Data Infrastructure Stocks Q4 Highlights: C3.ai (NYSE:AI)

Looking back on data infrastructure stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including C3.ai (NYSE:AI) and its peers.

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

The 4 data infrastructure stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 21.7% since the latest earnings results.

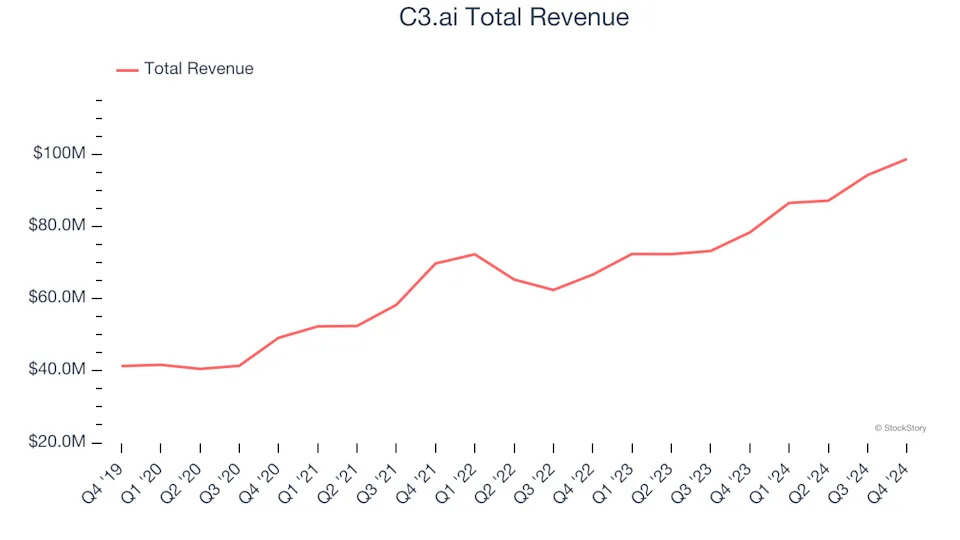

C3.ai (NYSE:AI)

Founded in 2009 by enterprise software veteran Tom Seibel, C3.ai (NYSE:AI) provides software that makes it easy for organizations to add artificial intelligence technology to their applications.

C3.ai reported revenues of $98.78 million, up 26% year on year. This print exceeded analysts’ expectations by 0.5%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

“In the third quarter, C3 AI achieved significant milestones — expanding our global distribution network, advancing our leadership in agentic and generative AI, and delivering total revenue reaching $98.8 million, up 26% year-over-year,” said Thomas M. Siebel, Chairman and CEO, C3 AI.

C3.ai scored the fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 18.1% since reporting and currently trades at $22.28.

Is now the time to buy C3.ai? Access our full analysis of the earnings results here, it’s free .

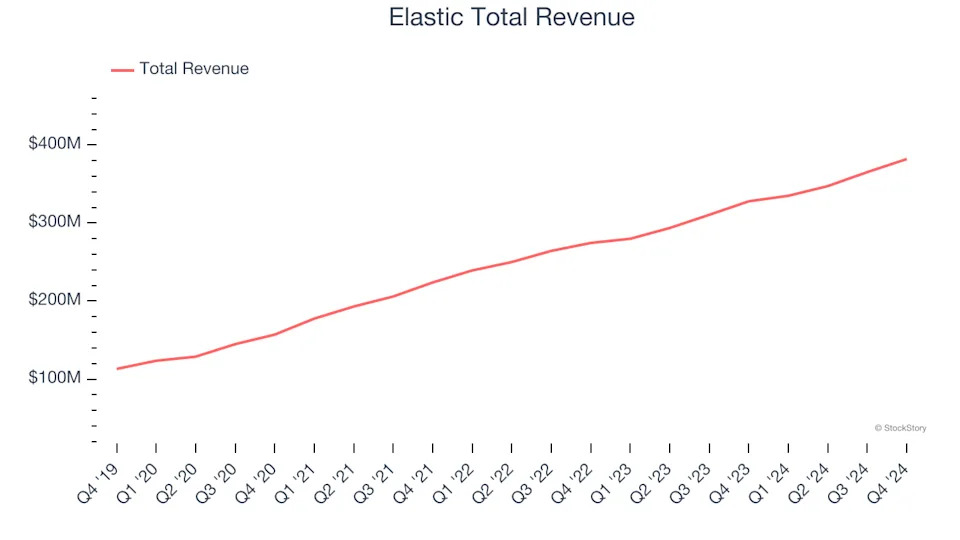

Best Q4: Elastic (NYSE:ESTC)

Started by Shay Banon as a search engine for his wife's growing list of recipes at Le Cordon Bleu cooking school in Paris, Elastic (NYSE:ESTC) helps companies integrate search into their products and monitor their cloud infrastructure.

Elastic reported revenues of $382.1 million, up 16.5% year on year, outperforming analysts’ expectations by 3.5%. The business had a strong quarter with a solid beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Elastic scored the biggest analyst estimates beat and highest full-year guidance raise among its peers. The company added 40 enterprise customers paying more than $100,000 annually to reach a total of 1,460. The stock is down 18.1% since reporting. It currently trades at $83.03.