3 Reasons OMI is Risky and 1 Stock to Buy Instead

What a brutal six months it’s been for Owens & Minor. The stock has dropped 45.6% and now trades at $7.30, rattling many shareholders. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is now the time to buy Owens & Minor, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free .

Even with the cheaper entry price, we don't have much confidence in Owens & Minor. Here are three reasons why we avoid OMI and a stock we'd rather own.

Why Is Owens & Minor Not Exciting?

With roots dating back to 1882 and operations spanning approximately 80 countries, Owens & Minor (NYSE:OMI) is a healthcare solutions company that manufactures medical supplies, distributes products to healthcare providers, and delivers medical equipment directly to patients.

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Owens & Minor’s 3% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the healthcare sector.

2. Previous Growth Initiatives Haven’t Impressed

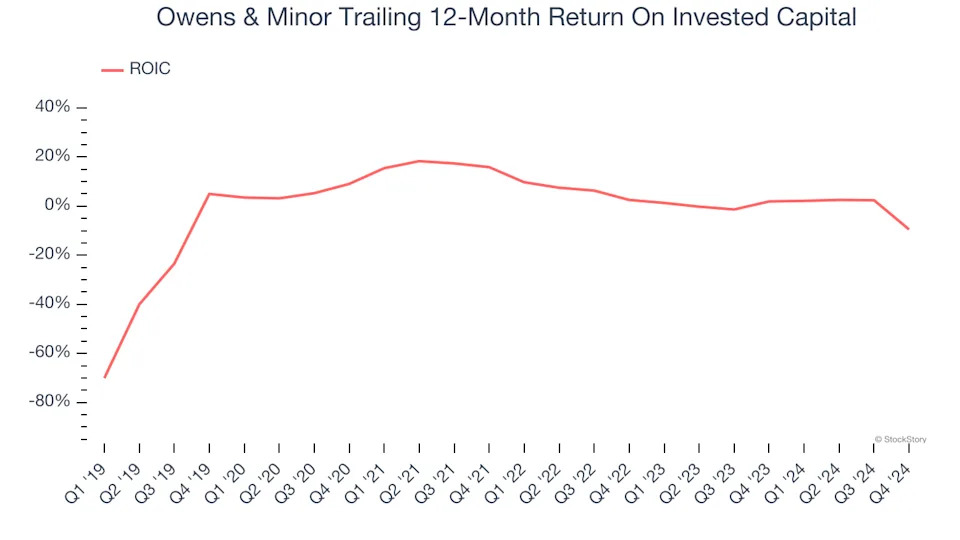

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Owens & Minor historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Owens & Minor’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Owens & Minor isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 3.9× forward price-to-earnings (or $7.30 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce .