3 Reasons STNG is Risky and 1 Stock to Buy Instead

Scorpio Tankers’s stock price has taken a beating over the past six months, shedding 43.5% of its value and falling to $34.66 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Scorpio Tankers, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why you should be careful with STNG and a stock we'd rather own.

Why Is Scorpio Tankers Not Exciting?

Operating one of the youngest fleets in the industry, Scorpio Tankers (NYSE: STNG) is an international provider of marine transportation services, specializing in the shipment of refined petroleum.

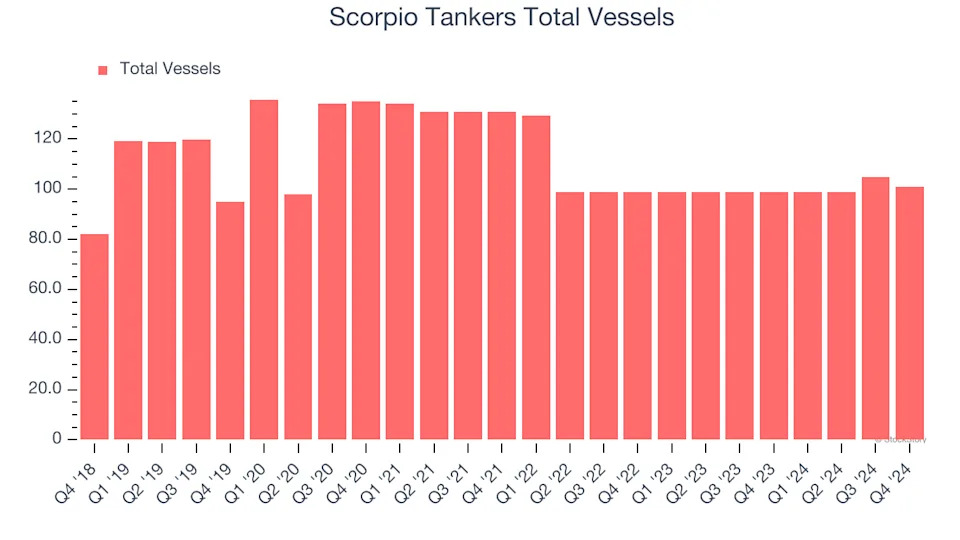

1. Decline in total vessels Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Scorpio Tankers, our preferred volume metric is total vessels). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Scorpio Tankers’s total vessels came in at 100.9 in the latest quarter, and over the last two years, averaged 2% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Scorpio Tankers might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Scorpio Tankers’s revenue to drop by 24.3%, a decrease from its 9.1% annualized declines for the past two years. This projection is underwhelming and implies its products and services will face some demand challenges.

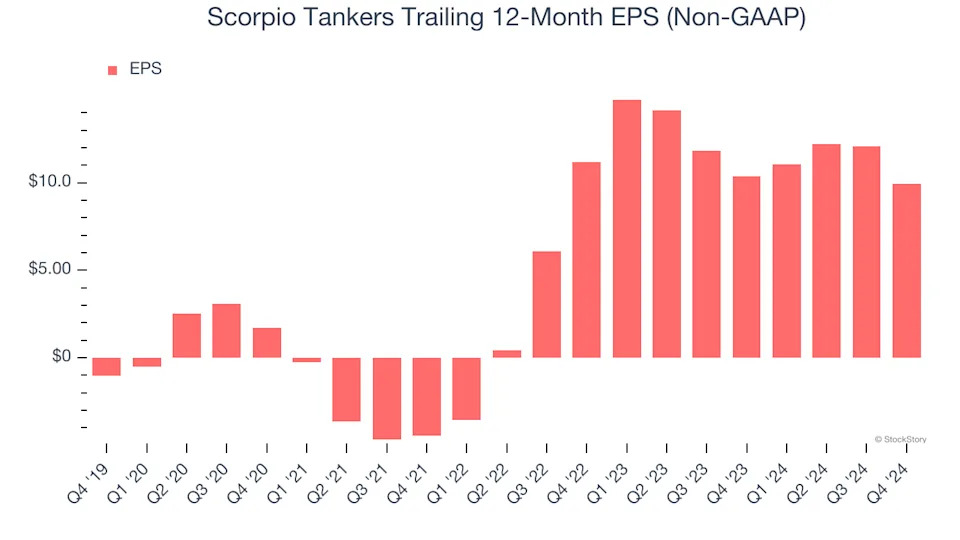

3. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Scorpio Tankers, its EPS and revenue declined by 5.7% and 9.1% annually over the last two years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Scorpio Tankers’s low margin of safety could leave its stock price susceptible to large downswings.