3 Reasons BECN is Risky and 1 Stock to Buy Instead

Beacon Roofing Supply currently trades at $123.42 and has been a dream stock for shareholders. It’s returned 536% since April 2020, blowing past the S&P 500’s 91.2% gain. The company has also beaten the index over the past six months as its stock price is up 32.2%.

Is now the time to buy Beacon Roofing Supply, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free .

We’re happy investors have made money, but we're cautious about Beacon Roofing Supply. Here are three reasons why you should be careful with BECN and a stock we'd rather own.

Why Is Beacon Roofing Supply Not Exciting?

Established in 1928, Beacon Roofing Supply (NASDAQ:BECN) distributes residential and commercial roofing materials and complementary building products.

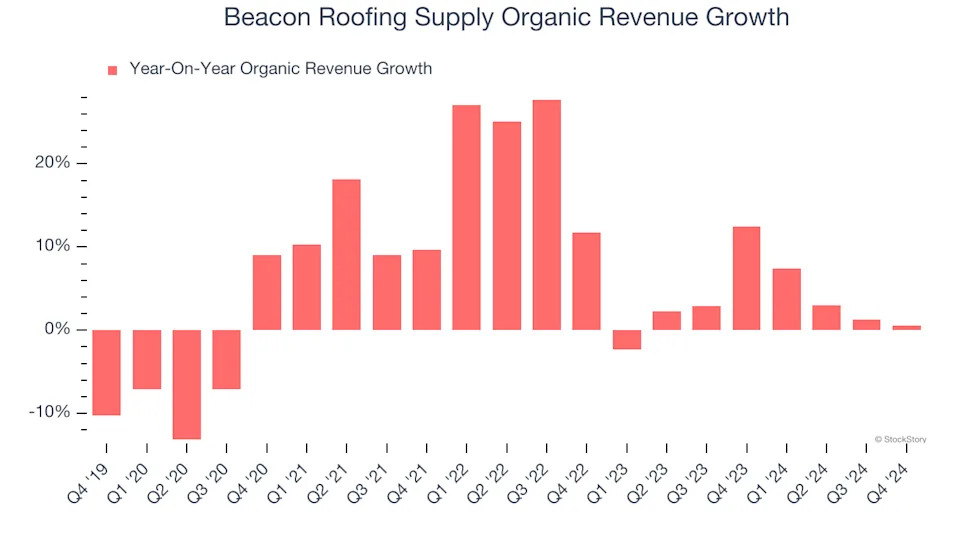

1. Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand Building Material Distributors companies by analyzing their organic revenue. This metric gives visibility into Beacon Roofing Supply’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Beacon Roofing Supply’s organic revenue averaged 3.4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Beacon Roofing Supply’s revenue to rise by 3.7%, a deceleration versus its 7.6% annualized growth for the past two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

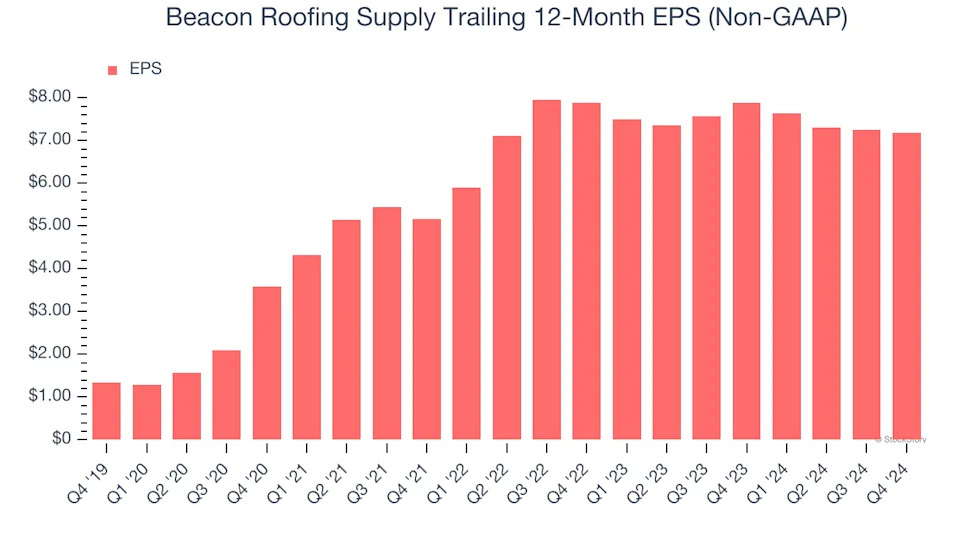

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Beacon Roofing Supply, its EPS declined by 4.6% annually over the last two years while its revenue grew by 7.6%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Beacon Roofing Supply isn’t a terrible business, but it doesn’t pass our bar. With its shares outperforming the market lately, the stock trades at 15.6× forward price-to-earnings (or $123.42 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce .