Winners And Losers Of Q4: Cadence (NASDAQ:CDNS) Vs The Rest Of The Design Software Stocks

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Cadence (NASDAQ:CDNS) and the best and worst performers in the design software industry.

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

The 6 design software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 9.8% since the latest earnings results.

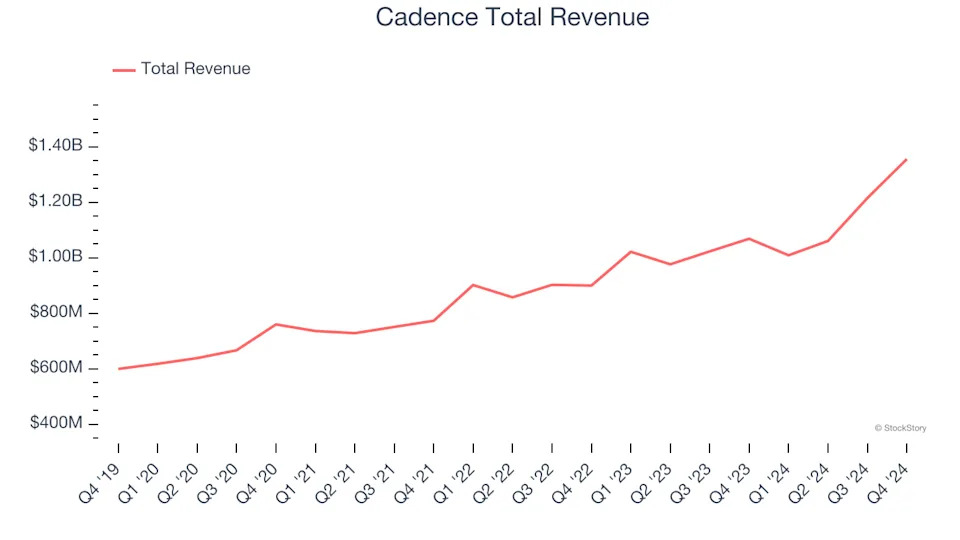

Cadence (NASDAQ:CDNS)

With the name chosen to reflect the idea of a repeating pattern or rhythm in electronic design, Cadence Design Systems (NASDAQ:CDNS) offers a software-as-a-service platform for semiconductor engineering and design.

Cadence reported revenues of $1.36 billion, up 26.9% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with an impressive beat of analysts’ billings estimates but full-year revenue guidance slightly missing analysts’ expectations.

“Cadence delivered exceptional results in the fourth quarter, capping off a strong 2024 with 13.5% revenue growth and 42.5% non-GAAP operating margin for the year,” said Anirudh Devgan, president and chief executive officer.

Cadence pulled off the fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 3.7% since reporting and currently trades at $282.98.

Is now the time to buy Cadence? Access our full analysis of the earnings results here, it’s free .

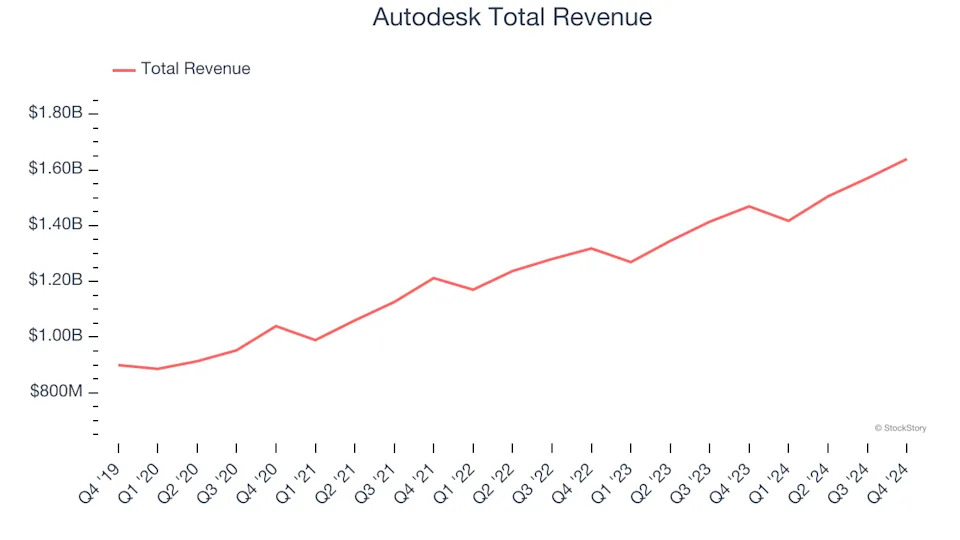

Best Q4: Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.64 billion, up 11.6% year on year, in line with analysts’ expectations. The business had a very strong quarter with full-year guidance of accelerating revenue growth and an impressive beat of analysts’ EBITDA estimates.

The stock is down 3.7% since reporting. It currently trades at $271.99.

Is now the time to buy Autodesk? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.