3 Reasons to Avoid AMRC and 1 Stock to Buy Instead

Shareholders of Ameresco would probably like to forget the past six months even happened. The stock dropped 66.9% and now trades at $10.51. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Ameresco, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Despite the more favorable entry price, we're swiping left on Ameresco for now. Here are three reasons why there are better opportunities than AMRC and a stock we'd rather own.

Why Is Ameresco Not Exciting?

Having played a role in upgrading the energy solutions of Alcatraz Island, Ameresco (NYSE:AMRC) provides energy and renewable energy solutions for various sectors.

1. Revenue Tumbling Downwards

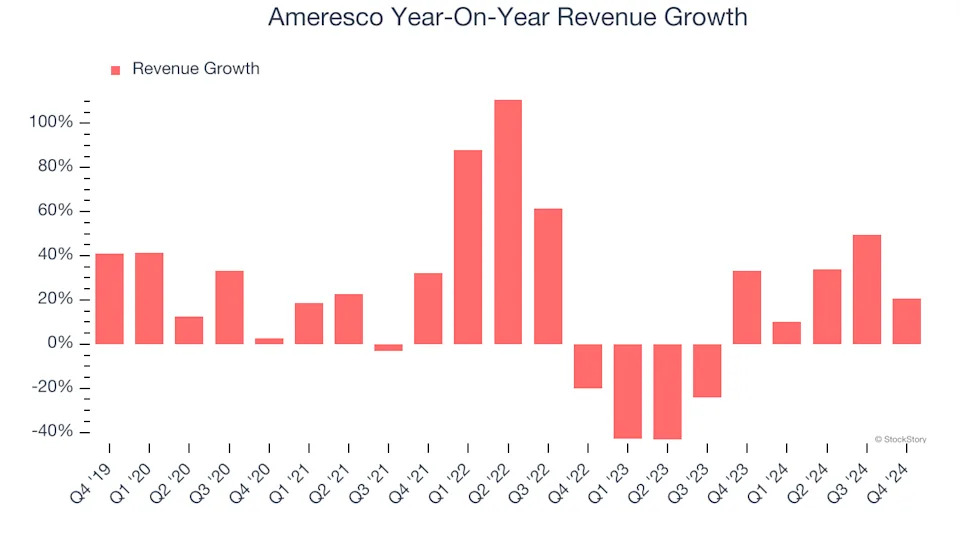

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Ameresco’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.5% over the last two years.

2. Cash Burn Ignites Concerns

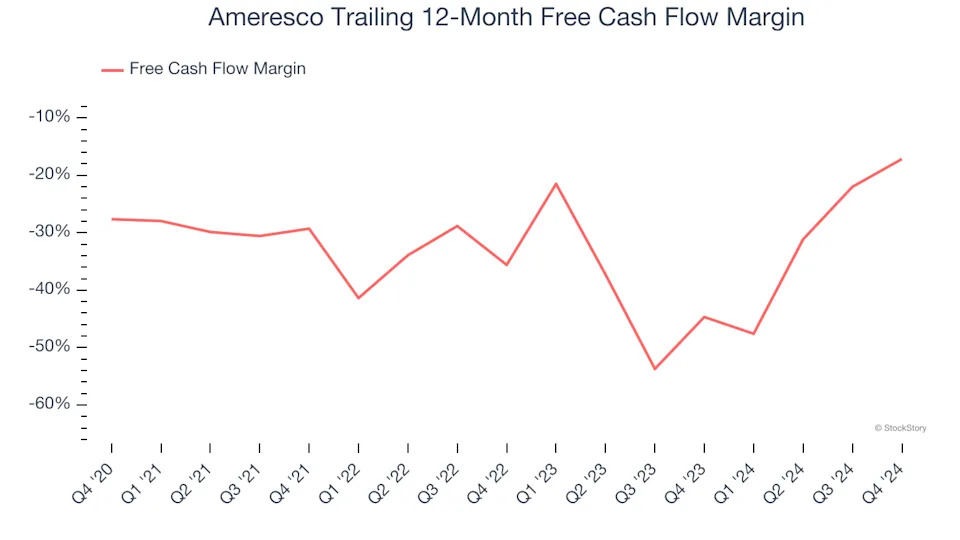

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Ameresco’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 30.6%, meaning it lit $30.61 of cash on fire for every $100 in revenue.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Ameresco burned through $303.7 million of cash over the last year, and its $1.70 billion of debt exceeds the $108.5 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Ameresco’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Ameresco until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.