3 Reasons to Sell HPQ and 1 Stock to Buy Instead

HP has gotten torched over the last six months - since October 2024, its stock price has dropped 33.9% to $23.95 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in HP, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free .

Even though the stock has become cheaper, we're swiping left on HP for now. Here are three reasons why HPQ doesn't excite us and a stock we'd rather own.

Why Do We Think HP Will Underperform?

Born from the legendary Silicon Valley garage startup founded by Bill Hewlett and Dave Packard in 1939, HP (NYSE:HPQ) designs and sells personal computers, printers, and related technology products and services to consumers, businesses, and enterprises worldwide.

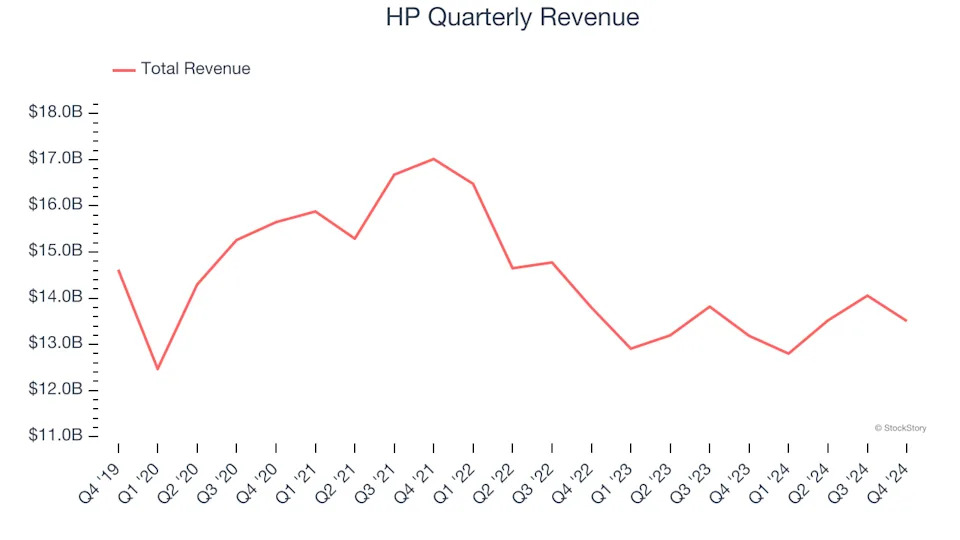

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, HP’s demand was weak and its revenue declined by 1.7% per year. This wasn’t a great result and signals it’s a low quality business.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect HP’s revenue to rise by 1.8%. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

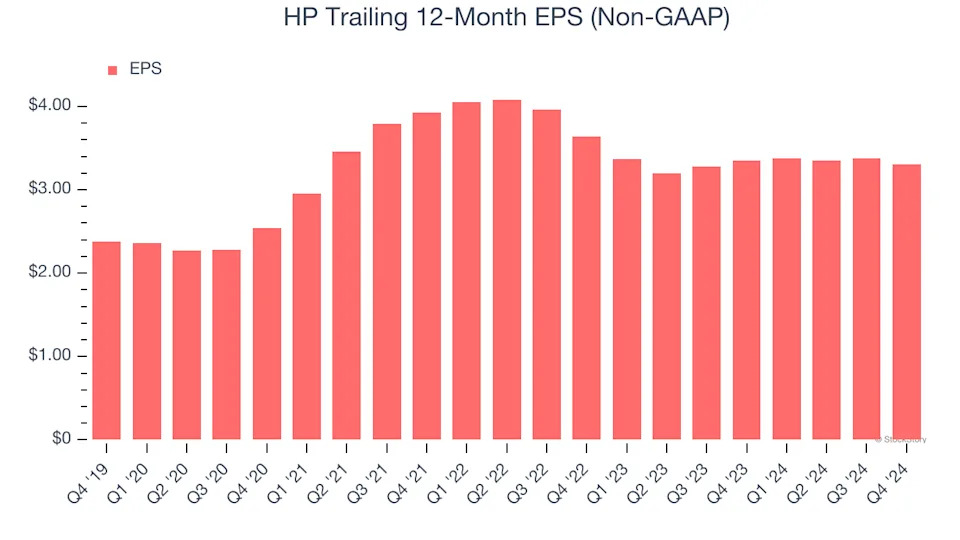

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

HP’s EPS grew at an unimpressive 6.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.7% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

We see the value of companies helping consumers, but in the case of HP, we’re out. After the recent drawdown, the stock trades at 6.4× forward price-to-earnings (or $23.95 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy .