3 Reasons to Avoid AHCO and 1 Stock to Buy Instead

Shareholders of AdaptHealth would probably like to forget the past six months even happened. The stock dropped 25.2% and now trades at $7.97. This might have investors contemplating their next move.

Is there a buying opportunity in AdaptHealth, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free .

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why AHCO doesn't excite us and a stock we'd rather own.

Why Is AdaptHealth Not Exciting?

With a network of approximately 680 locations serving patients across all 50 states, AdaptHealth (NASDAQ:AHCO) provides home medical equipment, supplies, and related services to patients with chronic conditions like sleep apnea, diabetes, and respiratory disorders.

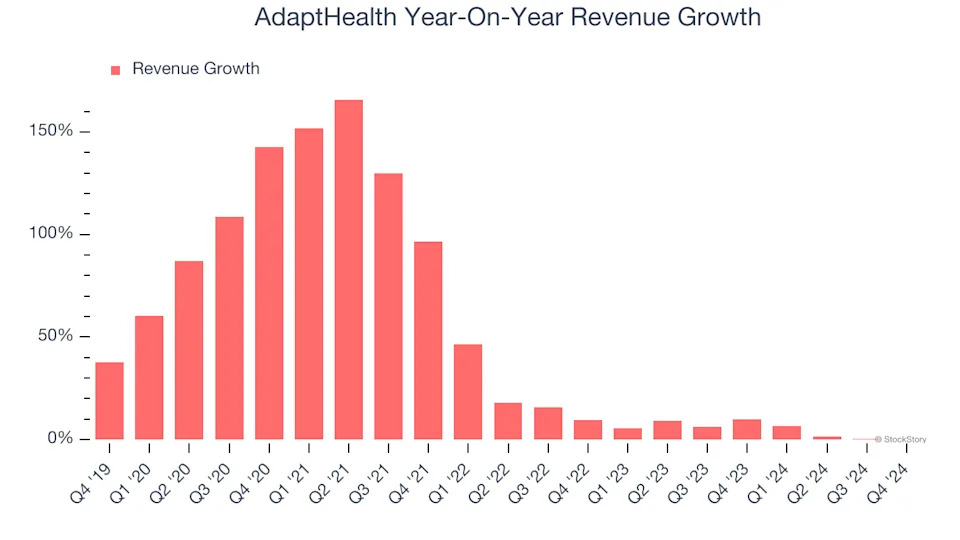

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within healthcare, a stretched historical view may miss recent innovations or disruptive industry trends. AdaptHealth’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 4.8% over the last two years was well below its five-year trend.

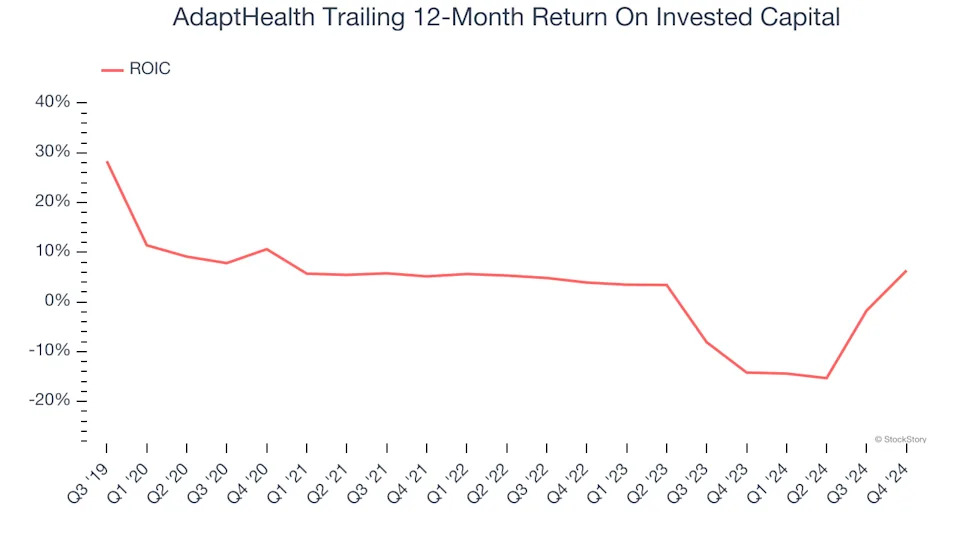

2. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

AdaptHealth historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.4%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, AdaptHealth’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

AdaptHealth isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 7.8× forward price-to-earnings (or $7.97 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses .