Monarch (NASDAQ:MCRI) Posts Better-Than-Expected Sales In Q1

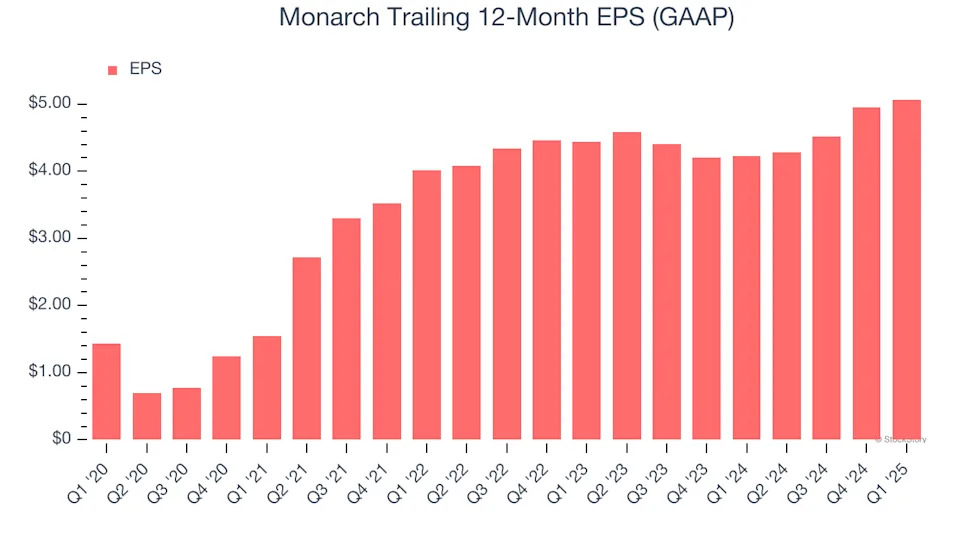

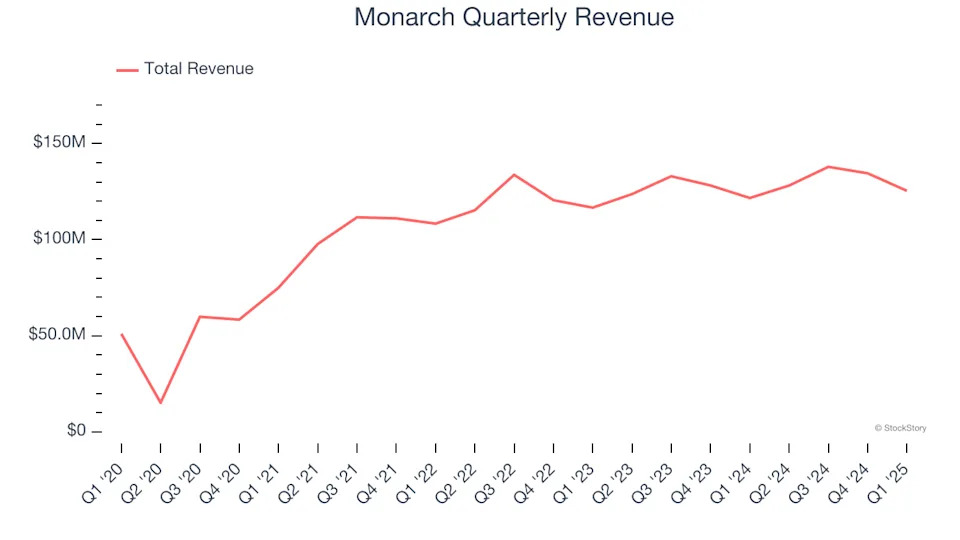

Luxury casino and resort operator Monarch (NASDAQ:MCRI) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 3.1% year on year to $125.4 million. Its GAAP profit of $1.05 per share was 6.1% above analysts’ consensus estimates.

Is now the time to buy Monarch? Find out in our full research report .

Monarch (MCRI) Q1 CY2025 Highlights:

Company Overview

Established in 1993, Monarch (NASDAQ:MCRI) operates luxury casinos and resorts, offering high-end gaming, dining, and hospitality experiences.

Casino Operator

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

Sales Growth

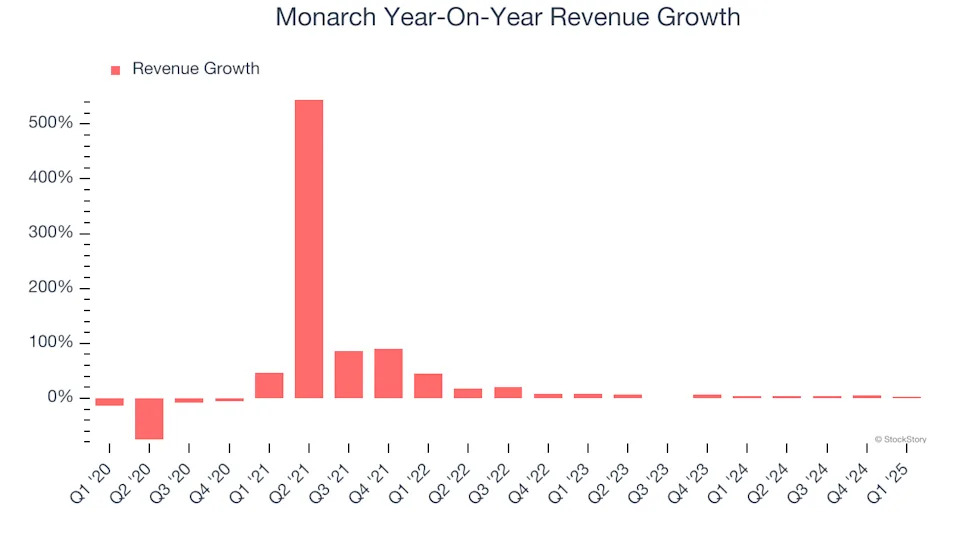

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Monarch’s sales grew at a decent 16.8% compounded annual growth rate over the last five years. Its growth was slightly above the average consumer discretionary company and shows its offerings resonate with customers.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Monarch’s recent performance shows its demand has slowed as its annualized revenue growth of 4% over the last two years was below its five-year trend. Note that COVID hurt Monarch’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

Monarch also breaks out the revenue for its three most important segments: Casino, Dining, and Hotel, which are 58.1%, 23.9%, and 13.3% of revenue. Over the last two years, Monarch’s revenues in all three segments increased. Its Casino revenue (Poker, Blackjack) averaged year-on-year growth of 4.2% while its Dining (food and beverage) and Hotel (overnight stays) revenues averaged 2.9% and 3.5%.