Spotting Winners: LegalZoom (NASDAQ:LZ) And Online Marketplace Stocks In Q4

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how online marketplace stocks fared in Q4, starting with LegalZoom (NASDAQ:LZ).

Marketplaces have existed for centuries. Where once it was a main street in a small town or a mall in the suburbs, sellers benefitted from proximity to one another because they could draw customers by offering convenience and selection. Today, a myriad of online marketplaces fulfill that same role, aggregating large customer bases, which attracts commission-paying sellers, generating flywheel scale effects that feed back into further customer acquisition.

The 13 online marketplace stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.6% since the latest earnings results.

LegalZoom (NASDAQ:LZ)

Founded by famous lawyer Robert Shapiro, LegalZoom (NASDAQ:LZ) offers online legal services and documentation assistance for individuals and businesses.

LegalZoom reported revenues of $161.7 million, up 1.9% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a strong quarter for the company with EBITDA guidance for next quarter exceeding analysts’ expectations and a decent beat of analysts’ number of subscription units estimates.

“We are making solid progress against our goal to position LegalZoom for long-term, sustainable growth,” said Jeff Stibel, Chairman and Chief Executive Officer of LegalZoom.

The stock is down 20.7% since reporting and currently trades at $7.03.

Is now the time to buy LegalZoom? Access our full analysis of the earnings results here, it’s free .

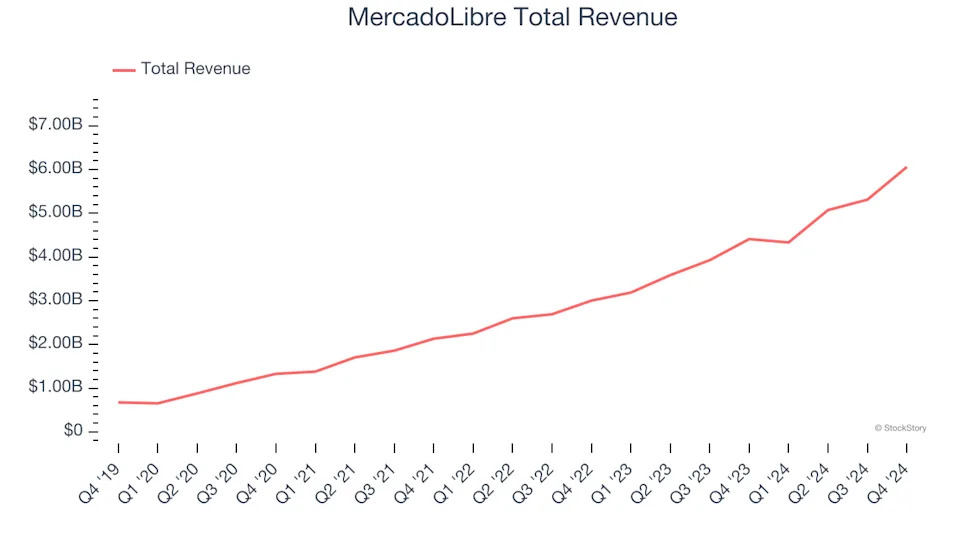

Best Q4: MercadoLibre (NASDAQ:MELI)

Originally started as an online auction platform, MercadoLibre (NASDAQ:MELI) is a one-stop e-commerce marketplace and fintech platform in Latin America.

MercadoLibre reported revenues of $6.06 billion, up 37.4% year on year, outperforming analysts’ expectations by 2.8%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ number of unique active users estimates.

The market seems content with the results as the stock is up 4.2% since reporting. It currently trades at $2,208.

Is now the time to buy MercadoLibre? Access our full analysis of the earnings results here, it’s free .

Weakest Q4: Teladoc (NYSE:TDOC)

Founded to help people in rural areas get online medical consultations, Teladoc Health (NYSE:TDOC) is a telemedicine platform that facilitates remote doctor’s visits.