3 Reasons to Sell MLKN and 1 Stock to Buy Instead

What a brutal six months it’s been for MillerKnoll. The stock has dropped 29.8% and now trades at $16.66, rattling many shareholders. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in MillerKnoll, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free .

Even though the stock has become cheaper, we don't have much confidence in MillerKnoll. Here are three reasons why MLKN doesn't excite us and a stock we'd rather own.

Why Do We Think MillerKnoll Will Underperform?

Created through the 2021 merger of industry icons Herman Miller and Knoll, MillerKnoll (NASDAQ:MLKN) designs, manufactures, and distributes interior furnishings for offices, healthcare facilities, educational settings, and homes worldwide.

1. Revenue Tumbling Downwards

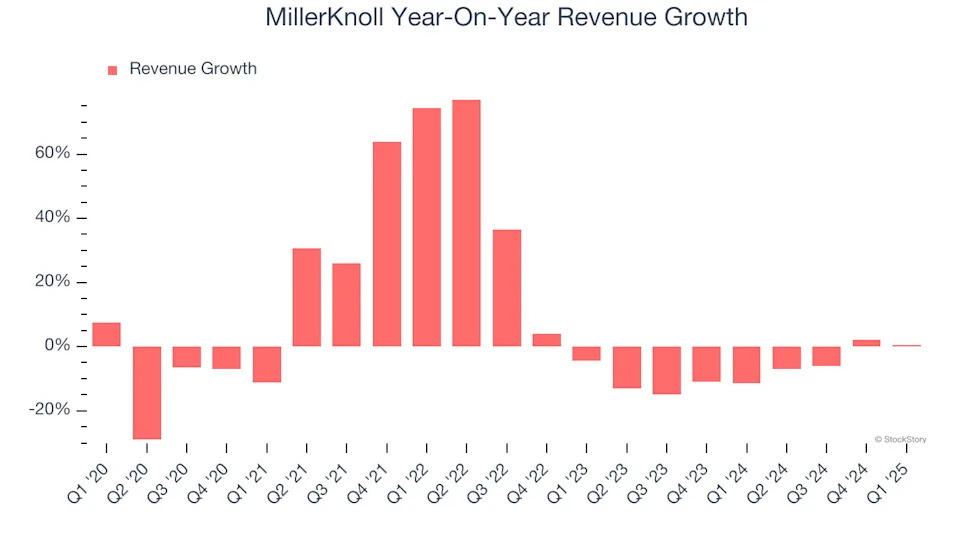

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. MillerKnoll’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 7.8% over the last two years.

2. EPS Trending Down

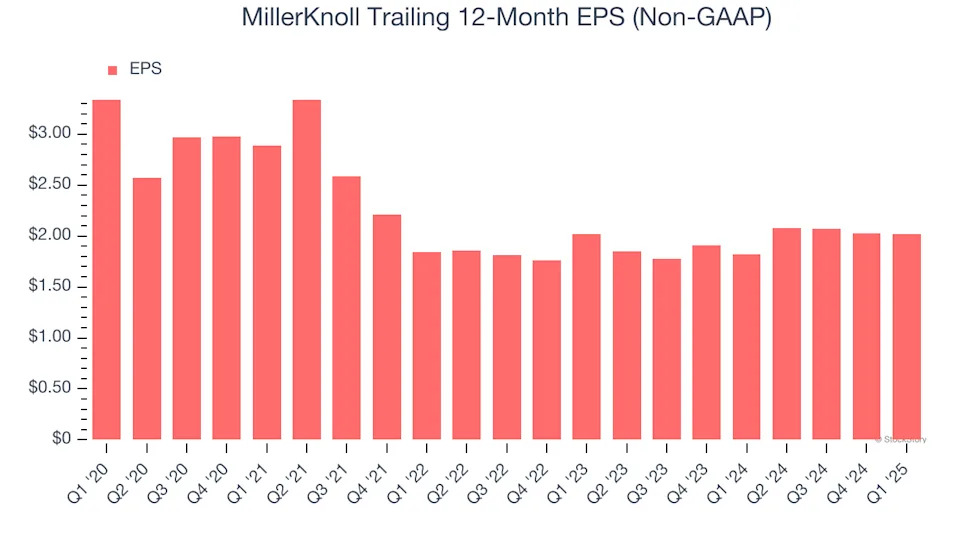

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for MillerKnoll, its EPS declined by 9.6% annually over the last five years while its revenue grew by 6%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Free Cash Flow Margin Dropping

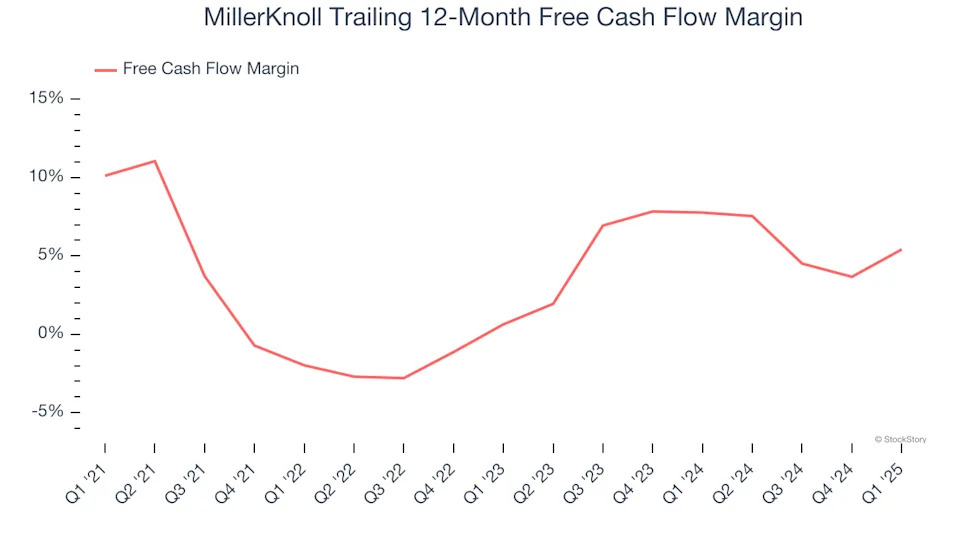

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, MillerKnoll’s margin dropped by 4.7 percentage points over the last five years. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s in the middle of an investment cycle. MillerKnoll’s free cash flow margin for the trailing 12 months was 5.4%.

Final Judgment

MillerKnoll doesn’t pass our quality test. Following the recent decline, the stock trades at 6.5× forward price-to-earnings (or $16.66 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. We’d suggest looking at one of our all-time favorite software stocks .