ServiceNow (NYSE:NOW) Reports Q1 In Line With Expectations, Stock Soars

Enterprise workflow software maker ServiceNow (NYSE:NOW) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 18.6% year on year to $3.09 billion. Its non-GAAP profit of $4.04 per share was 5.4% above analysts’ consensus estimates.

Is now the time to buy ServiceNow? Find out in our full research report .

ServiceNow (NOW) Q1 CY2025 Highlights:

“ServiceNow’s position as the platinum standard for enterprise-grade AI drove these outstanding first quarter results,” said ServiceNow Chairman and CEO Bill McDermott.

Company Overview

Founded by Fred Luddy, who coded the company's initial prototype on a flight from San Francisco to London, ServiceNow (NYSE:NOW) is a software provider helping companies automate workflows across IT, HR, and customer service.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

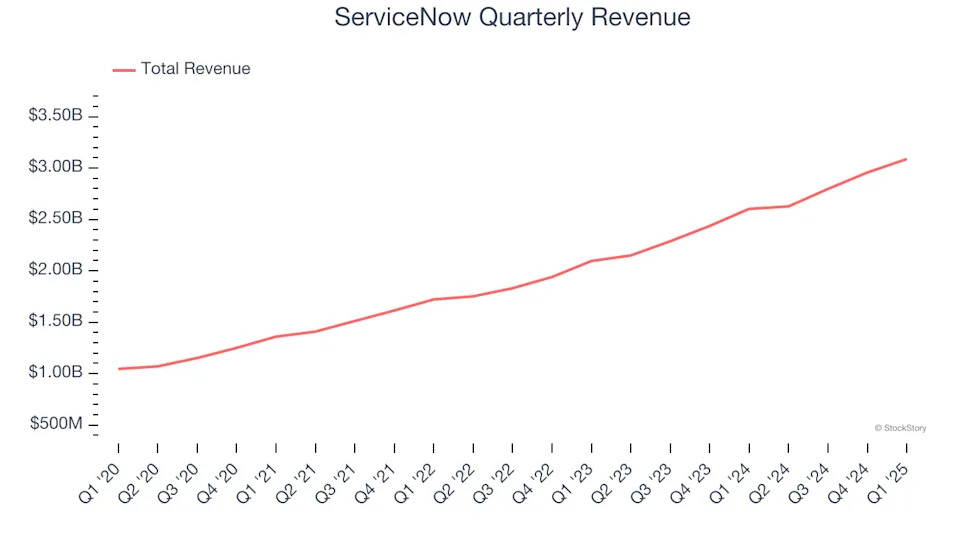

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, ServiceNow grew its sales at a decent 22.4% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, ServiceNow’s year-on-year revenue growth was 18.6%, and its $3.09 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 18.7% over the next 12 months, a deceleration versus the last three years. We still think its growth trajectory is attractive given its scale and indicates the market is forecasting success for its products and services.