Media Stocks Q4 In Review: fuboTV (NYSE:FUBO) Vs Peers

The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how media stocks fared in Q4, starting with fuboTV (NYSE:FUBO).

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

The 7 media stocks we track reported a satisfactory Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 29.3% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.6% since the latest earnings results.

fuboTV (NYSE:FUBO)

Originally launched as a soccer streaming platform, fuboTV (NYSE:FUBO) is a video streaming service specializing in live sports, news, and entertainment content.

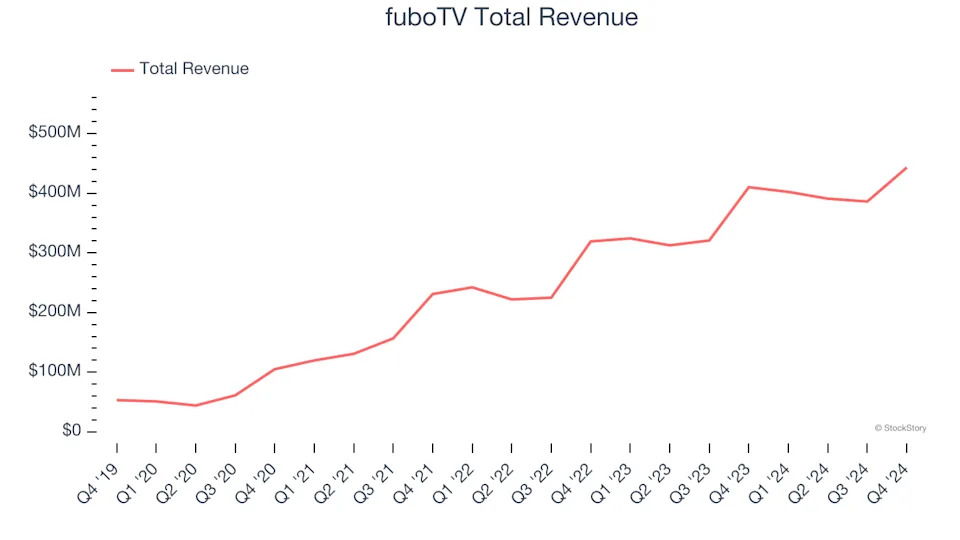

fuboTV reported revenues of $443.3 million, up 8.1% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

fuboTV achieved the fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 15.7% since reporting and currently trades at $2.98.

Is now the time to buy fuboTV? Access our full analysis of the earnings results here, it’s free .

Best Q4: Disney (NYSE:DIS)

Founded by brothers Walt and Roy, Disney (NYSE:DIS) is a multinational entertainment conglomerate, renowned for its theme parks, movies, television networks, and merchandise.

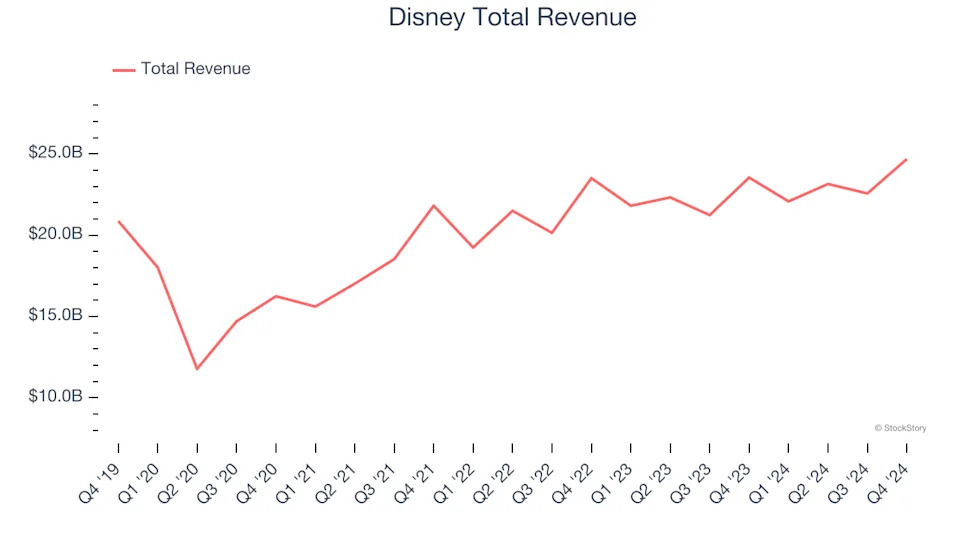

Disney reported revenues of $24.69 billion, up 4.8% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

The stock is down 20% since reporting. It currently trades at $90.64.

Is now the time to buy Disney? Access our full analysis of the earnings results here, it’s free .

Slowest Q4: Warner Bros. Discovery (NASDAQ:WBD)

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ:WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.