You Can’t Out-Trade Tariffs as Stocks Move In Tandem

(Bloomberg) -- Traders have long known Donald Trump intended to use tariffs as a tool for economic policy. Citigroup Inc., a year ago, even offered up a handy framework for trading potential levies on China.

Most Read from Bloomberg

Lean into a group of companies like Target Corp. and Lowe’s Cos. that derive much of their sales in the US, and stay away from firms like Becton Dickinson and Co. and Starbucks Corp. with a high portion of sales or manufacturing in China.

Turns out, both have been dogs. The long basket is down 16%, since the S&P 500 hit a record in February. That’s just a tad better than the short basket. Each has done worse than the S&P 500 in that time. In fact, there’s little to discern any difference in their performance. They tend to rise and fall in tandem.

It’s hard to fault the composition of the baskets, though. Citi’s researchers expected tariffs to be around 50%, not the actual 145%. And few on Wall Street foresaw Trump slapping 10% tariffs on virtually all trading partners, more on some of the most important - punitive enough that calls for a global economic slowdown are rising.

The upshot has been that the expected tariff trade has now become an all-or-nothing bet on whether the US can avoid a recession.

“I don’t think that many people at all expected the degree of confrontation — both ways, between China and the US — anywhere close to what we’ve gotten,” said Mark Hackett, chief market strategist at Nationwide. “If the tariffs cause some sort of catastrophic pullback in consumer spending, everything that we had modeled for doesn’t work anymore.”

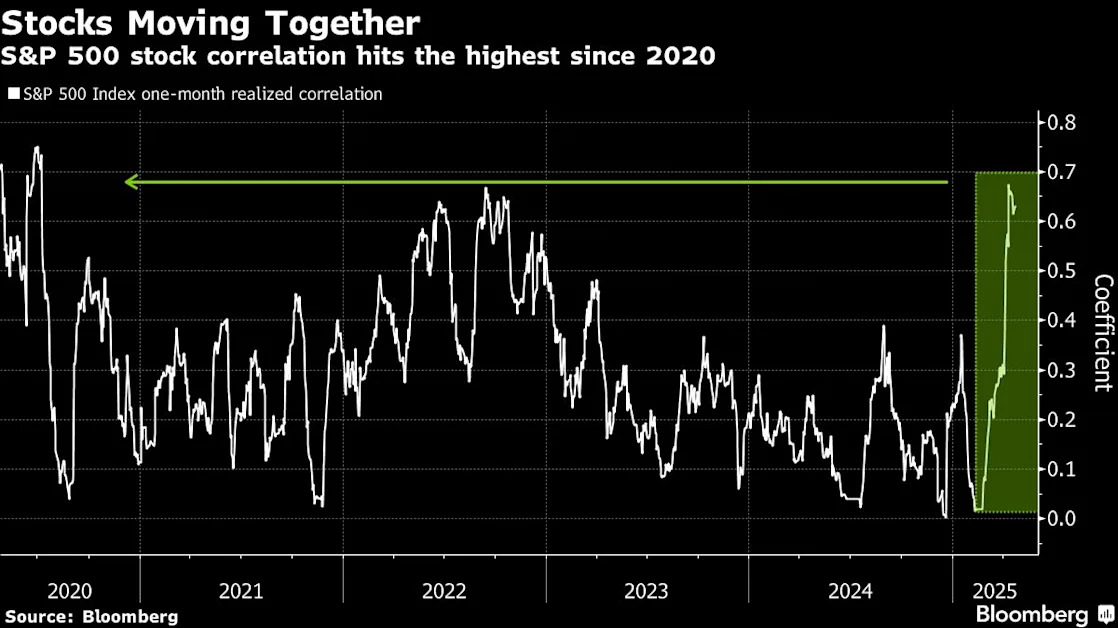

The near-uniform performance of Citi’s tariff baskets underscores just how lockstep moves have become on US equity markets, where a gauge of one-month realized correlation in the benchmark index has risen to the highest level since July 2020.

Take this week. More than 70% of the benchmark was higher Wednesday, while 98% of the gauge ended the day in the green Tuesday. Monday’s selloff, meanwhile, saw about 92% of stocks close lower.

For stock traders, the monolithic swings have made life difficult. Tariff threats go up, recession odds go up, stocks go down — and vice versa.

“There’s clearly a fear out there,” said Jay Hatfield, chief executive officer of Infrastructure Capital Advisors. “Clearly when we were hitting 5,000, that was the notion, that we were going to have a recession, and an earnings recession as well. Maybe the recession’s not that deep, but earnings get hammered by tariffs.”