the drop in sales could mean that the current downcycle is deepening. Company management is currently guiding for a 2.5% year-on-year decline in sales next quarter.