3 Reasons TPR is Risky and 1 Stock to Buy Instead

Tapestry currently trades at $69 and has been a dream stock for shareholders. It’s returned 358% since April 2020, blowing past the S&P 500’s 91.1% gain. The company has also beaten the index over the past six months as its stock price is up 36.7% thanks to its solid quarterly results.

Is now the time to buy Tapestry, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free .

We’re glad investors have benefited from the price increase, but we don't have much confidence in Tapestry. Here are three reasons why you should be careful with TPR and a stock we'd rather own.

Why Is Tapestry Not Exciting?

Originally founded as Coach, Tapestry (NYSE:TPR) is an American fashion conglomerate with a portfolio of luxury brands offering high-quality accessories and fashion products.

1. Long-Term Revenue Growth Disappoints

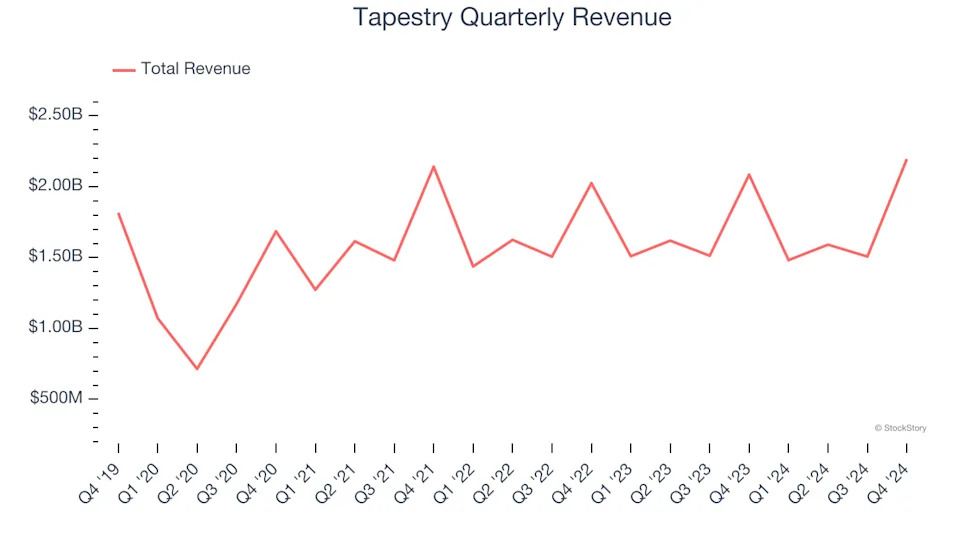

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Tapestry grew its sales at a weak 2.4% compounded annual growth rate. This was below our standards.

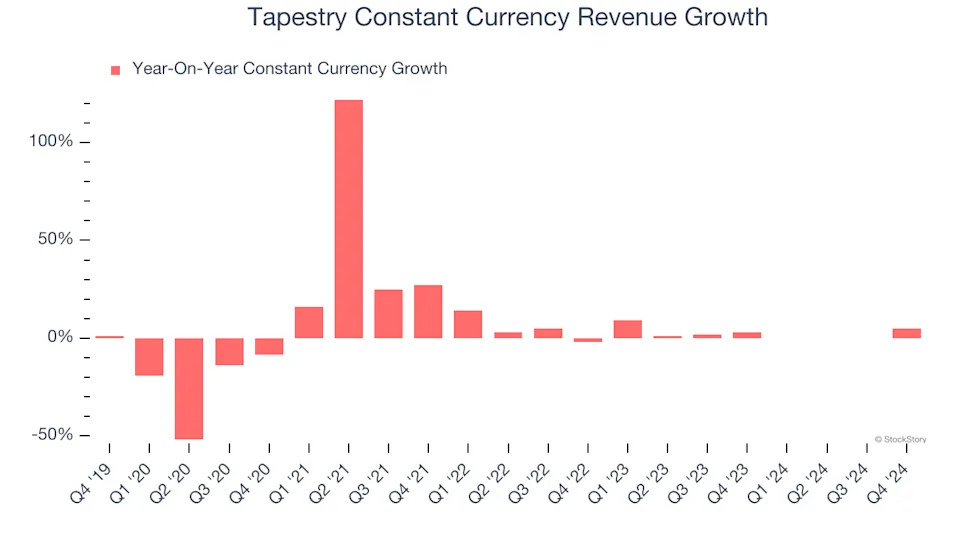

2. Weak Constant Currency Growth Points to Soft Demand

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Apparel and Accessories companies. This metric excludes currency movements, which are outside of Tapestry’s control and are not indicative of underlying demand.

Over the last two years, Tapestry’s constant currency revenue averaged 2.5% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

3. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Tapestry’s revenue to rise by 2.8%, close to its 1.4% annualized growth for the past two years. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

Final Judgment

Tapestry isn’t a terrible business, but it doesn’t pass our quality test. With its shares topping the market in recent months, the stock trades at 13.7× forward price-to-earnings (or $69 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy .