3 Reasons SCI is Risky and 1 Stock to Buy Instead

Service International currently trades at $78.99 per share and has shown little upside over the past six months, posting a middling return of 4%. However, the stock is beating the S&P 500’s 11% decline during that period.

Is now the time to buy Service International, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free .

Despite the relative momentum, we're swiping left on Service International for now. Here are three reasons why SCI doesn't excite us and a stock we'd rather own.

Why Is Service International Not Exciting?

Founded in 1962, Service International (NYSE: SCI) is a leading provider of death care products and services in North America.

1. Decline in Funeral Services Performed Points to Weak Demand

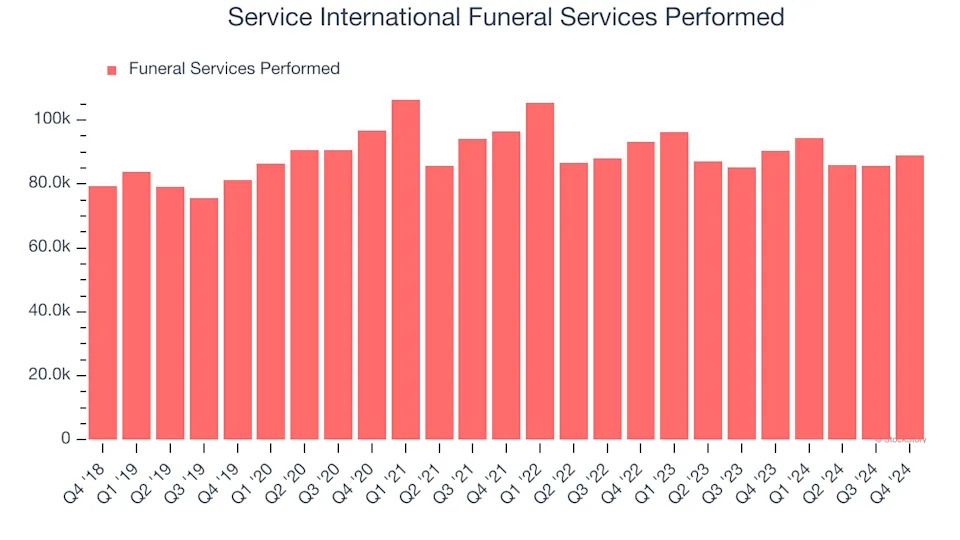

Revenue growth can be broken down into changes in price and volume (for companies like Service International, our preferred volume metric is funeral services performed). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Service International’s funeral services performed came in at 88,934 in the latest quarter, and over the last two years, averaged 2.3% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Service International might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Service International’s revenue to rise by 2.2%, close to its flat sales for the past two years. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Service International’s ROIC averaged 3.3 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.