Dollar, Stock Futures Decline as Trump Berates Fed: Markets Wrap

(Bloomberg) -- A gauge of the dollar fell to the lowest since January 2024 and US stock-index futures retreated after President Donald Trump’s criticism of the Federal Reserve raised concerns over its independence.

Most Read from Bloomberg

The greenback weakened against every major currency after the National Economic Council Director Kevin Hassett said Friday Trump is studying whether he’s able to fire Fed Chairman Jerome Powell. Those comments prompted hedge funds to sell the dollar on Monday, traders said. Gold, which typically has an inverse relationship with the US currency, rose to a record.

Treasuries dropped and the yen strengthened while the euro and the Swiss franc were among the biggest gainers among currencies, with the former rallying to the highest in three years.

Trump — frustrated that the central bank hasn’t moved to lower interest rates — posted on social media last week that Powell’s “termination cannot come fast enough!” Rebuking the Fed not only undermines the principle of central bank independence, but also risks politicizing US monetary policy in a way that markets will find deeply unsettling, according to analysts such as Christopher Wong.

“Frankly, firing Powell stretches belief,” said Wong, a Singapore-based forex strategist at Oversea-Chinese Banking Corp. “If the credibility of the Fed is called into question, it could severely erode confidence in the dollar. Markets may continue to demand a political risk premium on USD assets, especially if this narrative gains traction in the weeks and days ahead.”

The declines in US assets indicate that the once-popular America-first trade - buying assets that win when the US outperforms - is reversing after Trump ratcheted up global levies, roiling the Treasuries market and wiping off trillions from global stocks. The dollar was already under pressure after the president imposed tariffs, with a Bloomberg gauge of the currency’s strength weakening for three consecutive weeks.

The currency’s weakness extended as the day progressed with the Bloomberg Dollar Spot Index falling as much as 0.9% Monday, on top of last week’s 0.7% decline. Every Group-of-10 currency gained against the greenback, with the yen — another haven asset — also strengthening to levels last seen in September. That sent stock indexes in Japan lower by more than 1%.

The dollar’s decline is not just because of the Fed, but also due to factors such as investors looking at diversification amid the trade war, said Rachana Mehta, a co-head for regional fixed income at Maybank Asset Management. Asian countries have a lot of dollar deposits due to attractive interest rates, she said.

“I think they’re trying to convert some of this and they’re trying to diversify the results,” she said.

Trump told reporters he could force Powell out if he wanted to. The president hasn’t clarified whether that means he intends to find a way to fire the Fed chief, or is simply eager for Powell’s term to end as scheduled in May 2026.

Fed Chicago President Austan Goolsbee warned against efforts to curtail the central bank’s independence. “There’s virtual unanimity among economists that monetary independence from political interference — that the Fed or any central bank be able to do the job that it needs to do — is really important,” Goolsbee said on CBS’s Face the Nation on Sunday.

Trump would put the credibility of the dollar on the line and destabilize the US economy if he fired Powell, French Finance Minister Eric Lombard warned.

US equities posted a weekly loss amid disappointment over the Fed’s pushback on the idea of the central bank supporting markets. Fed San Francisco President Mary Daly said the US central bank may hold rates longer than anticipated due to inflation risks, but could yet cut later this year.

“The Fed is a very, very juicy opportunity for Trump if what he wants is not only to lower the dollar, but to lower the cost of funding for the massive sovereign debt that the US has accumulated,” said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis.

In a sign that investors are rotating investments away from the US, Deutsche Bank AG said that Chinese clients have reduced some of their Treasuries holdings in favor of European debt. European high-quality bonds, Japanese government bonds and gold are likely to be the potential choices for investors as alternatives to Treasuries, said Lillian Tao, head of China macro and global emerging market sales at the bank.

Japanese super-long government bonds drew a record foreign inflow last month.

Meanwhile, the Treasury yield curve steepened with the two-year notes rallying even as longer tenors were sold off on Monday, in a sign that investors were pricing in both possible rate cuts and reflecting concerns over the investability of long-term US assets.

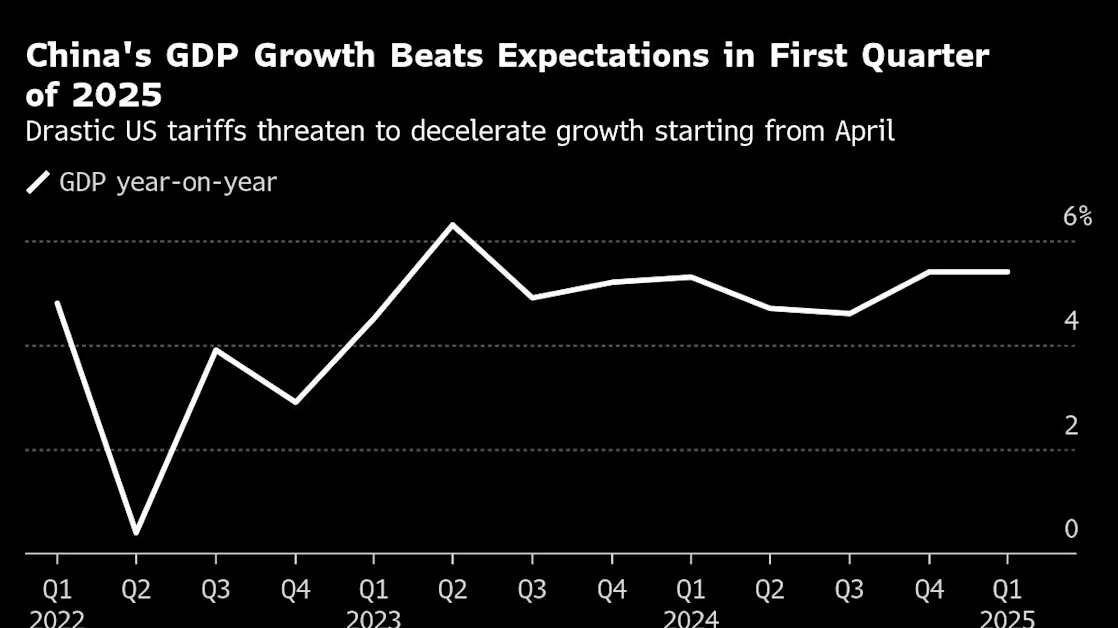

This week, traders will be seeking clues on how early tariffs talks pan out. After the “big progress” in the Japan-US talks, Trump said he’s “very confident” of a deal with the European Union. Questions surround the status of China talks after the country indicated it has several conditions for agreeing to talks with the administration.

Read: World’s Economic Chiefs to Face Trump’s Trade War in Washington

Beijing warned nations against making trade agreements with Washington that hurt China, highlighting how economies around the world risk getting caught up in tensions between the two powerhouses.

US Vice President JD Vance arrives in New Delhi Monday as the US threatens to increase the 10% tariffs on Indian exports to 26% if no deal is reached by the end of the 90-day pause Trump put in place earlier this month.

In commodities, oil retreated as traders fretted about the impact of the US-led trade war on energy demand.

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Ruth Carson, David Finnerty and Catherine Bosley.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.