3 Reasons to Sell MKC and 1 Stock to Buy Instead

McCormick trades at $74.11 per share and has stayed right on track with the overall market, losing 5.4% over the last six months while the S&P 500 is down 5.4%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in McCormick, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Even with the cheaper entry price, we're swiping left on McCormick for now. Here are three reasons why MKC doesn't excite us and a stock we'd rather own.

Why Is McCormick Not Exciting?

The classic red Heinz ketchup bottle’s competitor, McCormick (NYSE:MKC) sells food-flavoring products like condiments, spices, and seasoning mixes.

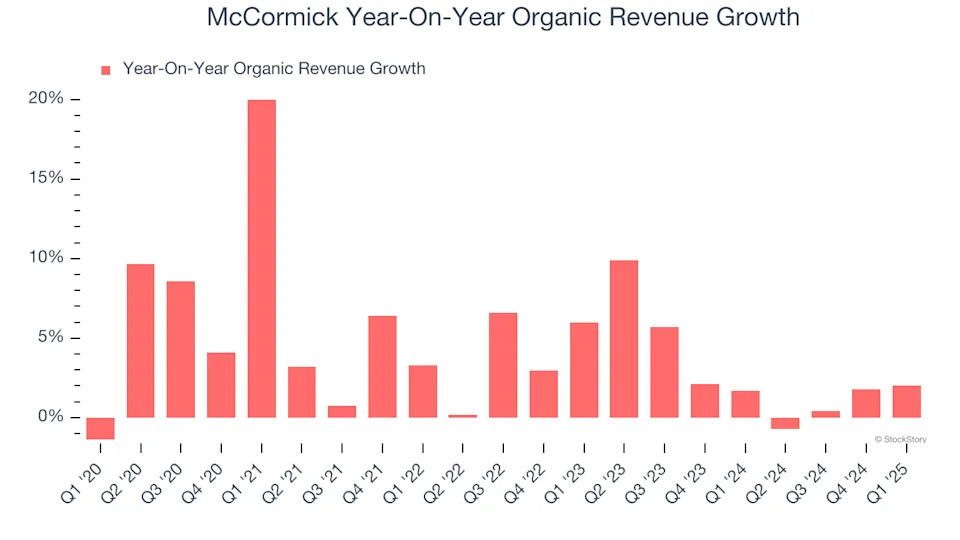

1. Slow Organic Growth Suggests Waning Demand In Core Business

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

The demand for McCormick’s products has generally risen over the last two years but lagged behind the broader sector. On average, the company’s organic sales have grown by 2.9% year on year.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect McCormick’s revenue to rise by 2.2%, close to its 1.9% annualized growth for the past three years. This projection is underwhelming and suggests its newer products will not lead to better top-line performance yet.

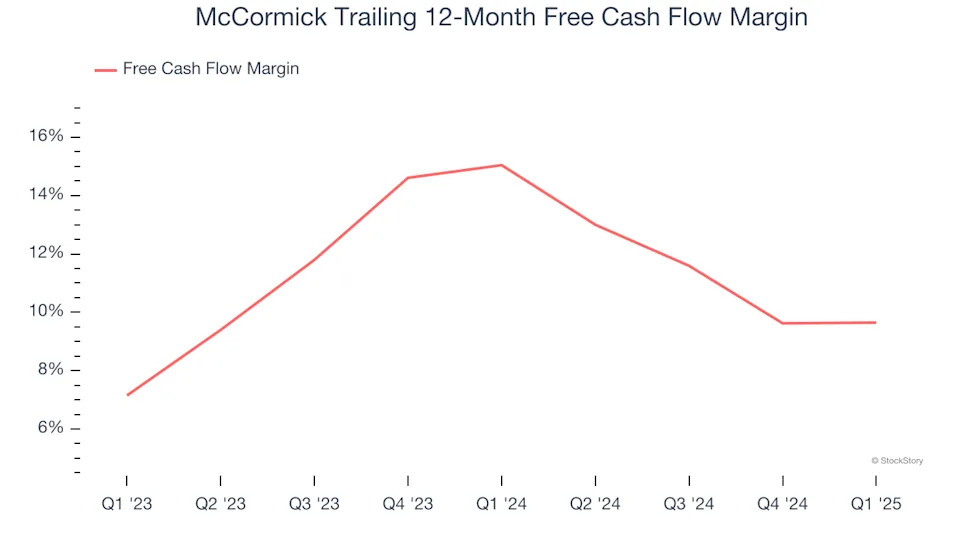

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, McCormick’s margin dropped by 5.4 percentage points over the last year. If its declines continue, it could signal increasing investment needs and capital intensity. McCormick’s free cash flow margin for the trailing 12 months was 9.6%.

Final Judgment

McCormick isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 23.9× forward price-to-earnings (or $74.11 per share). This multiple tells us a lot of good news is priced in - we think there are better investment opportunities out there. We’d recommend looking at the most entrenched endpoint security platform on the market .