3 Reasons to Sell MRC and 1 Stock to Buy Instead

MRC Global trades at $11.60 per share and has moved almost in lockstep with the market over the last six months. The stock has lost 6.5% while the S&P 500 is down 5.2%. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in MRC Global, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons why we avoid MRC and a stock we'd rather own.

Why Do We Think MRC Global Will Underperform?

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE:MRC) offers pipes, valves, and fitting products for various industries.

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. MRC Global’s demand was weak over the last five years as its sales fell at a 3.3% annual rate. This was below our standards and is a sign of poor business quality.

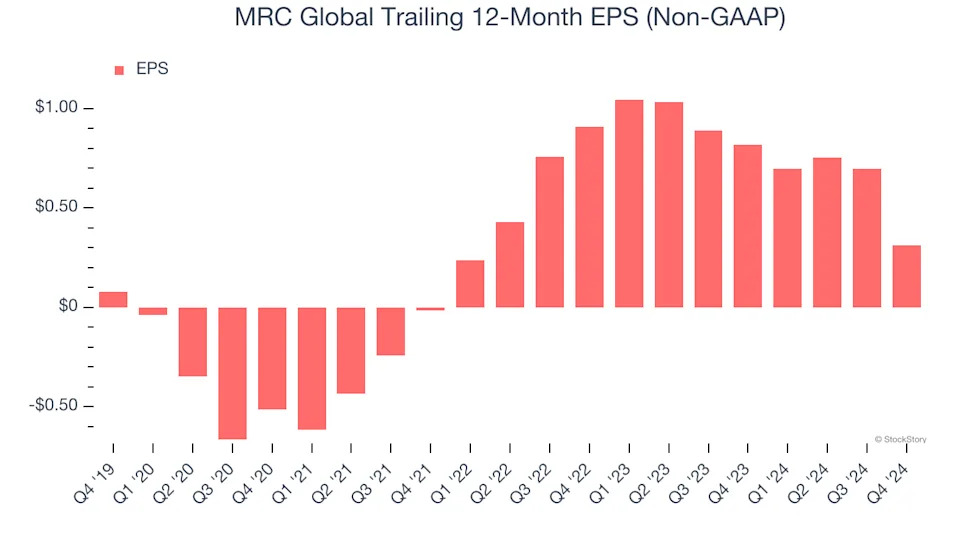

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for MRC Global, its EPS declined by more than its revenue over the last two years, dropping 41.5%. This tells us the company struggled to adjust to shrinking demand.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

MRC Global historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.3%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

MRC Global doesn’t pass our quality test. Following the recent decline, the stock trades at 10.8× forward price-to-earnings (or $11.60 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere. We’d suggest looking at the Amazon and PayPal of Latin America .

Stocks We Would Buy Instead of MRC Global

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.