Why you shouldn't freak out about the stock market's recent 'death cross,' according to one strategist

The stock market has been rattled this year, with the S&P 500 falling 10% year-to-date as investors worry about the economic fallout from President Donald Trump's tariffs.

Those worries were compounded earlier this week when the S&P 500 and Nasdaq 100 flashed a "death cross" signal, which has historically been considered a bearish technical "sell" indicator.

But Adam Turnquist, chief technical strategist at LPL Financial, told BI this week that investors shouldn't be too freaked out.

That's because the historical returns following past death cross signals in the stock market have actually been pretty positive.

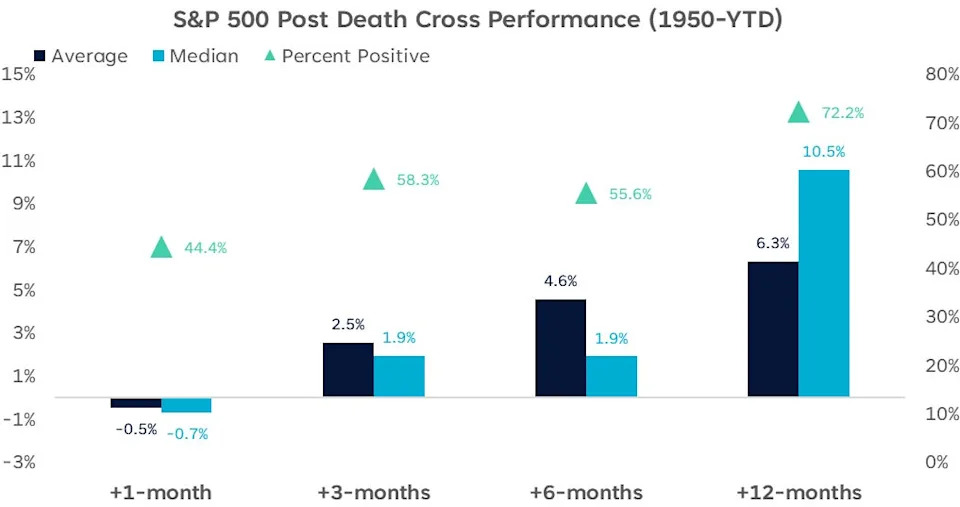

Turnquist crunched the numbers and found that since 1950, the 3-, 6-, and 12-month average forward returns for the S&P 500 after a death cross signal flashed were positive.

In addition, all three time horizons had a positive percentage rate of over 50%, with a 72% win rate 12 months after the signal.

Turnquist does still admit that the death cross can be an accurate signal of losses ahead, citing a handful of examples.

"While death crosses indicate recent price action is losing momentum and can serve as a prescient warning sign for developing downside risk, as was the case in March '22, early December '18, December '07, and Oct '00, the name is not as ominous as it may sound," Turnquist said.

Returns after waterfall declines

Turnquist took his analysis even further by isolating death cross signals that occurred during past "waterfall" declines in the stock market, similar to the historic sell-off seen earlier this month.

"When you have a death cross with a pretty severe drawdown, you tend to get much better forward returns, meaning you've already priced in a lot of the damage," Turnquist said.

Turnquist said that death crosses that occur within one month of a 15% drawdown in the S&P 500 have resulted in a 12-month forward average return of 16%, and a win rate of 83%.

The S&P 500 saw an as-much-as-21% decline from highs during the recent sell-off, which — based on Turnquist's linear regression analysis — should precede to a 32% return in the next 12 months.

Turnquist said that's "not necessarily our call." But it suggests that the stock market could be primed for a big rebound based on the historical price action of death crosses.