Data-Crunching Wall Street Skeptics Sit Out the Turnaround Trade

(Bloomberg) -- Michael Mullaney’s mind was elsewhere during the market rebound this week, even as stocks surged, borrowing costs for Corporate America eased and Treasuries settled down.

Most Read from Bloomberg

Instead, the head of research at value-investing firm Boston Partners found himself checking and re-checking economic data that he fears show early signs of the damage already caused by Donald Trump’s trade war. Signals like dwindling Los Angeles shipping volumes, declining tourism-related travel and shrinking credit-card receipts in key consumer sectors.

His cautious stance runs counter to his peers plunging back into risk assets — relieved by signals from both Trump and Treasury Secretary Scott Bessent that the White House appears to be easing its muscular posture against top economic partners.

“This is not going to go away in 90 days,” says Mullaney, who helps oversee $110 billion. “There’s still going to be significant impact on economic activity no matter where these tariff levels actually settle out.”

While a full-on market meltdown may have been averted, he’s holding cash, worried the fallout from the trade hostility may be too entrenched to avert. Time will tell if the will to caution is the correct one — or just another example in the long history of skeptics getting clobbered when American markets shake off malaise and rebound.

Favoring cash can be costly in weeks like the one just finished, in which credit, stocks and Treasuries posted their best in-tandem run-up of the year. Bitcoin surpassed $95,000, leading the rebound in risk assets. Risk premiums for high-yield debt were on course to tighten the most since 2023, while measures of credit volatility fell sharply. Leveraged exchange-traded funds with bullish investing tilts have also taken $7 billion of inflows in the past month.

Mullaney and a few like-minded pros see reason to doubt that Wall Street’s history of quick resurrections will repeat. They’re sweating over categories of high-frequency data that, while far from front-page news, may provide clues as to whether April’s policy disruption will cause lasting economic pain.

At Apollo Global Management Inc., chief economist Torsten Slok flagged a “collapsing” number of container vessels departing China for the United States, writing in a note that consumers will soon see higher inflation and significant layoffs in trucking, logistics and retail jobs. At JPMorgan Chase & Co., chief US economist Michael Feroli is looking at high-frequency data already showing a drop in international visitors, which he warns would put pressure on economic growth.

The S&P 500 is now less than 3% below levels seen just before the unveiling of tariffs on so-called Liberation Day. Benchmark 10-year Treasury yields have fallen more than 20 basis points in the past two weeks, calming fears that foreign investors are fleeing US assets en masse, while the dollar has stabilized.

“There’s a binary difference in the state of the world between pre-April data with very low tariffs and post-Liberation Day data,” said Jake Schurmeier, portfolio manager at Harbor Capital Advisors. “The economy through March had few tangible effects of tariffs, sentiment was souring, but activity wasn’t. April and May we should begin to see real price and quantity effects of tariffs.”

Schurmeier, who has neutral positioning in his portfolio, is also worried about a material slowdown in trade activity. He’s parsing through daily data on port queues and global shipping volumes as some of the most up-do-date insights on the economy.

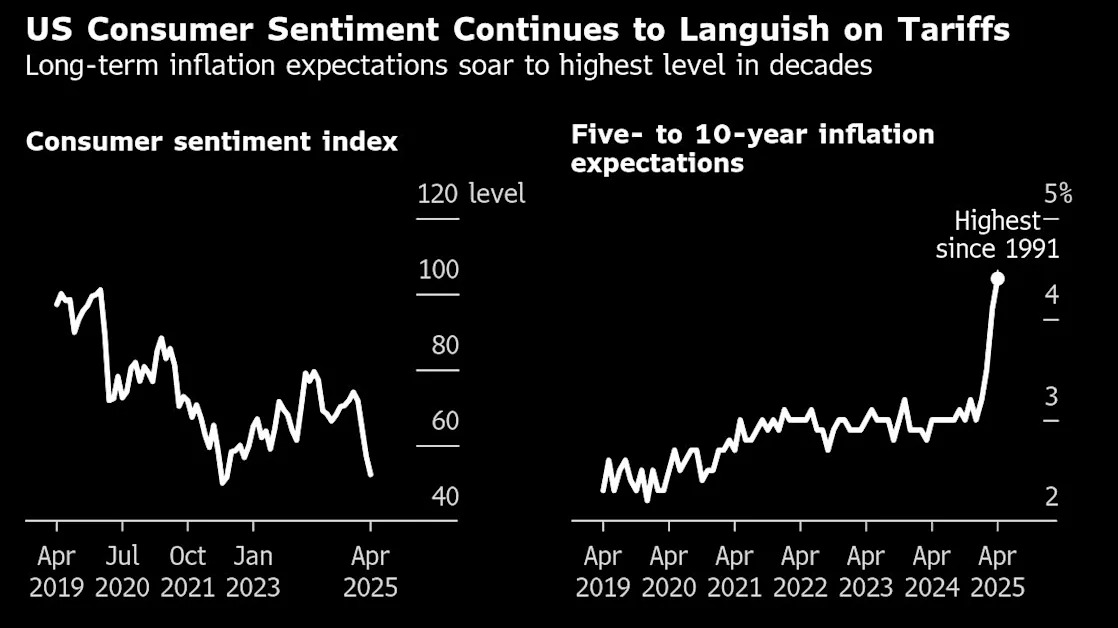

A refrain of bulls is that, while consumer sentiment has suggested caution time and time again, so-called soft data pales next to hard reports based on real money changing hands. Yet there are signs Trump’s trade war will materially hit growth, with the median respondent in a Bloomberg survey of economists now seeing a 45% chance of a recession in the next 12 months. That’s up from 30% in March.

On Friday, US consumer sentiment reached one of its lowest readings as long-term inflation expectations jumped again. Mixed corporate earnings have brought limited clarity as companies remain unsure about tariff fallout.

Danielle DiMartino Booth, chief strategist at QI Research, is watching an index that screens how many households are tapping bankruptcy lawyers. It’s already at the highest since the pandemic.

“Lending standards are tightening, getting clamped down, mortgages are being rejected, refinancing applications are being rejected and there’s no fiscal stimulus,” she said.

DiMartino Booth is telling clients who want equity exposure to add high dividend and defensive stocks, while touting Treasury bills along with high-quality corporate bonds with limited interest-rate risk.

Regardless, signs that Trump has reconsidered some of his most aggressive policy signs have reinvigorated Wall Street bulls. The president on Tuesday said he had no intention of firing Federal Reserve Chair Jerome Powell and also said he’d be willing to “substantially” pare back his 145% tariffs on China. Some of that optimism was later punctured after Trump issued confusing signals about the status of talks while Treasury Secretary Scott Bessent clarified the US was not looking to unilaterally lower tariffs on China.

Over in Huntersville, North Carolina, Cliff Hodge plans to capitalize on the rebound to pare equity risk, and is maintaining a defensive posture in fixed income.

“We do incorporate a number of high-frequency data points into our investing process. Most of it is consumption or labor-market oriented,” said the chief investment officer at Cornerstone Wealth. “Quite a few of them are pointing toward an economy which is slowing, though too early to make a call on outright recession.”

--With assistance from Nazmul Ahasan.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.